- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Earnings Guidance Shift Might Change the Case for Investing in Sun Art Retail Group (SEHK:6808)

Reviewed by Sasha Jovanovic

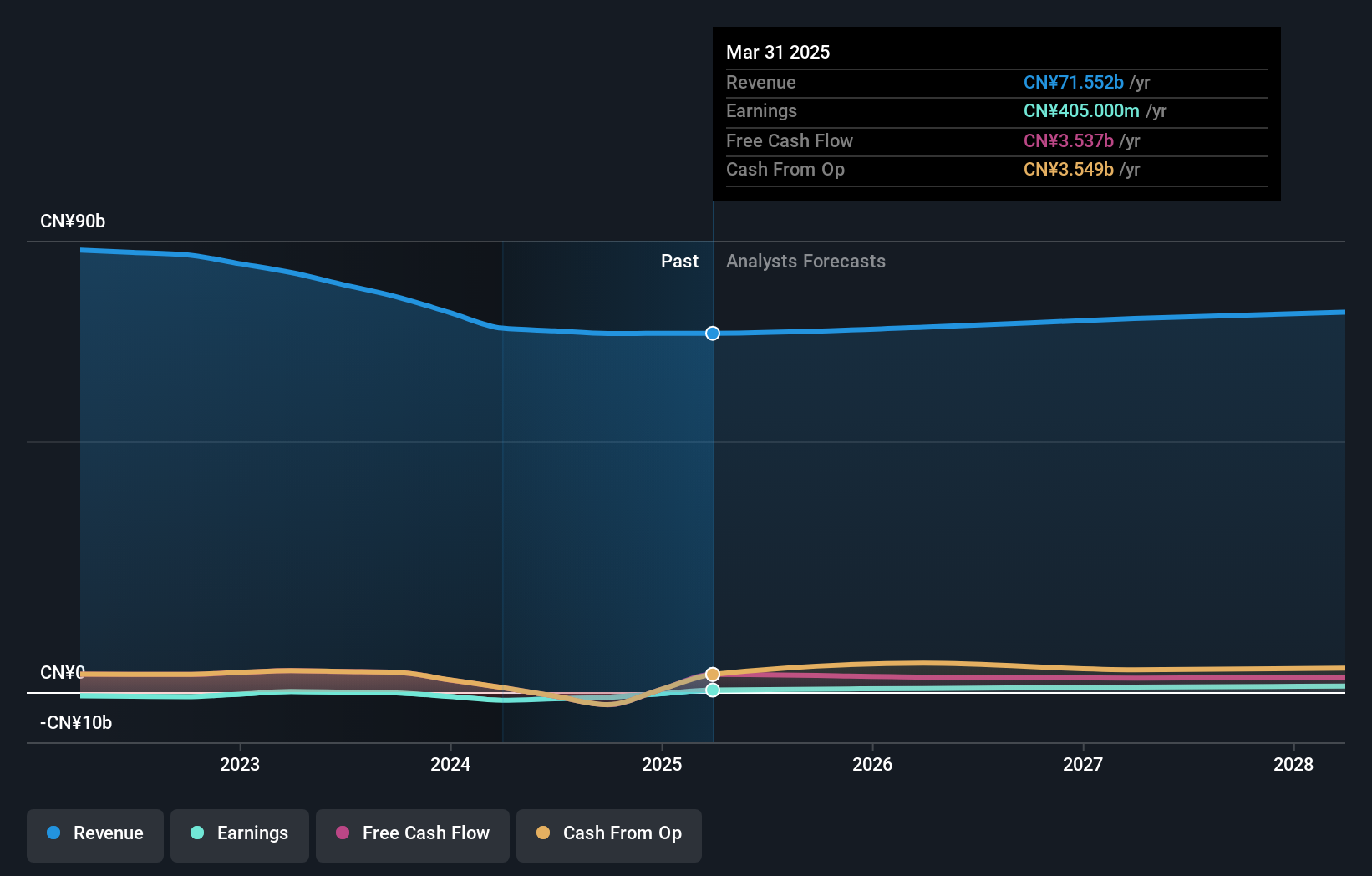

- On October 20, 2025, Sun Art Retail Group announced earnings guidance for the six months ended September 30, 2025, anticipating a net loss of approximately RMB 110 million to RMB 140 million amid intensified market competition, weaker consumer demand, and one-off expenses.

- This marks a shift from the previous year's profit, highlighting the impact of reduced consumer spending and an unfavorable holiday calendar overlap on revenue and profitability.

- We'll examine how heightened competition and changing consumer habits are influencing Sun Art Retail Group's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Sun Art Retail Group's Investment Narrative?

For anyone considering Sun Art Retail Group, the investment narrative has shifted significantly with the latest profit warning. The anticipated net loss detailed on October 20, 2025, breaks a recent return to profitability and brings new weight to concerns about the company’s ability to defend its market share, especially as competition and shifting consumer habits eat into sales. While earlier analysis highlighted profit growth and a rebound in earnings, these latest pressures, coupled with recent one-off restructuring costs and a double-digit drop in revenue, suggest that near-term catalysts now hinge on management’s response to weak consumer demand and efficiency initiatives. The move to withdraw the final dividend and a very expensive price-to-earnings ratio already signaled tougher conditions; this new guidance underscores just how material these risks have become for the business.

Yet, with these headwinds, the risk of earnings volatility is now hard to ignore.

Exploring Other Perspectives

Explore another fair value estimate on Sun Art Retail Group - why the stock might be worth as much as 23% more than the current price!

Build Your Own Sun Art Retail Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Art Retail Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sun Art Retail Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Art Retail Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives