- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1854

China Wantian Holdings Limited (HKG:1854) Shares Slammed 32% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the China Wantian Holdings Limited (HKG:1854) share price has dived 32% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

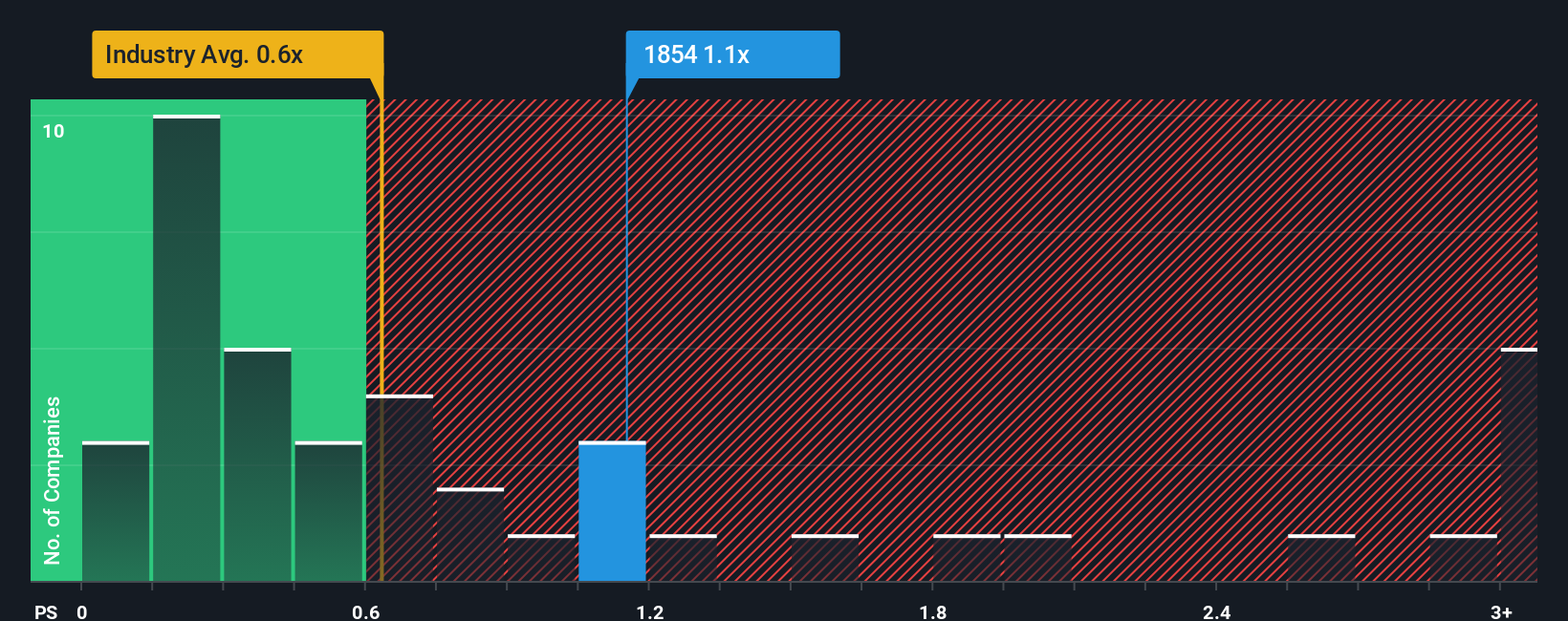

Even after such a large drop in price, when almost half of the companies in Hong Kong's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider China Wantian Holdings as a stock probably not worth researching with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for China Wantian Holdings

How China Wantian Holdings Has Been Performing

With revenue growth that's exceedingly strong of late, China Wantian Holdings has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Wantian Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For China Wantian Holdings?

The only time you'd be truly comfortable seeing a P/S as high as China Wantian Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 121% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 15%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why China Wantian Holdings' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does China Wantian Holdings' P/S Mean For Investors?

China Wantian Holdings' P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of China Wantian Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for China Wantian Holdings (2 are significant!) that you should be aware of before investing here.

If you're unsure about the strength of China Wantian Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1854

China Wantian Holdings

An investment holding company, engages in the green food supply and catering chain, and environmental protection and technology businesses in the People’s Republic of China, and Hong Kong.

Adequate balance sheet with low risk.

Market Insights

Community Narratives