- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1854

With A 26% Price Drop For China Wantian Holdings Limited (HKG:1854) You'll Still Get What You Pay For

China Wantian Holdings Limited (HKG:1854) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 83%, which is great even in a bull market.

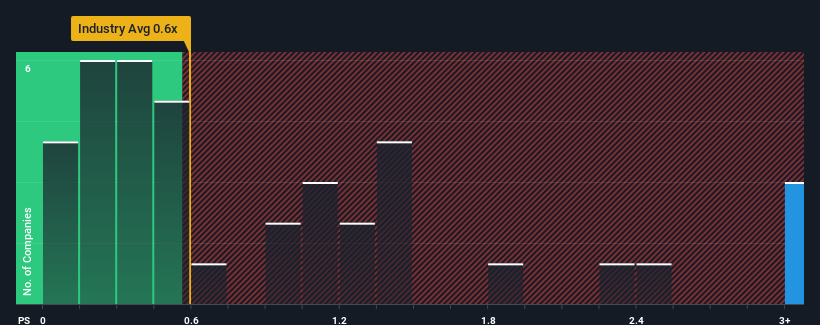

Even after such a large drop in price, you could still be forgiven for thinking China Wantian Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.1x, considering almost half the companies in Hong Kong's Consumer Retailing industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for China Wantian Holdings

What Does China Wantian Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, China Wantian Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for China Wantian Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as China Wantian Holdings' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 57%. The latest three year period has also seen an excellent 124% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why China Wantian Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does China Wantian Holdings' P/S Mean For Investors?

China Wantian Holdings' shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Wantian Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You should always think about risks. Case in point, we've spotted 2 warning signs for China Wantian Holdings you should be aware of, and 1 of them is a bit concerning.

If these risks are making you reconsider your opinion on China Wantian Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1854

China Wantian Holdings

An investment holding company, engages in the green food supply and catering chain, and environmental protection and technology businesses in the People’s Republic of China, and Hong Kong.

Adequate balance sheet with low risk.

Market Insights

Community Narratives