Positive Sentiment Still Eludes Harbour Equine Holdings Limited (HKG:8377) Following 32% Share Price Slump

Harbour Equine Holdings Limited (HKG:8377) shares have had a horrible month, losing 32% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

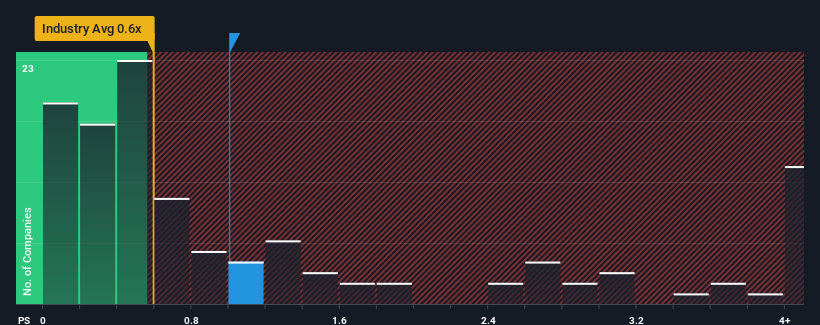

Even after such a large drop in price, there still wouldn't be many who think Harbour Equine Holdings' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Hong Kong's Luxury industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Harbour Equine Holdings

What Does Harbour Equine Holdings' Recent Performance Look Like?

The revenue growth achieved at Harbour Equine Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Harbour Equine Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Harbour Equine Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.7% last year. Pleasingly, revenue has also lifted 75% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we find it interesting that Harbour Equine Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Harbour Equine Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Harbour Equine Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Harbour Equine Holdings (at least 2 which make us uncomfortable), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Harbour Equine Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Harbour Equine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8377

Harbour Equine Holdings

An investment holding company, engages in the manufacture, trade, and sale of sewing threads and garment accessories in the People's Republic of China, Hong Kong, the Middle East, Australia, Mauritius, and internationally.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives