China Dongxiang (Group) Co., Ltd.'s (HKG:3818) 44% Price Boost Is Out Of Tune With Revenues

China Dongxiang (Group) Co., Ltd. (HKG:3818) shareholders would be excited to see that the share price has had a great month, posting a 44% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

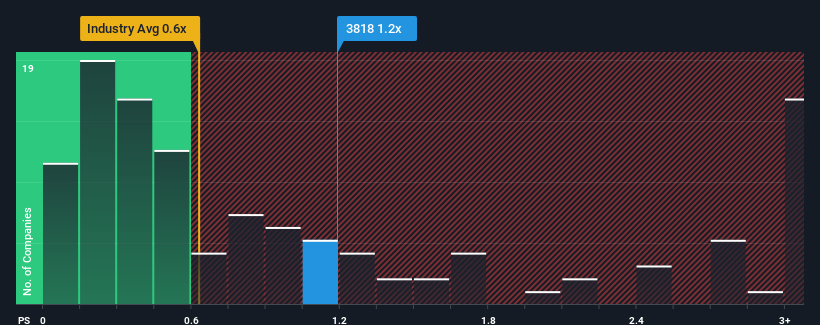

After such a large jump in price, you could be forgiven for thinking China Dongxiang (Group) is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in Hong Kong's Luxury industry have P/S ratios below 0.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Dongxiang (Group)

How China Dongxiang (Group) Has Been Performing

China Dongxiang (Group) could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on China Dongxiang (Group) will help you uncover what's on the horizon.How Is China Dongxiang (Group)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as China Dongxiang (Group)'s is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 3.9% gain to the company's revenues. Still, lamentably revenue has fallen 11% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.0% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that China Dongxiang (Group)'s P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does China Dongxiang (Group)'s P/S Mean For Investors?

China Dongxiang (Group)'s P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see China Dongxiang (Group) trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China Dongxiang (Group) that you need to be mindful of.

If these risks are making you reconsider your opinion on China Dongxiang (Group), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives