- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1833

Ping An Healthcare and Technology Company Limited's (HKG:1833) Share Price Could Signal Some Risk

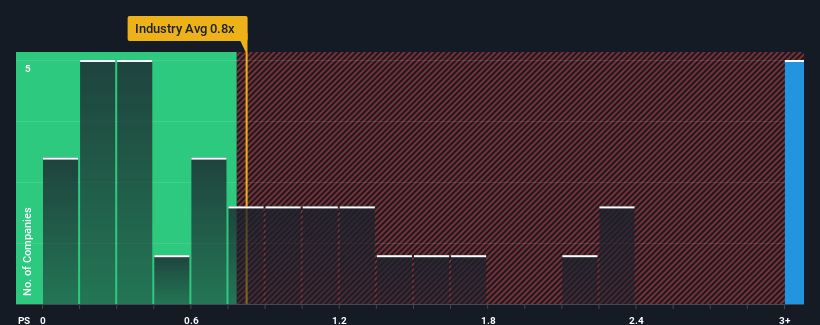

When you see that almost half of the companies in the Consumer Retailing industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.8x, Ping An Healthcare and Technology Company Limited (HKG:1833) looks to be giving off strong sell signals with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ping An Healthcare and Technology

What Does Ping An Healthcare and Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Ping An Healthcare and Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Ping An Healthcare and Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ping An Healthcare and Technology's Revenue Growth Trending?

Ping An Healthcare and Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 14% per year over the next three years. That's shaping up to be materially lower than the 24% per year growth forecast for the broader industry.

In light of this, it's alarming that Ping An Healthcare and Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ping An Healthcare and Technology, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Ping An Healthcare and Technology with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Ping An Healthcare and Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1833

Ping An Healthcare and Technology

Operates an online healthcare services platform in China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives