- Philippines

- /

- Banks

- /

- PSE:BPI

Global Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history and grapple with concerns over elevated stock valuations, investors are increasingly seeking stability amid volatility. In this context, dividend stocks can offer a compelling option for those looking to balance potential income with exposure to equity markets, especially as interest rates remain a focal point for economic policy decisions worldwide.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.29% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.83% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.72% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.40% | ★★★★★★ |

Click here to see the full list of 1374 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bank of the Philippine Islands (PSE:BPI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of the Philippine Islands, with a market cap of ₱568 billion, offers a range of financial products and services to both retail and corporate clients in the Philippines through its subsidiaries.

Operations: The revenue segments for Bank of the Philippine Islands encompass a variety of financial products and services tailored for both retail and corporate clients within the Philippines.

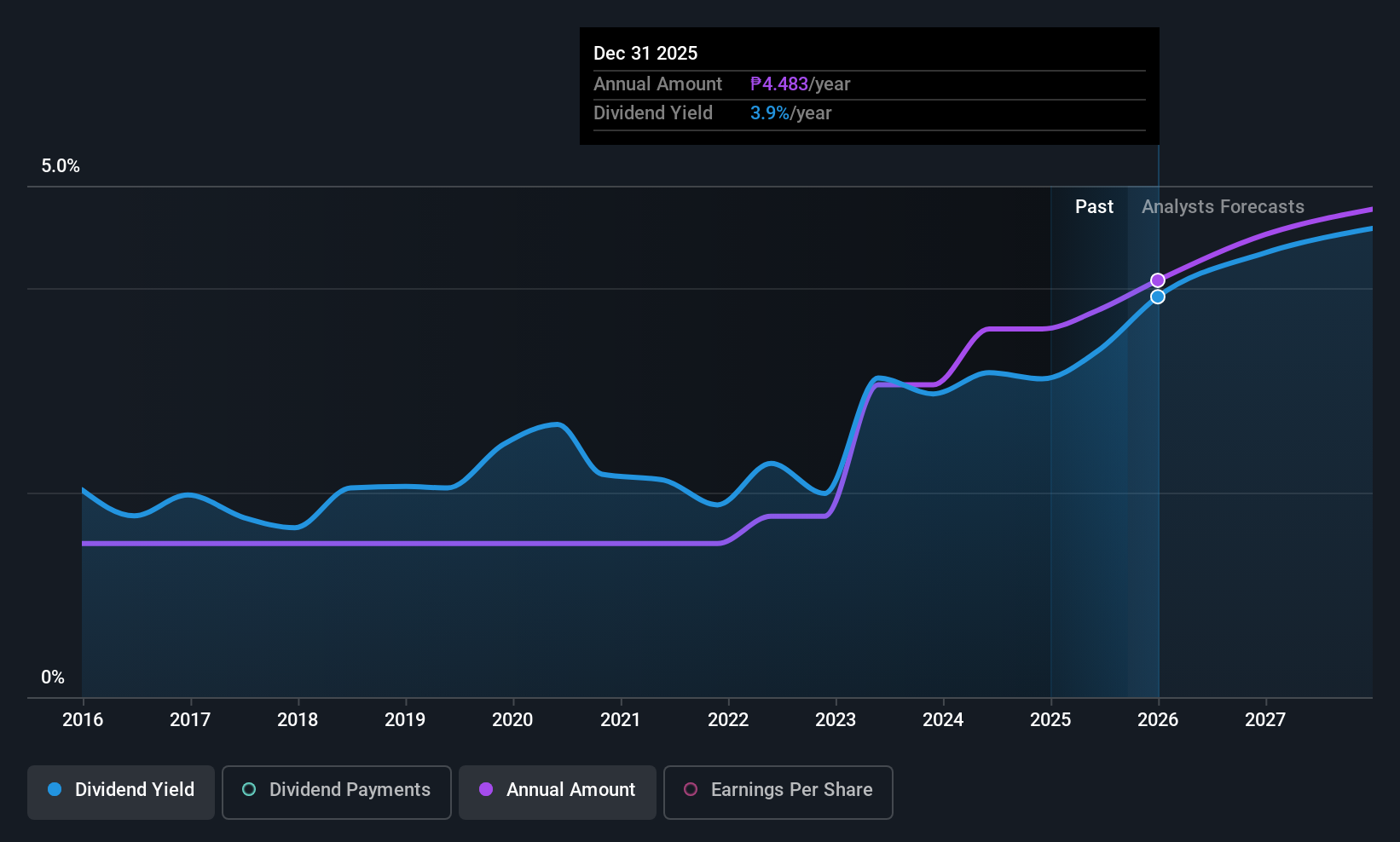

Dividend Yield: 3.9%

Bank of the Philippine Islands recently declared a cash dividend of PHP 2.28 per share, reflecting its commitment to regular dividends, which have shown stability over the past decade. Despite a relatively low dividend yield of 3.87% compared to top-tier payers in the Philippines, BPI maintains a sustainable payout ratio at 33.2%, ensuring dividends are well covered by earnings. However, it faces legal challenges that may impact financials if resolved unfavorably.

- Get an in-depth perspective on Bank of the Philippine Islands' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Bank of the Philippine Islands shares in the market.

Yue Yuen Industrial (Holdings) (SEHK:551)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yue Yuen Industrial (Holdings) Limited is an investment holding company that manufactures and sells various types of footwear, including athletic, athleisure, casual, and outdoor shoes across China, Asia, the United States, Europe, and internationally with a market cap of approximately HK$25.09 billion.

Operations: Yue Yuen Industrial (Holdings) Limited generates its revenue primarily through the manufacturing and sale of athletic, athleisure, casual, and outdoor footwear across various global markets.

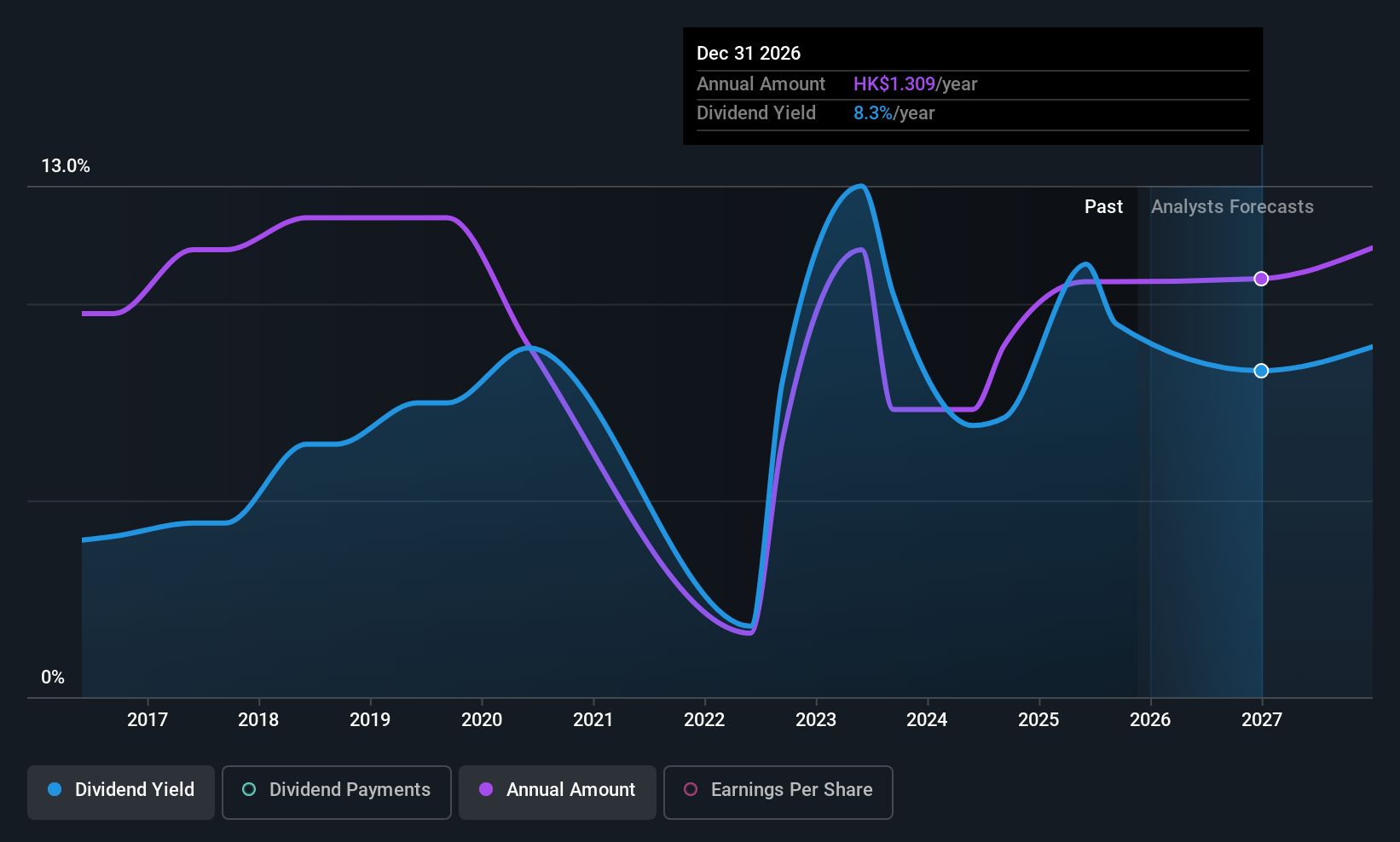

Dividend Yield: 8.2%

Yue Yuen Industrial offers an attractive dividend yield of 8.25%, ranking in the top 25% among Hong Kong payers, yet its dividends have been volatile over the past decade. Although trading at a significant discount to estimated fair value, its high cash payout ratio of 125.8% raises concerns about sustainability, as dividends are not well covered by free cash flows despite being covered by earnings at a payout ratio of 79.1%.

- Unlock comprehensive insights into our analysis of Yue Yuen Industrial (Holdings) stock in this dividend report.

- The analysis detailed in our Yue Yuen Industrial (Holdings) valuation report hints at an deflated share price compared to its estimated value.

Standard Chemical & Pharmaceutical (TWSE:1720)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Standard Chemical & Pharmaceutical Co., Ltd. manufactures and sells pharmaceutical products both in Taiwan and internationally, with a market cap of NT$11.24 billion.

Operations: Standard Chemical & Pharmaceutical Co., Ltd. generates its revenue from the manufacture and sale of pharmaceutical products across both domestic and international markets.

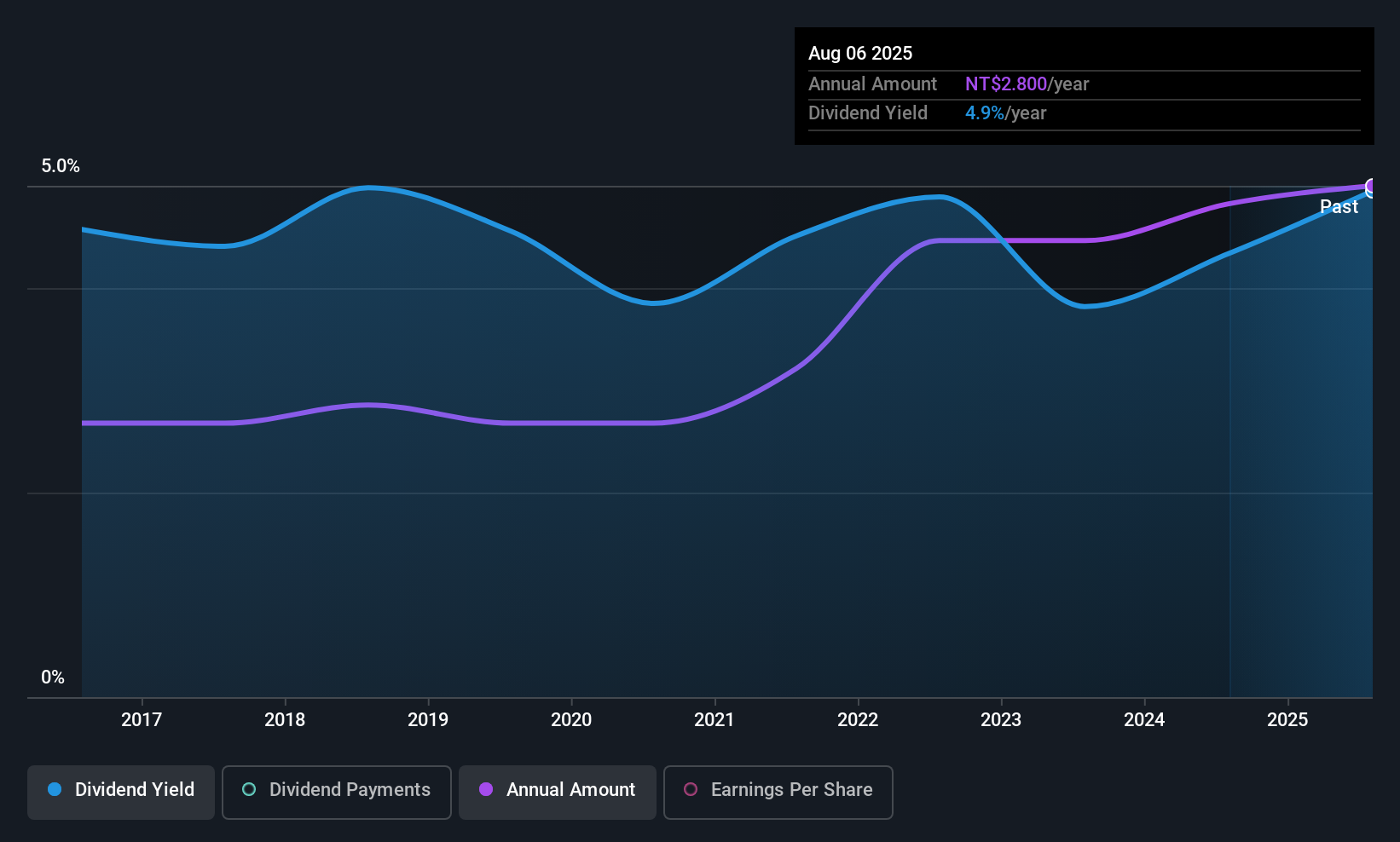

Dividend Yield: 4.5%

Standard Chemical & Pharmaceutical's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 56% and 43.1%, respectively. While the dividend yield of 4.45% is below Taiwan's top tier, it remains reliable and stable over the past decade. Recent earnings growth, with net income rising to TWD 307.6 million in Q3 from TWD 217.39 million last year, underscores financial health supporting its dividends further.

- Click to explore a detailed breakdown of our findings in Standard Chemical & Pharmaceutical's dividend report.

- Upon reviewing our latest valuation report, Standard Chemical & Pharmaceutical's share price might be too pessimistic.

Taking Advantage

- Navigate through the entire inventory of 1374 Top Global Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of the Philippine Islands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:BPI

Bank of the Philippine Islands

Provides various financial products and services to retail and corporate clients in the Philippines.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives