- Hong Kong

- /

- Hospitality

- /

- SEHK:1128

Investor Optimism Abounds Wynn Macau, Limited (HKG:1128) But Growth Is Lacking

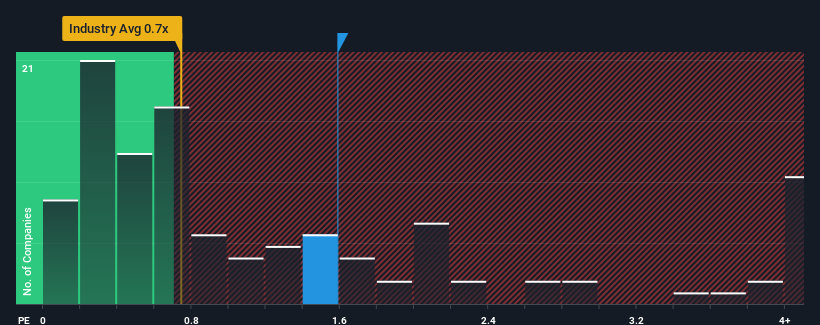

When you see that almost half of the companies in the Hospitality industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.7x, Wynn Macau, Limited (HKG:1128) looks to be giving off some sell signals with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wynn Macau

What Does Wynn Macau's P/S Mean For Shareholders?

Wynn Macau certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wynn Macau.Is There Enough Revenue Growth Forecasted For Wynn Macau?

Wynn Macau's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to grow revenue by 219% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the analysts watching the company. With the industry predicted to deliver 16% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Wynn Macau is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Wynn Macau's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Wynn Macau currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Wynn Macau that you should be aware of.

If these risks are making you reconsider your opinion on Wynn Macau, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Macau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1128

Wynn Macau

Owns, develops, and operates integrated destination casino resorts in the People’s Republic of China.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives