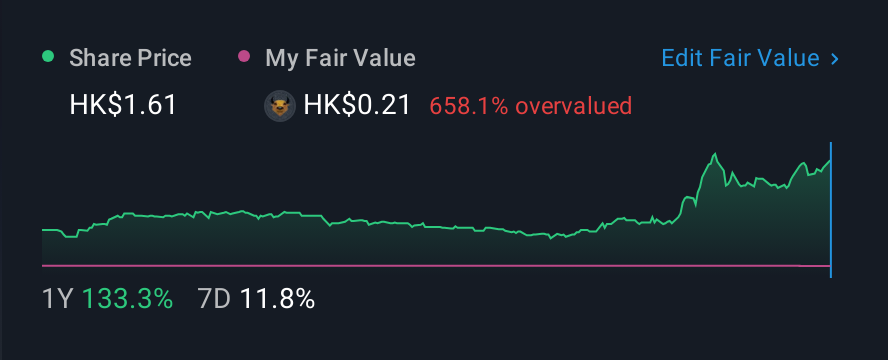

WebX International Holdings Company Limited's (HKG:8521) 99% Share Price Surge Not Quite Adding Up

Despite an already strong run, WebX International Holdings Company Limited (HKG:8521) shares have been powering on, with a gain of 99% in the last thirty days. The last 30 days bring the annual gain to a very sharp 99%.

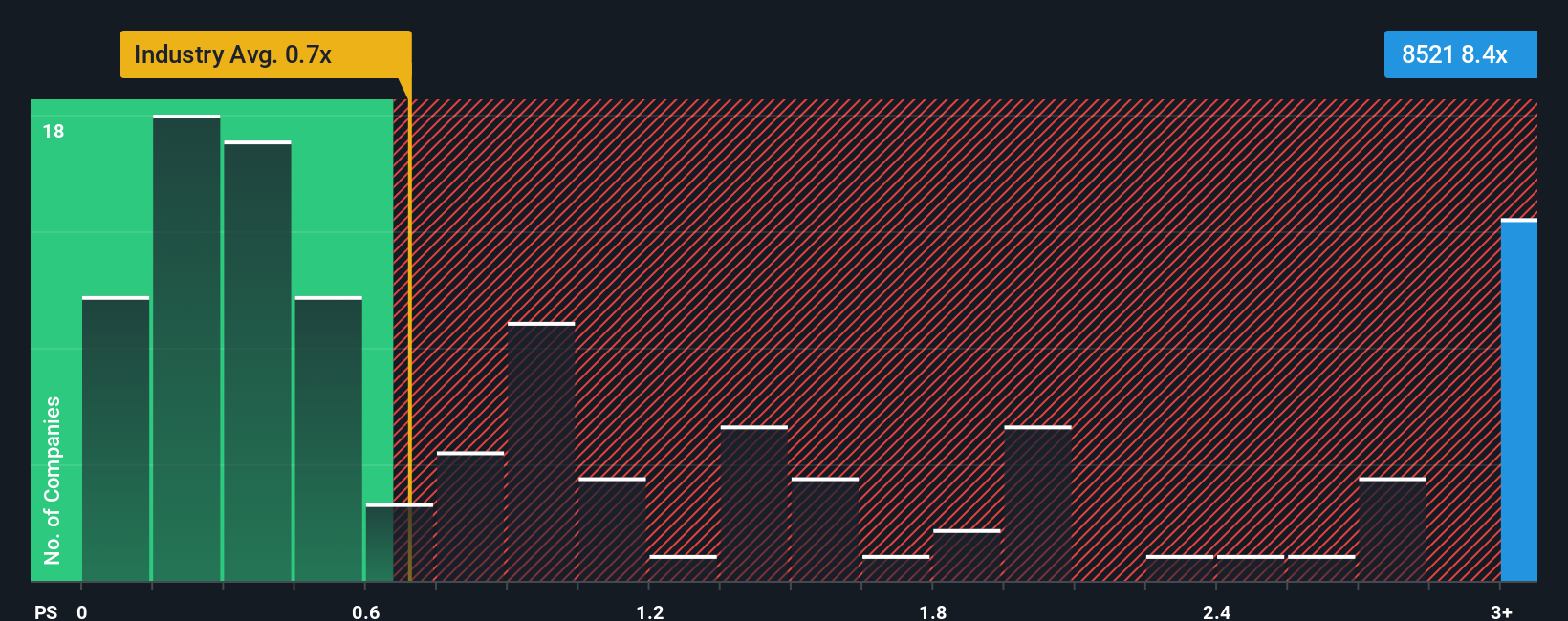

Since its price has surged higher, when almost half of the companies in Hong Kong's Luxury industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider WebX International Holdings as a stock not worth researching with its 8.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for WebX International Holdings

What Does WebX International Holdings' P/S Mean For Shareholders?

WebX International Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on WebX International Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For WebX International Holdings?

In order to justify its P/S ratio, WebX International Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 9.1% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 2.2% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 40% shows it's an unpleasant look.

With this information, we find it concerning that WebX International Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On WebX International Holdings' P/S

The strong share price surge has lead to WebX International Holdings' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of WebX International Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for WebX International Holdings (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if WebX International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8521

WebX International Holdings

An investment holding company, provides functional knitted fabrics in the People's Republic of China and Hong Kong.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success