Yue Yuen Industrial (Holdings) (HKG:551) Is Due To Pay A Dividend Of $0.70

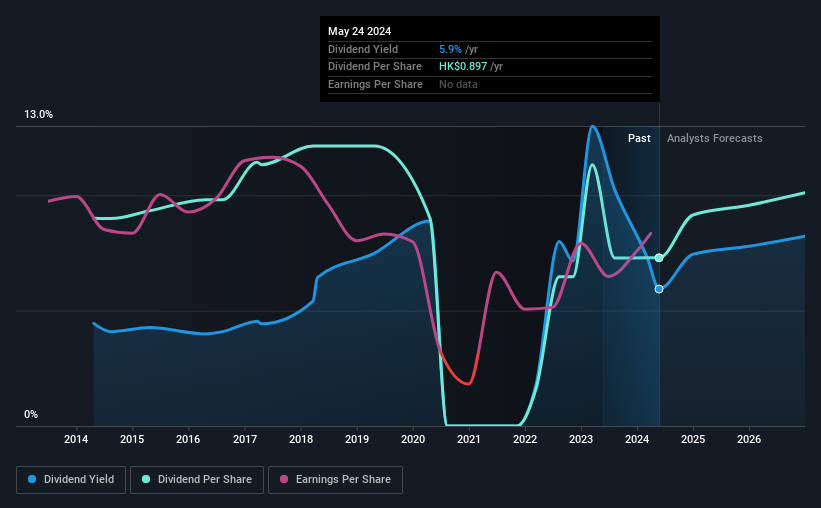

The board of Yue Yuen Industrial (Holdings) Limited (HKG:551) has announced that it will pay a dividend of $0.70 per share on the 21st of June. This makes the dividend yield 5.9%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Yue Yuen Industrial (Holdings)'s stock price has increased by 91% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Yue Yuen Industrial (Holdings)

Yue Yuen Industrial (Holdings) Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, Yue Yuen Industrial (Holdings) was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to expand by 29.8%. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was $0.142 in 2014, and the most recent fiscal year payment was $0.115. Doing the maths, this is a decline of about 2.1% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Yue Yuen Industrial (Holdings) May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Yue Yuen Industrial (Holdings) is struggling to find viable investments, so it is returning more to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On Yue Yuen Industrial (Holdings)'s Dividend

Overall, a consistent dividend is a good thing, and we think that Yue Yuen Industrial (Holdings) has the ability to continue this into the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Yue Yuen Industrial (Holdings) that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:551

Yue Yuen Industrial (Holdings)

An investment holding company, manufactures and sells athletic, athleisure, casual, and outdoor footwear in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives