Fountain Set (Holdings) (HKG:420) adds HK$49m to market cap in the past 7 days, though investors from five years ago are still down 56%

This week we saw the Fountain Set (Holdings) Limited (HKG:420) share price climb by 11%. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 70% during that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Fountain Set (Holdings)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

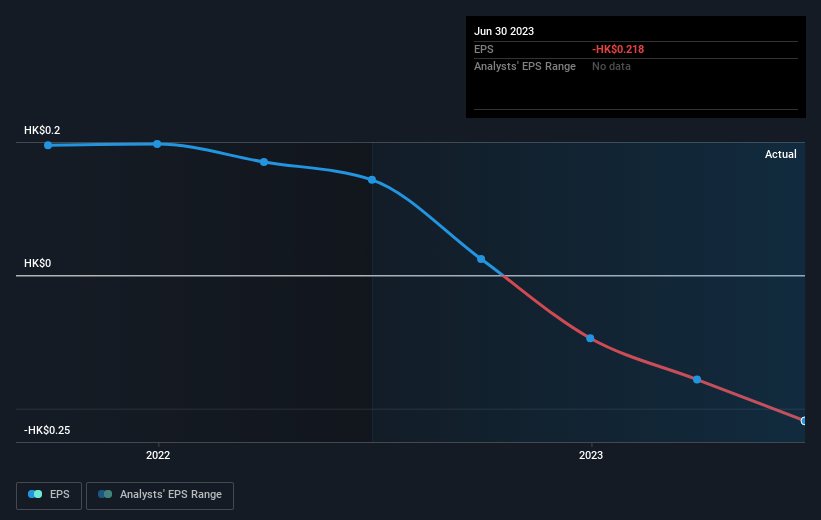

Over five years Fountain Set (Holdings)'s earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But we would generally expect a lower price, given the situation.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Fountain Set (Holdings)'s earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Fountain Set (Holdings)'s total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Fountain Set (Holdings) shareholders, and that cash payout explains why its total shareholder loss of 56%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Fountain Set (Holdings) shareholders are down 52% for the year. Unfortunately, that's worse than the broader market decline of 20%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Fountain Set (Holdings) better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Fountain Set (Holdings) you should be aware of, and 1 of them is a bit concerning.

We will like Fountain Set (Holdings) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:420

Fountain Set (Holdings)

An investment holding company, produces and sells knitted fabrics and garments in Hong Kong, the People’s Republic of China, Taiwan, Korea, Sri Lanka, the United States, Europe, and internationally.

Excellent balance sheet average dividend payer.