As the global economy navigates a complex landscape marked by mixed performances across major indices and cautious monetary policies, the Asian markets present intriguing opportunities for investors. Amidst these conditions, identifying undervalued stocks becomes crucial, as they hold potential for growth when market sentiment stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$178.50 | NT$356.20 | 49.9% |

| Tibet Tianlu (SHSE:600326) | CN¥12.46 | CN¥24.52 | 49.2% |

| TESEC (TSE:6337) | ¥2101.00 | ¥4157.22 | 49.5% |

| TaewoongLtd (KOSDAQ:A044490) | ₩30150.00 | ₩60215.53 | 49.9% |

| Selvas AI (KOSDAQ:A108860) | ₩14560.00 | ₩28707.45 | 49.3% |

| Mobvista (SEHK:1860) | HK$18.92 | HK$37.79 | 49.9% |

| Meitu (SEHK:1357) | HK$9.23 | HK$18.23 | 49.4% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩8990.00 | ₩17681.61 | 49.2% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥64.24 | CN¥128.02 | 49.8% |

| Andes Technology (TWSE:6533) | NT$266.50 | NT$528.49 | 49.6% |

Let's review some notable picks from our screened stocks.

Mobvista (SEHK:1860)

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market cap of HK$28.99 billion.

Operations: The company's revenue is derived from two main segments: Marketing Technology Business, generating $17.61 million, and Advertising Technology Services, contributing $1.79 billion.

Estimated Discount To Fair Value: 49.9%

Mobvista's recent earnings report highlights a strong performance with sales reaching US$938.11 million, up from US$638.29 million the previous year, and net income increasing to US$32.28 million from US$9.27 million. The stock is trading at HK$18.92, significantly below its estimated fair value of HK$37.79, suggesting it may be undervalued based on cash flows despite high volatility in its share price recently. Earnings are projected to grow substantially above market averages over the next three years, driven by robust revenue growth and operating leverage improvements in its core programmatic advertising platform, Mintegral.

- Insights from our recent growth report point to a promising forecast for Mobvista's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Mobvista.

Guoquan Food (Shanghai) (SEHK:2517)

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China with a market cap of HK$10.79 billion.

Operations: The company's revenue is primarily generated from its retail segment through grocery stores, amounting to CN¥7.04 billion.

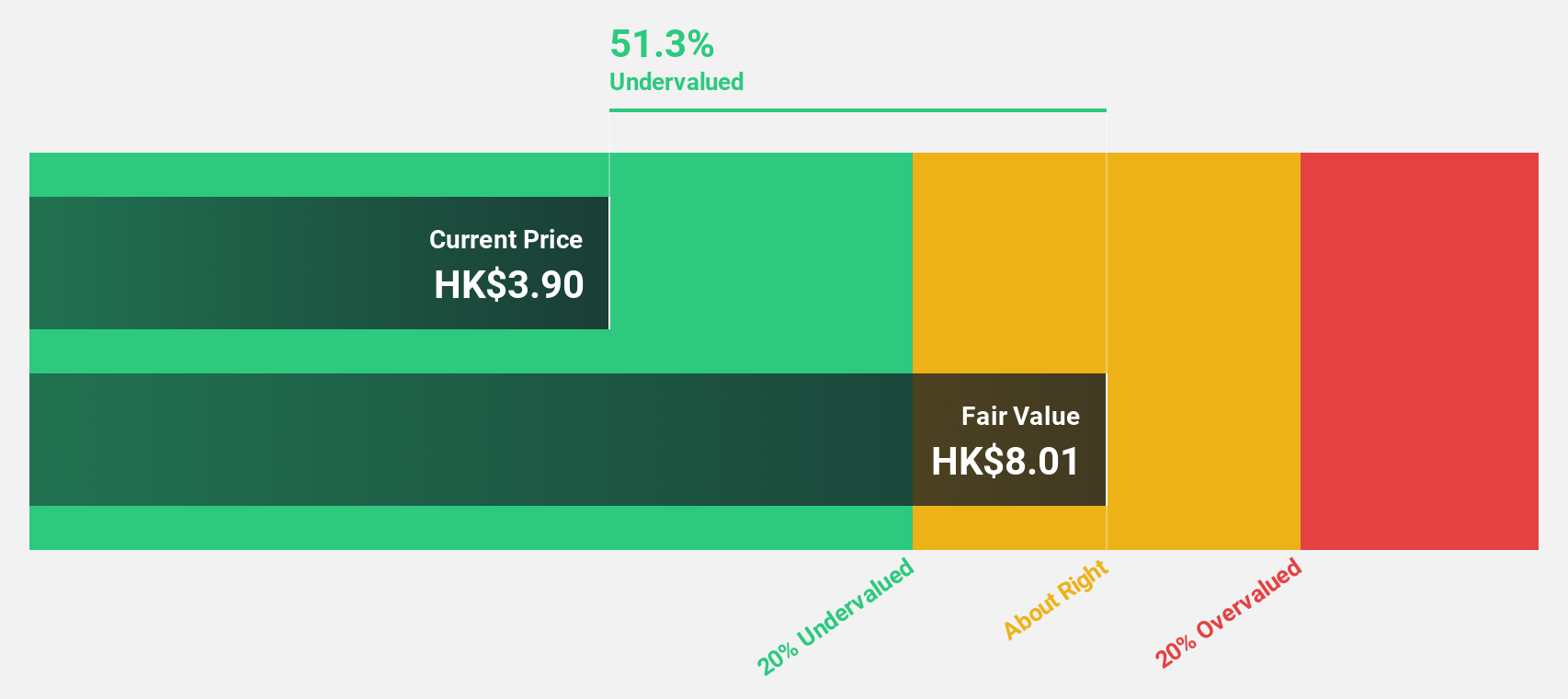

Estimated Discount To Fair Value: 49%

Guoquan Food (Shanghai) is trading at HK$4.09, significantly below its estimated fair value of HK$8.02, indicating potential undervaluation based on cash flows. Earnings are forecast to grow by 25.2% annually, outpacing the Hong Kong market's average growth rate. However, its dividend yield of 3.82% lacks coverage by earnings or free cash flow. Recent share repurchase activities aim to enhance net asset value per share and earnings per share, reflecting strategic capital management efforts.

- The growth report we've compiled suggests that Guoquan Food (Shanghai)'s future prospects could be on the up.

- Get an in-depth perspective on Guoquan Food (Shanghai)'s balance sheet by reading our health report here.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally with a market cap of HK$108.97 billion.

Operations: Akeso's revenue primarily derives from its research, development, production, and sale of biopharmaceutical products, totaling CN¥2.51 billion.

Estimated Discount To Fair Value: 39.6%

Akeso is trading at HK$118.3, substantially below its estimated fair value of HK$195.92, highlighting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 34.8% annually, surpassing the Hong Kong market's growth rate. Despite significant insider selling recently, Akeso's strategic advancements in immunotherapy and a robust pipeline of over 50 innovative assets position it for substantial future growth as it expands its presence in key oncology indications across global markets.

- Upon reviewing our latest growth report, Akeso's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Akeso.

Key Takeaways

- Investigate our full lineup of 269 Undervalued Asian Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives