- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Sun Art Retail Group Limited Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

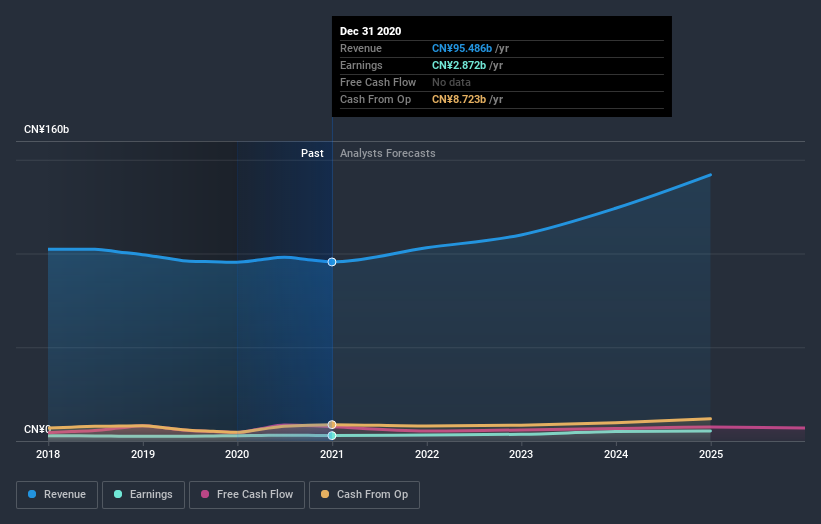

As you might know, Sun Art Retail Group Limited (HKG:6808) last week released its latest yearly, and things did not turn out so great for shareholders. Sun Art Retail Group missed analyst forecasts, with revenues of CN¥95b and statutory earnings per share (EPS) of CN¥0.30, falling short by 3.5% and 9.0% respectively. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Sun Art Retail Group

Following the latest results, Sun Art Retail Group's 19 analysts are now forecasting revenues of CN¥103.0b in 2021. This would be an okay 7.9% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to swell 14% to CN¥0.34. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥103.5b and earnings per share (EPS) of CN¥0.35 in 2021. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a minor downgrade to their earnings per share forecasts.

It might be a surprise to learn that the consensus price target fell 11% to CN¥9.43, with the analysts clearly linking lower forecast earnings to the performance of the stock price. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Sun Art Retail Group analyst has a price target of CN¥18.50 per share, while the most pessimistic values it at CN¥5.57. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that Sun Art Retail Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 7.9%, well above its historical decline of 0.8% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 10% per year. So although Sun Art Retail Group's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Sun Art Retail Group. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Sun Art Retail Group's revenues are expected to perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Sun Art Retail Group's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Sun Art Retail Group. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Sun Art Retail Group analysts - going out to 2024, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you’re looking to trade Sun Art Retail Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026