- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:8362

What Winning Tower Group Holdings Limited's (HKG:8362) 50% Share Price Gain Is Not Telling You

Winning Tower Group Holdings Limited (HKG:8362) shareholders have had their patience rewarded with a 50% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 62%.

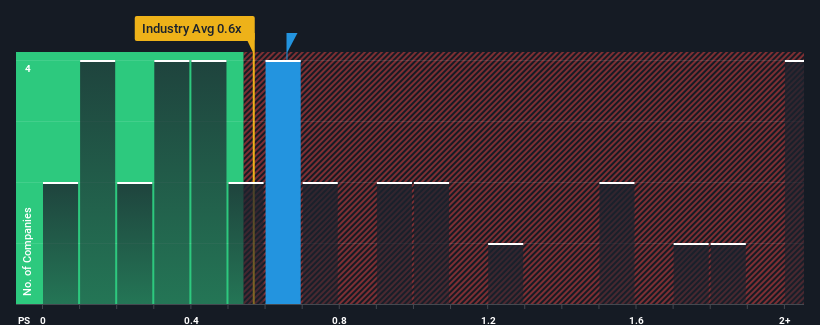

Even after such a large jump in price, it's still not a stretch to say that Winning Tower Group Holdings' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Hong Kong, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Winning Tower Group Holdings

How Has Winning Tower Group Holdings Performed Recently?

For instance, Winning Tower Group Holdings' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Winning Tower Group Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Winning Tower Group Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Winning Tower Group Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this information, we find it concerning that Winning Tower Group Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Winning Tower Group Holdings' P/S?

Winning Tower Group Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Winning Tower Group Holdings currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Winning Tower Group Holdings (at least 2 which can't be ignored), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Winning Tower Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8362

Winning Tower Group Holdings

An investment holding company, engages in the processing and trading of raw, frozen, and cooked food products in Hong Kong.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives