- Philippines

- /

- Office REITs

- /

- PSE:DDMPR

3 Promising Penny Stocks With Market Caps Under US$400M

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate cuts and mixed economic signals, investors are increasingly seeking opportunities that can offer growth potential at lower price points. Penny stocks, while often seen as a niche investment area, continue to present intriguing possibilities for those willing to explore smaller or newer companies. With strong financial health and solid fundamentals, these stocks can defy expectations and potentially deliver impressive returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £804.39M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £154.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

Click here to see the full list of 5,738 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

DDMP REIT (PSE:DDMPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DDMP REIT Inc. is a real estate investment trust company in the Philippines with a market cap of ₱18.36 billion.

Operations: The company generates revenue from its leasing business, amounting to ₱1.91 billion.

Market Cap: ₱18.36B

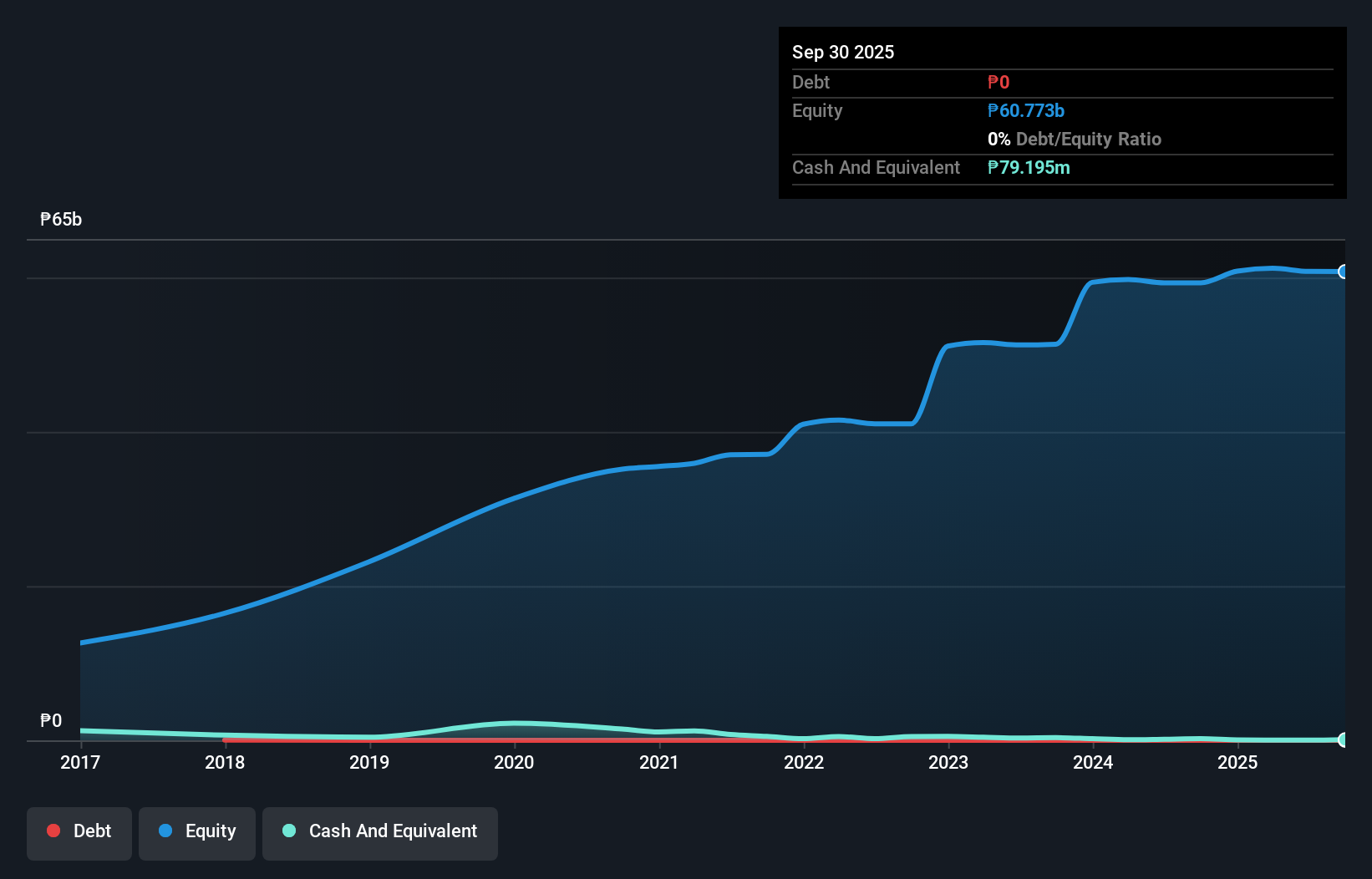

DDMP REIT Inc., with a market cap of ₱18.36 billion, recently reported declining earnings and revenue for the third quarter of 2024, reflecting negative growth compared to the previous year. Despite this, it remains debt-free and has a seasoned board with an average tenure of over ten years. The company trades significantly below its estimated fair value but faces challenges in sustaining its high dividend yield due to inadequate earnings coverage. Although DDMP's short-term assets exceed long-term liabilities, they fall short in covering short-term liabilities, highlighting potential liquidity concerns amidst stable weekly volatility.

- Get an in-depth perspective on DDMP REIT's performance by reading our balance sheet health report here.

- Learn about DDMP REIT's historical performance here.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. operates in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories both in China and internationally with a market cap of HK$2.02 billion.

Operations: The company generates CN¥1.72 billion in revenue from its apparel segment within China.

Market Cap: HK$2.02B

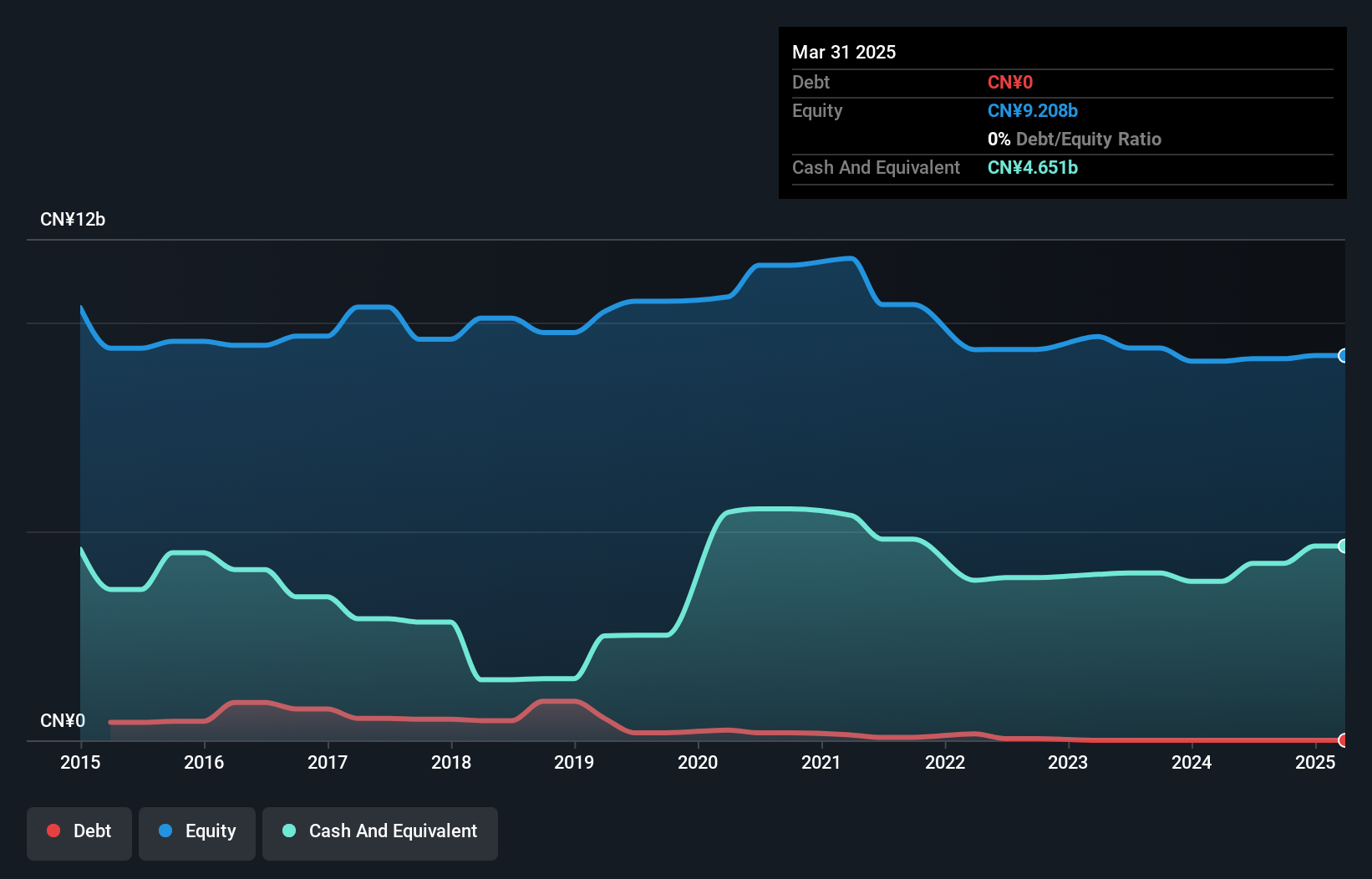

China Dongxiang (Group) Co., Ltd. has faced challenges with declining earnings over the past five years, reporting a net income of CN¥136.97 million for the recent half-year, recovering from a previous loss. Despite being debt-free and having substantial short-term assets of CN¥4.9 billion that cover both its short and long-term liabilities, the company remains unprofitable with a negative return on equity of -1.01%. Recent announcements include an interim special dividend of RMB 0.007 per share, reflecting efforts to reward shareholders amidst stable weekly volatility and experienced management oversight.

- Click here to discover the nuances of China Dongxiang (Group) with our detailed analytical financial health report.

- Gain insights into China Dongxiang (Group)'s past trends and performance with our report on the company's historical track record.

