Laopu Gold's Dividend Policy Approval Might Change The Case For Investing In Laopu Gold (SEHK:6181)

Reviewed by Sasha Jovanovic

- On November 18, 2025, Laopu Gold Co., Ltd. announced shareholder approval of an interim dividend of RMB 9.59 per share for the first half of the year, with payment scheduled for January 15, 2026 in both RMB and HKD to eligible shareholders.

- The approval of a formal dividend policy and amendments to the Articles of Association signify the company's focus on enhanced shareholder returns and governance practices.

- We will explore how the establishment of a consistent dividend policy shapes Laopu Gold’s investment case.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Laopu Gold's Investment Narrative?

For potential Laopu Gold shareholders, the key conviction centers on the company’s ability to sustain high earnings and sales growth while strengthening its commitment to shareholder returns. The newly approved interim dividend and adoption of a formal dividend policy mark a move toward more consistent capital return, aligning with management’s actions to deepen shareholder trust. This also signals a shift, potentially changing how investors view near-term catalysts: the focus may pivot from purely growth-driven narratives to questions around sustainability and capital allocation. While Laopu Gold’s recent results and analyst enthusiasm suggest momentum remains intact, the market’s pullback over the past quarter hints at investor caution around valuation risk and whether high projected returns can be maintained. The dividend announcement adds support in the short-term, but reassessment of future growth assumptions and capital discipline could become more prominent in risk considerations. On the flip side, board independence remains a factor to watch for prudent investors.

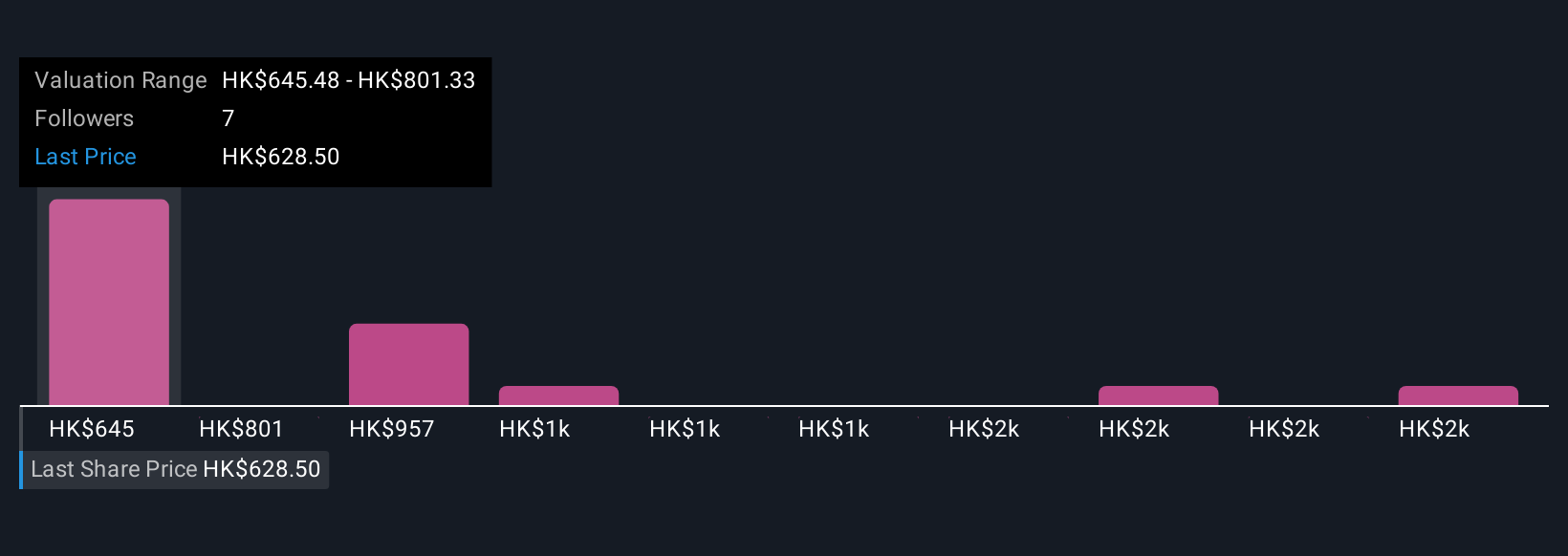

Despite retreating, Laopu Gold's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Laopu Gold - why the stock might be worth just HK$646.96!

Build Your Own Laopu Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laopu Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Laopu Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laopu Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success