WebX International Holdings First Half 2024 Earnings: EPS: HK$0.001 (vs HK$0.004 loss in 1H 2023)

WebX International Holdings (HKG:8521) First Half 2024 Results

Key Financial Results

- Revenue: HK$58.8m (up 38% from 1H 2023).

- Net income: HK$445.0k (up from HK$2.07m loss in 1H 2023).

- Profit margin: 0.8% (up from net loss in 1H 2023). The move to profitability was driven by higher revenue.

- EPS: HK$0.001 (up from HK$0.004 loss in 1H 2023).

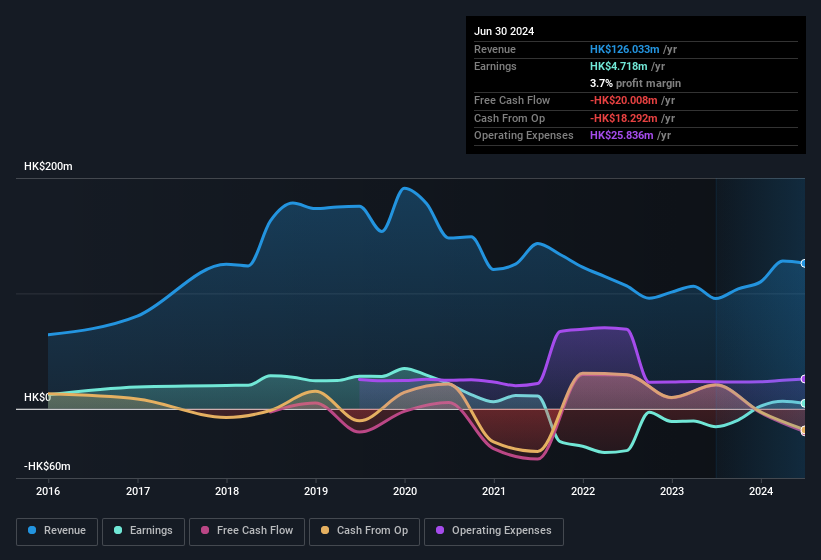

All figures shown in the chart above are for the trailing 12 month (TTM) period

WebX International Holdings shares are down 1.3% from a week ago.

Risk Analysis

What about risks? Every company has them, and we've spotted 6 warning signs for WebX International Holdings (of which 3 are a bit concerning!) you should know about.

Valuation is complex, but we're here to simplify it.

Discover if WebX International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8521

WebX International Holdings

An investment holding company, provides functional knitted fabrics in the People's Republic of China and Hong Kong.

Moderate with adequate balance sheet.