- Hong Kong

- /

- Consumer Durables

- /

- SEHK:833

How Much Did Alltronics Holdings'(HKG:833) Shareholders Earn From Share Price Movements Over The Last Three Years?

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Alltronics Holdings Limited (HKG:833); the share price is down a whopping 80% in the last three years. That'd be enough to cause even the strongest minds some disquiet. The good news is that the stock is up 2.1% in the last week.

See our latest analysis for Alltronics Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Alltronics Holdings has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

We note that the dividend has declined - a likely contributor to the share price drop. It doesn't seem like the changes in revenue would have impacted the share price much, but a closer inspection of the data might reveal something.

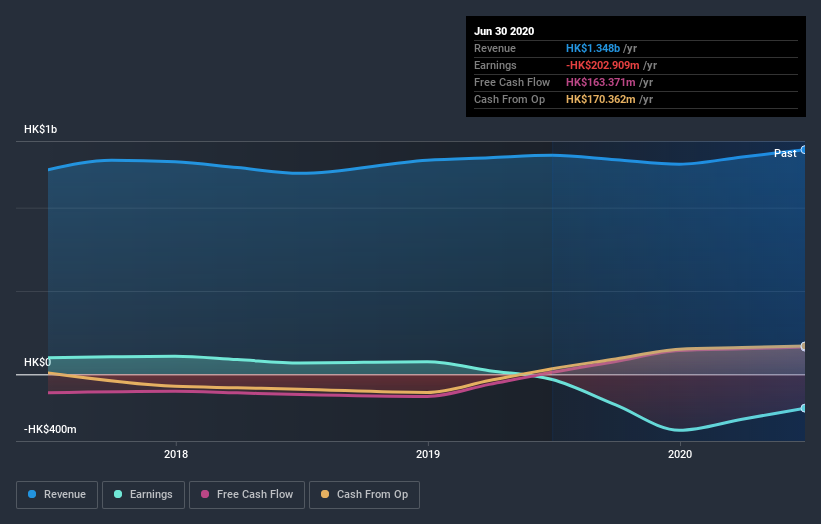

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Alltronics Holdings' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Alltronics Holdings shareholders have received a total shareholder return of 13% over the last year. That's including the dividend. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Alltronics Holdings (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

But note: Alltronics Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Alltronics Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:833

Alltronics Holdings

An investment holding company, manufactures and trades in electronic products, plastic molds, and plastic and other components for electronic products in the United States, Hong Kong, Europe, the People’s Republic of China, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives