- Hong Kong

- /

- Consumer Durables

- /

- SEHK:396

The 16% return this week takes Hing Lee (HK) Holdings' (HKG:396) shareholders five-year gains to 17%

Hing Lee (HK) Holdings Limited (HKG:396) shareholders will doubtless be very grateful to see the share price up 35% in the last quarter. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 51% in that half decade.

The recent uptick of 16% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Hing Lee (HK) Holdings

Hing Lee (HK) Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last five years Hing Lee (HK) Holdings saw its revenue shrink by 25% per year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

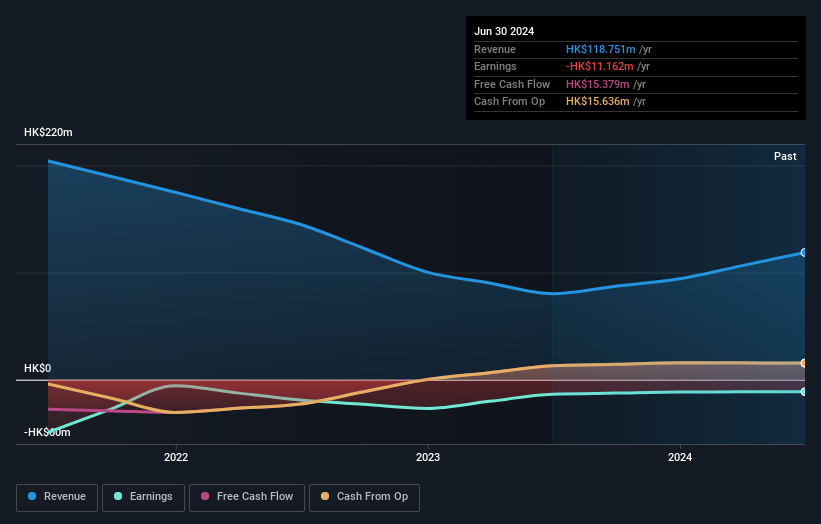

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Hing Lee (HK) Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hing Lee (HK) Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Hing Lee (HK) Holdings shareholders, and that cash payout contributed to why its TSR of 17%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Hing Lee (HK) Holdings shareholders have received a total shareholder return of 255% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Hing Lee (HK) Holdings better, we need to consider many other factors. Take risks, for example - Hing Lee (HK) Holdings has 2 warning signs we think you should be aware of.

But note: Hing Lee (HK) Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hing Lee (HK) Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:396

Hing Lee (HK) Holdings

An investment holding company, engages in the design, manufacture, marketing, sale, and export of home furniture products in the People's Republic of China, rest of Asia, Europe, and the United States.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives