Ferretti (SEHK:9638) Eyes Growth with Riva Residenze Launch and U.S. Market Expansion Potential

Reviewed by Simply Wall St

Ferretti (SEHK:9638) has demonstrated a significant growth trajectory with a notable 21.6% increase in earnings over the past year, outperforming the leisure industry average. The company's strategic expansion into luxury real estate with the launch of Riva Residenze, alongside securing nearly €300 million in orders, highlights its potential for new revenue streams and enhanced market positioning. This report explores Ferretti's financial health, strategic opportunities, and external challenges, providing a comprehensive overview of its current and future market prospects.

Click to explore a detailed breakdown of our findings on Ferretti.

Competitive Advantages That Elevate Ferretti

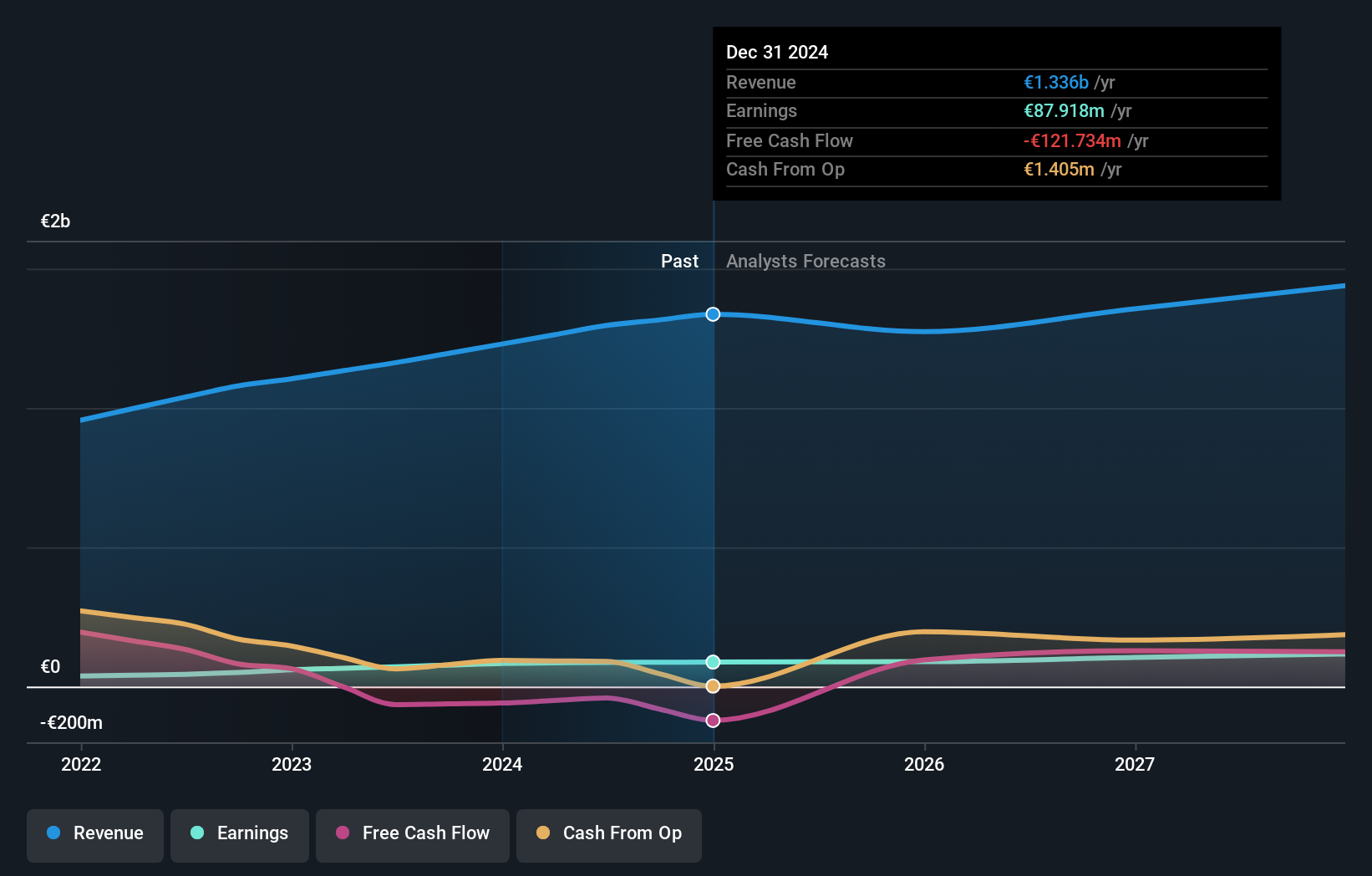

Ferretti has shown a commendable increase in earnings, surpassing the leisure industry average with a 21.6% rise over the past year. This performance is coupled with a significant 22.7% annual growth over the past five years, highlighting the company's strong financial health. The firm's ability to generate high levels of non-cash earnings underscores the quality of its past earnings. Additionally, Ferretti's net profit margin has improved to 6.7% from 6.1% last year, reflecting effective cost management and operational efficiency. The company also boasts more cash than total debt, which, along with its ability to cover interest payments, indicates solid financial stability. Analysts' prediction of a 68.7% stock price increase further emphasizes the market's confidence in Ferretti's future prospects.

Strategic Gaps That Could Affect Ferretti

Ferretti faces challenges with its revenue growth forecasted at 3.4% annually, which is lower than the Hong Kong market's 7.8%. Similarly, its projected earnings growth of 10.3% falls short of the market's 11.3%. The company's Return on Equity (ROE) stands at 10.2%, below the preferred 20% threshold, which might be a deterrent for potential investors. Moreover, dividend payments have only been stable for less than a decade, and the yield of 3.45% is relatively low compared to the top dividend payers in Hong Kong. These factors could impact investor sentiment and market positioning.

Future Prospects for Ferretti in the Market

Ferretti's recent initiatives, such as the launch of Riva Residenze, signal a strategic move into luxury real estate, potentially opening new revenue streams and enhancing its market position. The company has secured nearly €300 million in orders, indicating strong demand and growth prospects. Additionally, the U.S. market presents a significant opportunity, especially if economic conditions improve and consumer confidence rebounds. These ventures could drive performance and expand Ferretti's market share, leveraging its diverse brand portfolio and global reach.

External Factors Threatening Ferretti

Economic uncertainties, particularly in key regions like the U.S. and Asia Pacific, pose risks to Ferretti's sales and profitability. The company's performance in these areas has been hindered by geopolitical issues and consumer spending fluctuations. Furthermore, intense competition and pricing pressures, especially in the lower price segments, could erode margins if not managed effectively. These external challenges necessitate strategic responses to maintain Ferretti's competitive edge and ensure sustained growth.

Conclusion

Ferretti's impressive earnings growth, surpassing industry averages, and its strong financial health, as evidenced by its improved profit margins and cash position, underscore its potential for continued success. However, the company's slower revenue and earnings growth forecasts compared to the market, along with a lower Return on Equity, highlight areas that could deter investor interest. Nevertheless, Ferretti's strategic ventures into luxury real estate and the promising U.S. market could drive future performance. The company's current trading price, significantly below its estimated fair value with a favorable Price-To-Earnings Ratio of 11x, suggests a market opportunity for investors confident in Ferretti's strategic initiatives and financial stability to capitalize on potential stock price appreciation.

Summing It All Up

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9638

Ferretti

Designs, constructs, markets, and sells yachts and vessels under the Riva, Wally, Ferretti Yachts, Pershing, Itama, Easy Boat, CRN, and Custom Line brand names.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives