- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Alibaba Health (SEHK:241) Margins Jump to 5.8%, Reinforcing Bullish Profitability Narratives

Reviewed by Simply Wall St

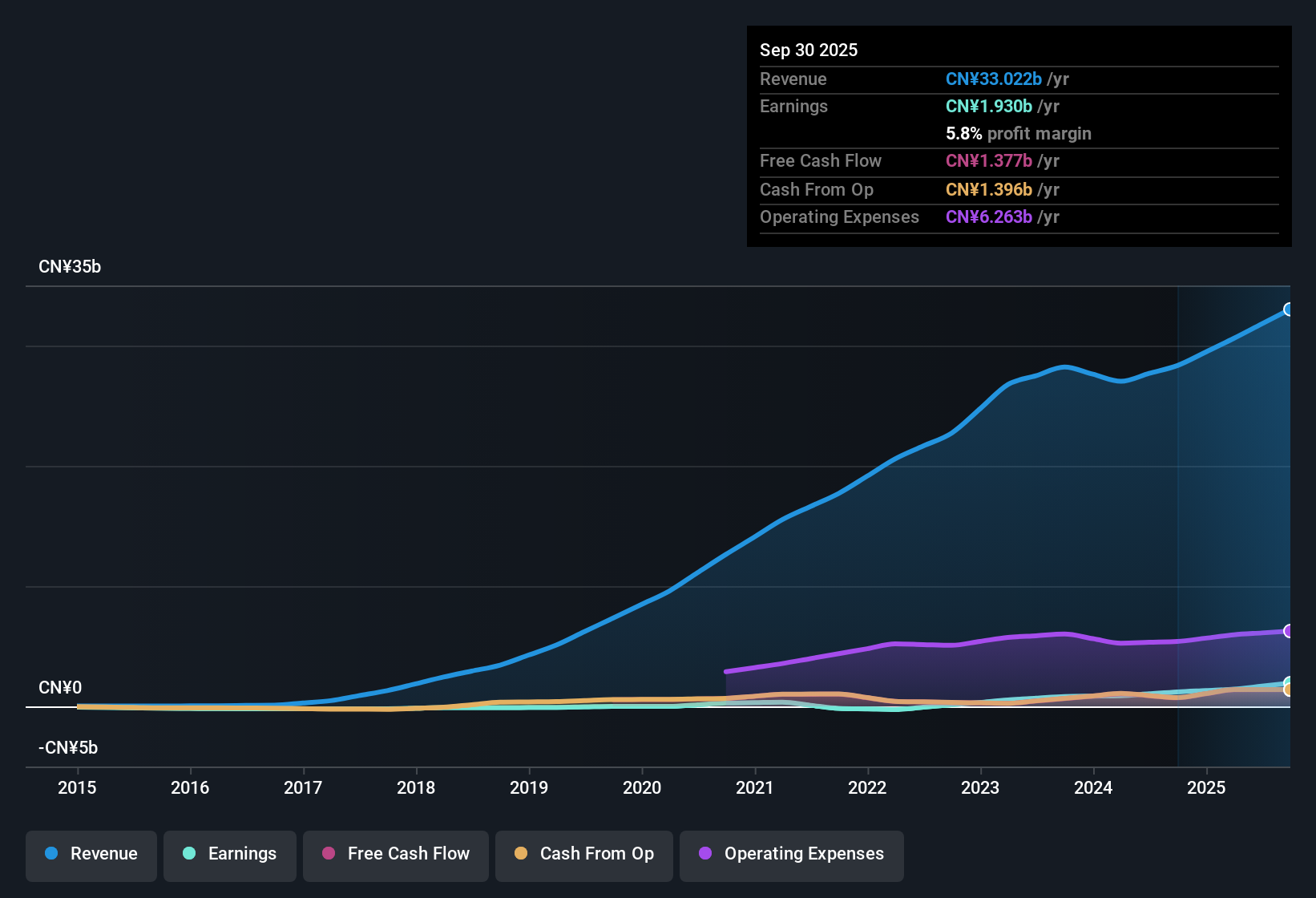

Alibaba Health Information Technology (SEHK:241) reported H1 2026 revenue of 16.3 billion CNY and basic EPS of 0.041 CNY, with net income excluding extra items at 663 million CNY. Over recent periods, revenue moved from 14.1 billion CNY in H2 2024 to 14.3 billion CNY in H1 2025, then rose to 16.3 billion CNY in H2 2025. EPS was 0.030 CNY in H2 2024, moved to 0.048 CNY in H1 2025, and landed at 0.041 CNY in H2 2025. Margins showed solid progress through these periods, helping to set the tone for the company’s latest results.

See our full analysis for Alibaba Health Information Technology.Now, let's sort how these headline figures line up with or break from the narratives most investors have in mind. We’re putting the numbers to the test against market sentiment and expectations next.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Step Up, Outpacing History

- Net profit margins climbed to 5.8% in the last twelve months, compared to 4.3% previously. This marks a strong improvement in profitability as earnings growth reached 60% over the same period.

- Bulls point to this margin expansion and earnings acceleration as clear evidence of Alibaba Health's improving efficiency. They note that the company has outperformed its own five-year average growth rate and is now delivering higher earnings quality.

- The bullish view is further supported by trailing twelve month basic EPS of 0.120 CNY, which represents an increase from previous periods and indicates that better cost discipline is supporting sustainable profit growth.

- Analysts watching the sector often highlight that this pace of margin improvement rarely occurs without major operational improvements, lending credibility to the bullish outlook on ongoing profitability.

Valuation Signals: Deep Discount but Still a Premium

- The company’s share price of 5.76 CNY trades at a 48.9% discount to its DCF fair value estimate of 11.26 CNY. However, its price-to-earnings ratio of 43.9x remains significantly above the Asian consumer retailing sector average of 16.8x.

- This context has market observers weighing two sides. The discount to fair value suggests possible opportunity for value-focused investors, but the still-high P/E ratio indicates lingering questions about how much future growth is already reflected in the share price.

- The consensus narrative notes that Alibaba Health’s valuation sits in a challenging position. It appears inexpensive relative to some peer averages, but remains expensive when compared to the broader sector.

- This dual dynamic draws attention to whether growth and margin gains can continue robustly enough to shift sentiment, especially considering the high expectations set by its current multiple.

Revenue Growth Beats Market Pace

- Top-line growth is forecast at 9.9% per year, surpassing the Hong Kong market average and indicating positive momentum in the company’s operating environment.

- Bulls emphasize this above-market revenue outlook as crucial, suggesting that Alibaba Health’s leadership in digital health and e-commerce may help the company maintain this growth trajectory.

- Evidence for this includes trailing twelve month revenue reaching 33.0 billion CNY, up from 28.3 billion CNY in previous periods, signaling traction that aligns with bullish expectations.

- Supporters also cite sector trends and strong government policy tailwinds as factors that could help Alibaba Health sustain its higher-than-market growth rate over the coming years.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Alibaba Health Information Technology's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite improving margins and revenue growth, Alibaba Health’s P/E remains well above sector averages. This raises questions about whether investors are overpaying for growth.

If you’re seeking candidates with stronger upside and more reasonable valuations, compare today’s market with these 925 undervalued stocks based on cash flows to find stocks trading below their fair value and spot better opportunities now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success