Should Shareholders Worry About ST International Holdings Company Limited's (HKG:8521) CEO Compensation Package?

Performance at ST International Holdings Company Limited (HKG:8521) has not been particularly rosy recently and shareholders will likely be holding CEO Bin Xi and the board accountable for this. At the upcoming AGM on 28 May 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

Check out our latest analysis for ST International Holdings

How Does Total Compensation For Bin Xi Compare With Other Companies In The Industry?

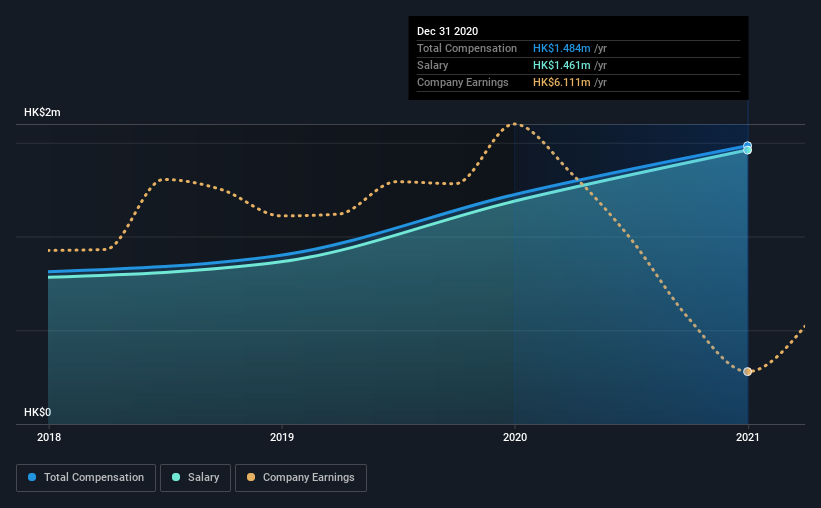

According to our data, ST International Holdings Company Limited has a market capitalization of HK$87m, and paid its CEO total annual compensation worth HK$1.5m over the year to December 2020. That's a notable increase of 21% on last year. In particular, the salary of HK$1.46m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.3m. That is to say, Bin Xi is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.5m | HK$1.2m | 98% |

| Other | HK$23k | HK$35k | 2% |

| Total Compensation | HK$1.5m | HK$1.2m | 100% |

On an industry level, around 93% of total compensation represents salary and 7% is other remuneration. ST International Holdings is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at ST International Holdings Company Limited's Growth Numbers

Over the last three years, ST International Holdings Company Limited has shrunk its earnings per share by 25% per year. Its revenue is down 30% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has ST International Holdings Company Limited Been A Good Investment?

The return of -42% over three years would not have pleased ST International Holdings Company Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Bin receives almost all of their compensation through a salary. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which is concerning) in ST International Holdings we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WebX International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8521

WebX International Holdings

An investment holding company, provides functional knitted fabrics in the People's Republic of China and Hong Kong.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success