The Bull Case For Yue Yuen Industrial (Holdings) (SEHK:551) Could Change Following Nine-Month Earnings Decline and Slower Sales

Reviewed by Sasha Jovanovic

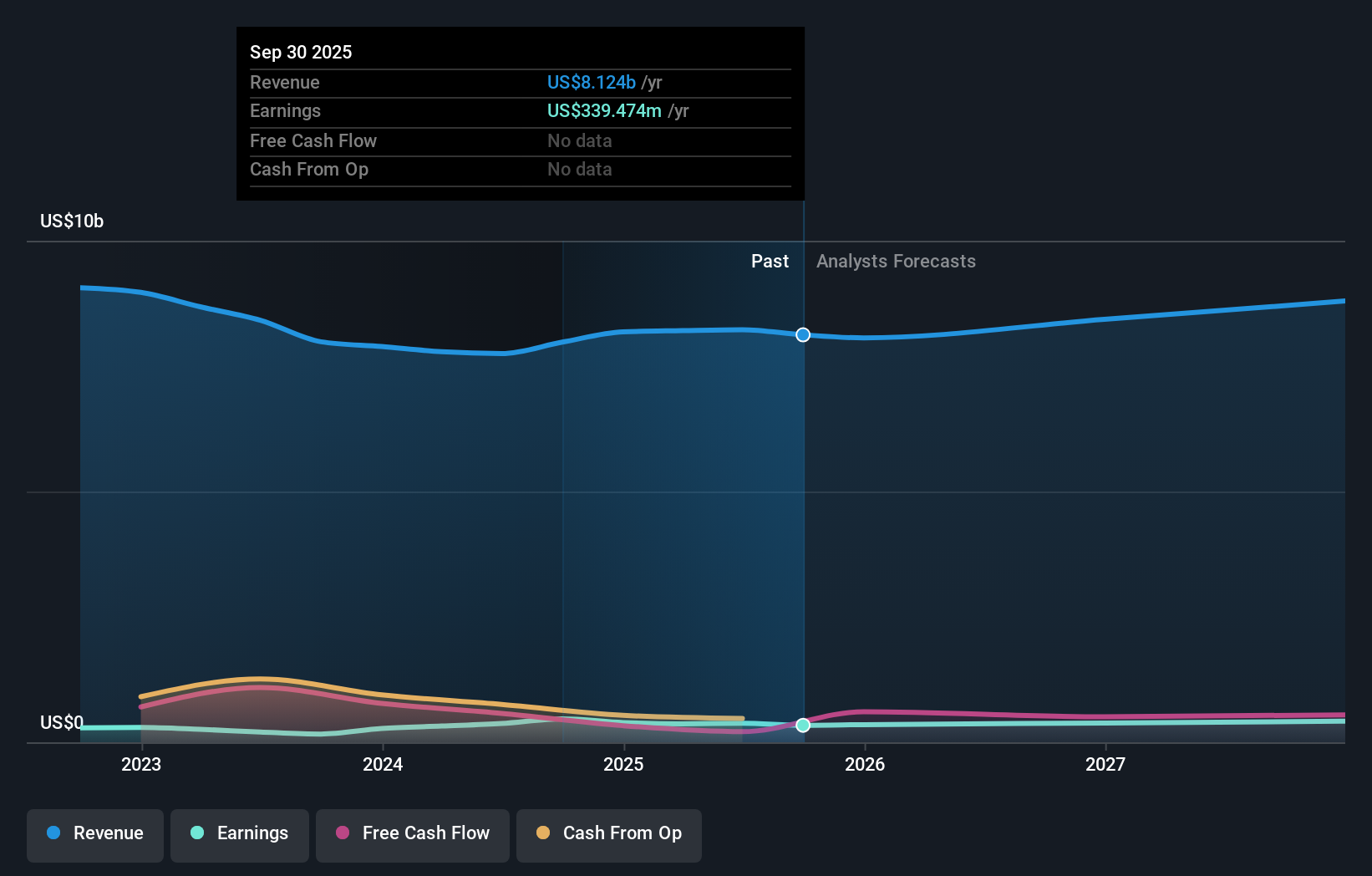

- Yue Yuen Industrial (Holdings) Limited recently reported earnings for the nine months ended September 30, 2025, with sales of US$6.02 billion and net income of US$278.72 million, both reflecting a decrease compared to the prior year.

- Lower profitability and revenue raise questions about challenges in the company's core footwear and manufacturing operations during the reporting period.

- We’ll explore how the earnings decline and subdued sales tempo could shape investor perspectives on Yue Yuen Industrial’s investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Yue Yuen Industrial (Holdings)'s Investment Narrative?

To invest in Yue Yuen Industrial, you need faith in the long-term stability of its footwear manufacturing and brand partnerships, despite recent challenges. The nine-month earnings update paints a picture of both resilience and pressure: sales held steady at just over US$6 billion, but net income declined by nearly US$53 million versus a year earlier. This underscored near-term risks around profitability, cost management, and possibly soft demand. Previously, some analysts saw catalysts in the company’s low valuation, regular dividends, and established management. However, the latest results might temper optimism, if falling margins persist, short-term catalysts like value re-rating or earnings momentum may be less convincing until a clearer turnaround appears. For now, the financials suggest that the business is facing headwinds these next few quarters, making risk and reward feel more balanced than before.

However, shifts in profitability trends could catch some investors off guard. Yue Yuen Industrial (Holdings)'s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Yue Yuen Industrial (Holdings) - why the stock might be worth less than half the current price!

Build Your Own Yue Yuen Industrial (Holdings) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yue Yuen Industrial (Holdings) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yue Yuen Industrial (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yue Yuen Industrial (Holdings)'s overall financial health at a glance.

No Opportunity In Yue Yuen Industrial (Holdings)?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:551

Yue Yuen Industrial (Holdings)

An investment holding company, manufactures and sells athletic, athleisure, casual, and outdoor footwear in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success