- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:197

Heng Tai Consumables Group Limited (HKG:197) Surges 59% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Heng Tai Consumables Group Limited (HKG:197) shares have been powering on, with a gain of 59% in the last thirty days. The last 30 days bring the annual gain to a very sharp 31%.

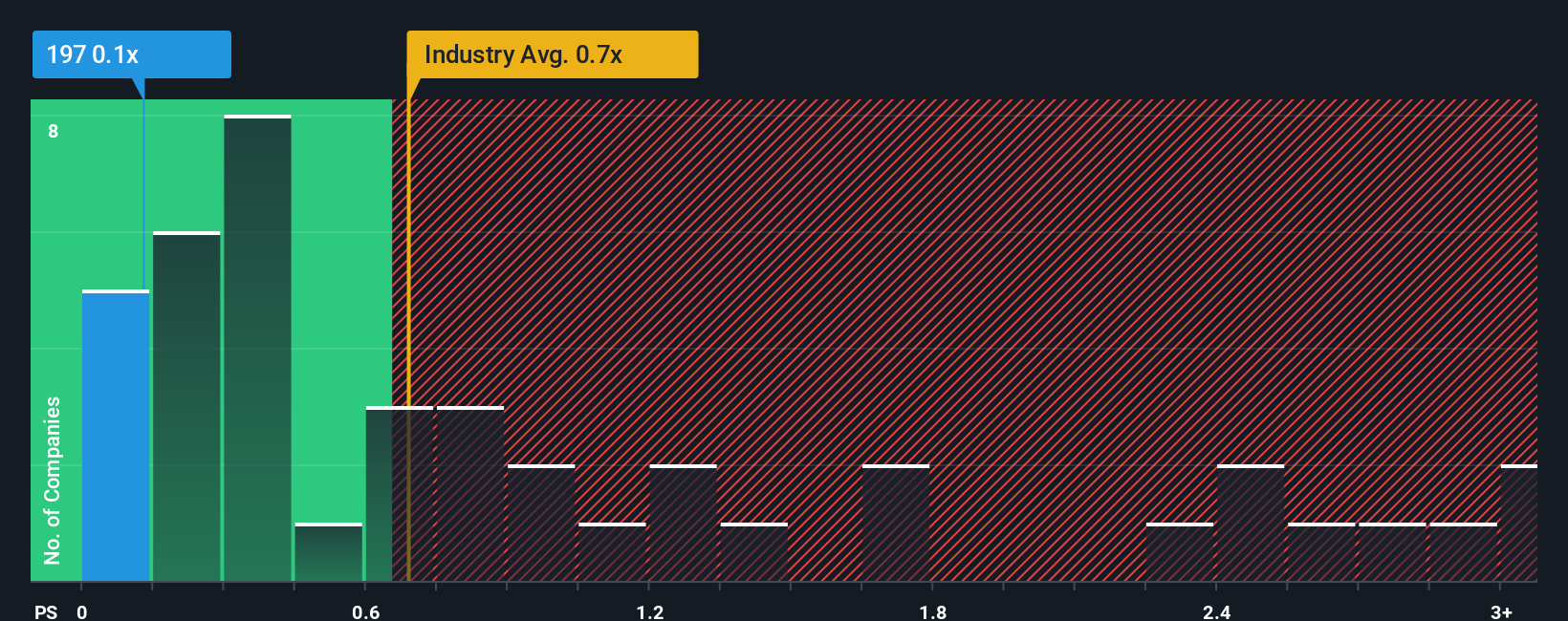

In spite of the firm bounce in price, it would still be understandable if you think Heng Tai Consumables Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Hong Kong's Consumer Retailing industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Heng Tai Consumables Group

What Does Heng Tai Consumables Group's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Heng Tai Consumables Group's revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Heng Tai Consumables Group will help you shine a light on its historical performance.How Is Heng Tai Consumables Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Heng Tai Consumables Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 15% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 9.7% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Heng Tai Consumables Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Heng Tai Consumables Group's P/S

Heng Tai Consumables Group's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Heng Tai Consumables Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Heng Tai Consumables Group that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Heng Tai Consumables Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:197

Heng Tai Consumables Group

An investment holding company, engages in the trading of packaged foods, beverages, and household consumables in Hong Kong and the People’s Republic of China.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives