Subdued Growth No Barrier To Perfectech International Holdings Limited (HKG:765) With Shares Advancing 41%

Perfectech International Holdings Limited (HKG:765) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

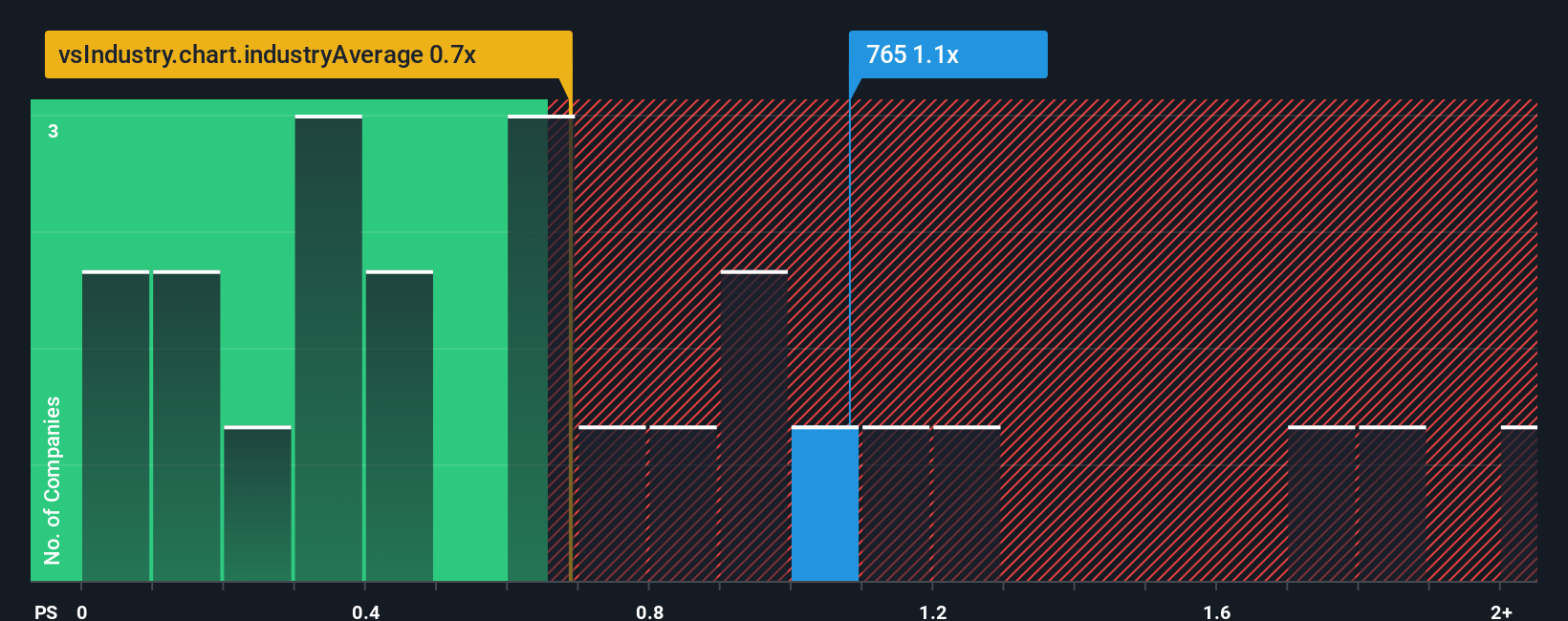

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Perfectech International Holdings' P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Leisure industry in Hong Kong is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Perfectech International Holdings

What Does Perfectech International Holdings' Recent Performance Look Like?

For example, consider that Perfectech International Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Perfectech International Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Perfectech International Holdings?

In order to justify its P/S ratio, Perfectech International Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. The last three years don't look nice either as the company has shrunk revenue by 27% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.8% shows it's an unpleasant look.

With this information, we find it concerning that Perfectech International Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Perfectech International Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Perfectech International Holdings' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We find it unexpected that Perfectech International Holdings trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Perfectech International Holdings is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:765

Perfectech International Holdings

An investment holding company, engages in the manufacture and sale of novelties, decoration, and toy products in Hong Kong, rest of Asia, Europe, the United States of America, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives