- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6618

JD Health International (SEHK:6618) Is Up 15.5% After Technology and Supply Chain Deals With JD.com - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- JD Health International reported stronger-than-expected third quarter results, partnered with leading pharmaceutical companies, and announced agreements with JD.com involving technology support, supply chain solutions, and healthcare services, with these deals to be voted on at an upcoming general meeting.

- JD Health’s advances in digital healthcare and ongoing collaborations have reinforced its leadership in online specialty medicines and expanded the reach of its smart health ecosystem across China.

- We'll examine how the new technology and supply chain agreements with JD.com might influence JD Health's long-term growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

JD Health International Investment Narrative Recap

To believe in JD Health International as a shareholder today means seeing the future of healthcare in China as firmly tied to digital integration, omnichannel expansion, and advanced supply chain capabilities. The newly announced agreements with JD.com could provide near-term momentum by easing operational complexity and broadening market access, but the greatest short-term catalyst remains accelerating digital health adoption, while the biggest risk continues to be intensifying competition from leading health-tech platforms and regulatory pressures, neither of which is substantially altered by this news, though improved operational support may help response agility.

The upcoming shareholder vote on integrated technology and supply chain support from JD.com stands out as most pertinent, as the strengthened partnership could directly impact JD Health’s operational efficiency and market reach, key elements underpinning both current business momentum and potential margin stability.

Yet, investors should be especially mindful that, despite recent operational tailwinds, growing dependence on JD Group logistics and segment integration means any shift in partner alignment or supply chain efficiency could...

Read the full narrative on JD Health International (it's free!)

JD Health International's outlook anticipates CN¥98.3 billion in revenue and CN¥6.9 billion in earnings by 2028. This scenario assumes a 14.7% annual revenue growth rate and a CN¥2.2 billion increase in earnings from the current CN¥4.7 billion.

Uncover how JD Health International's forecasts yield a HK$70.25 fair value, in line with its current price.

Exploring Other Perspectives

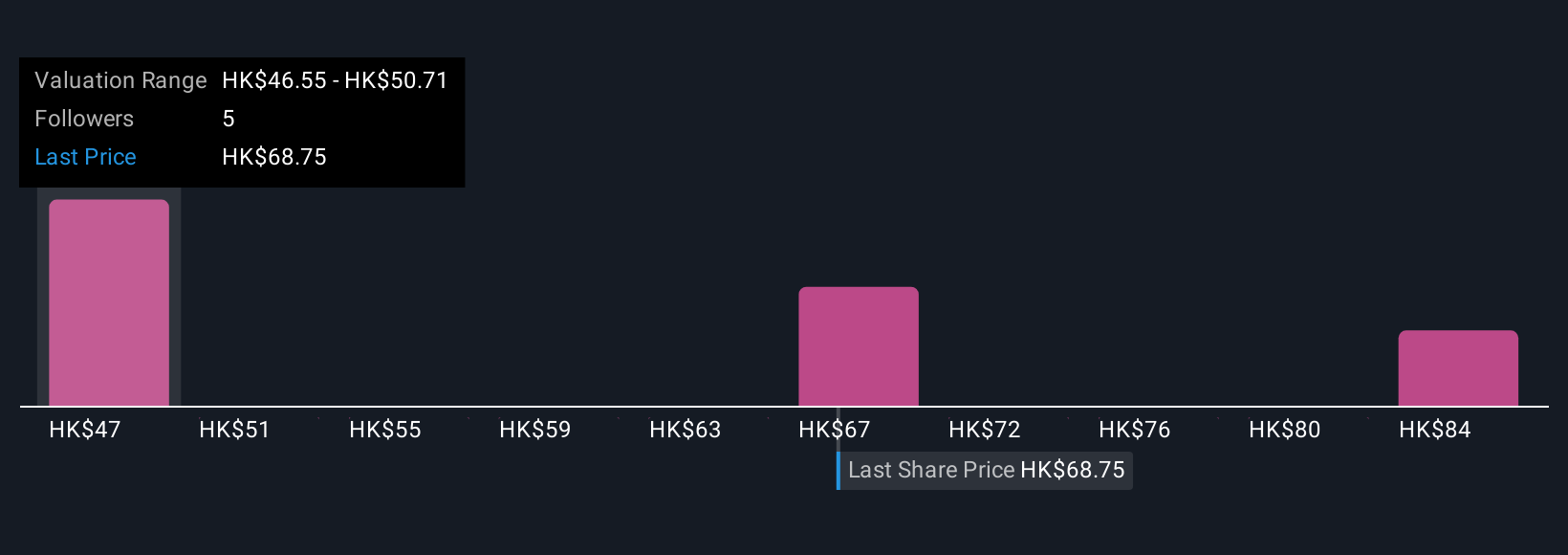

Three retail investors from the Simply Wall St Community valued JD Health between HK$46.55 and HK$88.13 per share, spanning a wide range of outlooks. While digital healthcare adoption supports growth, competitive and regulatory risks remain central for those exploring alternative perspectives on the company’s outlook.

Explore 3 other fair value estimates on JD Health International - why the stock might be worth as much as 28% more than the current price!

Build Your Own JD Health International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JD Health International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JD Health International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JD Health International's overall financial health at a glance.

No Opportunity In JD Health International?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6618

JD Health International

An investment holding company, engages in the operation of an online healthcare platform in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives