- Hong Kong

- /

- Consumer Durables

- /

- SEHK:526

Lisi Group (Holdings)'s (HKG:526) one-year earnings growth trails the 139% YoY shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Lisi Group (Holdings) Limited (HKG:526) share price has soared 139% in the last 1 year. Most would be very happy with that, especially in just one year! In more good news, the share price has risen 38% in thirty days. And shareholders have also done well over the long term, with an increase of 118% in the last three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Lisi Group (Holdings)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

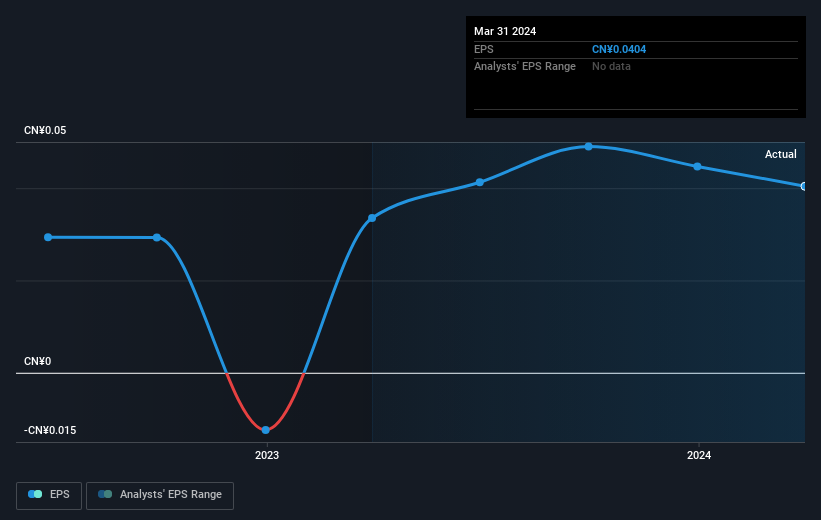

During the last year Lisi Group (Holdings) grew its earnings per share (EPS) by 20%. The share price gain of 139% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Lisi Group (Holdings)'s key metrics by checking this interactive graph of Lisi Group (Holdings)'s earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Lisi Group (Holdings) shareholders have received a total shareholder return of 139% over one year. That certainly beats the loss of about 13% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Lisi Group (Holdings) better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Lisi Group (Holdings) , and understanding them should be part of your investment process.

Of course Lisi Group (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:526

Lisi Group (Holdings)

An investment holding company, manufactures and trades in plastic and metallic household products in Mainland China, Hong Kong, the United States, Europe, and internationally.

Excellent balance sheet with proven track record.