Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that China Dongxiang (Group) Co., Ltd. (HKG:3818) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for China Dongxiang (Group)

What Is China Dongxiang (Group)'s Debt?

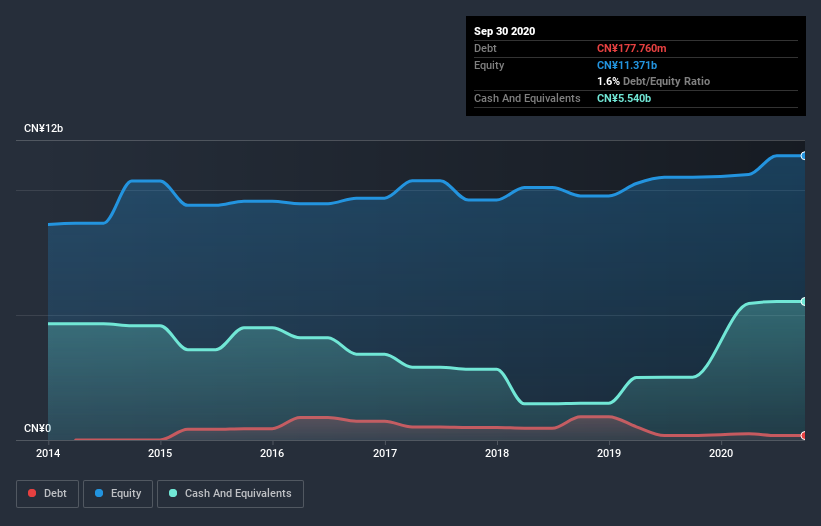

As you can see below, China Dongxiang (Group) had CN¥177.8m of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds CN¥5.54b in cash, so it actually has CN¥5.36b net cash.

How Strong Is China Dongxiang (Group)'s Balance Sheet?

We can see from the most recent balance sheet that China Dongxiang (Group) had liabilities of CN¥822.4m falling due within a year, and liabilities of CN¥355.1m due beyond that. On the other hand, it had cash of CN¥5.54b and CN¥642.4m worth of receivables due within a year. So it can boast CN¥5.00b more liquid assets than total liabilities.

This surplus liquidity suggests that China Dongxiang (Group)'s balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Simply put, the fact that China Dongxiang (Group) has more cash than debt is arguably a good indication that it can manage its debt safely.

On top of that, China Dongxiang (Group) grew its EBIT by 77% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if China Dongxiang (Group) can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While China Dongxiang (Group) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, China Dongxiang (Group) saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case China Dongxiang (Group) has CN¥5.36b in net cash and a strong balance sheet. And we liked the look of last year's 77% year-on-year EBIT growth. So we don't think China Dongxiang (Group)'s use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - China Dongxiang (Group) has 3 warning signs (and 1 which is concerning) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade China Dongxiang (Group), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success