Carry Wealth Holdings (SEHK:643)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Carry Wealth Holdings Limited is an investment holding company that manufactures, trades, and markets garment products for various brands globally, with a market cap of HK$346.44 million.

Operations: The company generates revenue of HK$546.68 million from its garment manufacturing and trading segment.

Market Cap: HK$346.44M

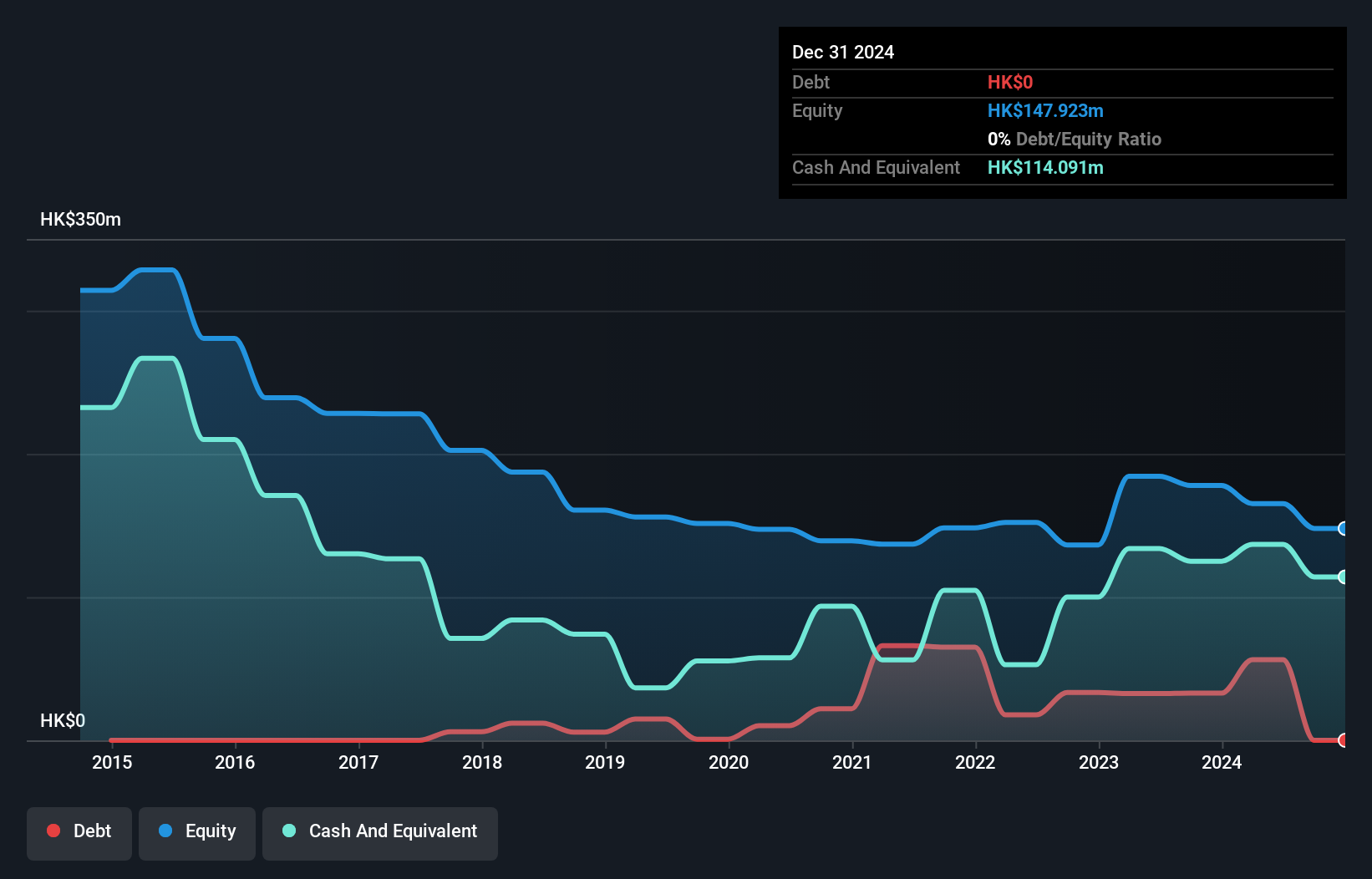

Carry Wealth Holdings Limited, with a market cap of HK$346.44 million, is navigating financial challenges as it remains unprofitable despite generating revenue from its garment manufacturing and trading segment. The company benefits from having more cash than total debt, and its short-term assets of HK$235 million exceed both short-term liabilities (HK$111.3 million) and long-term liabilities (HK$19 million). However, the company's share price has been highly volatile recently, and it faces a negative return on equity at -10.02%. A recent leadership change saw Mr. Shen Peng appointed as chairman to potentially steer strategic improvements.

- Click to explore a detailed breakdown of our findings in Carry Wealth Holdings' financial health report.

- Examine Carry Wealth Holdings' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Access the full spectrum of 5,738 Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:DDMPR

DDMP REIT

Operates as a real estate investment trust company in the Philippines.

Excellent balance sheet and good value.

Market Insights

Community Narratives