Does JNBY Design’s (SEHK:3306) Dividend and Auditor Shift Mark a Turning Point in Oversight Strategy?

Reviewed by Sasha Jovanovic

- At its annual general meeting held on 30 October 2025, JNBY Design Limited approved the declaration of a final dividend of HK$0.93 (approximately RMB0.86) per ordinary share for the year ended 30 June 2025 and appointed Deloitte Touche Tohmatsu as the company’s auditor.

- Simultaneous consideration of a dividend payout and auditor change highlights a period of both capital return and potentially evolving oversight for JNBY Design.

- With a newly declared dividend shaping investor expectations, we’ll explore what these board decisions mean for JNBY Design’s investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is JNBY Design's Investment Narrative?

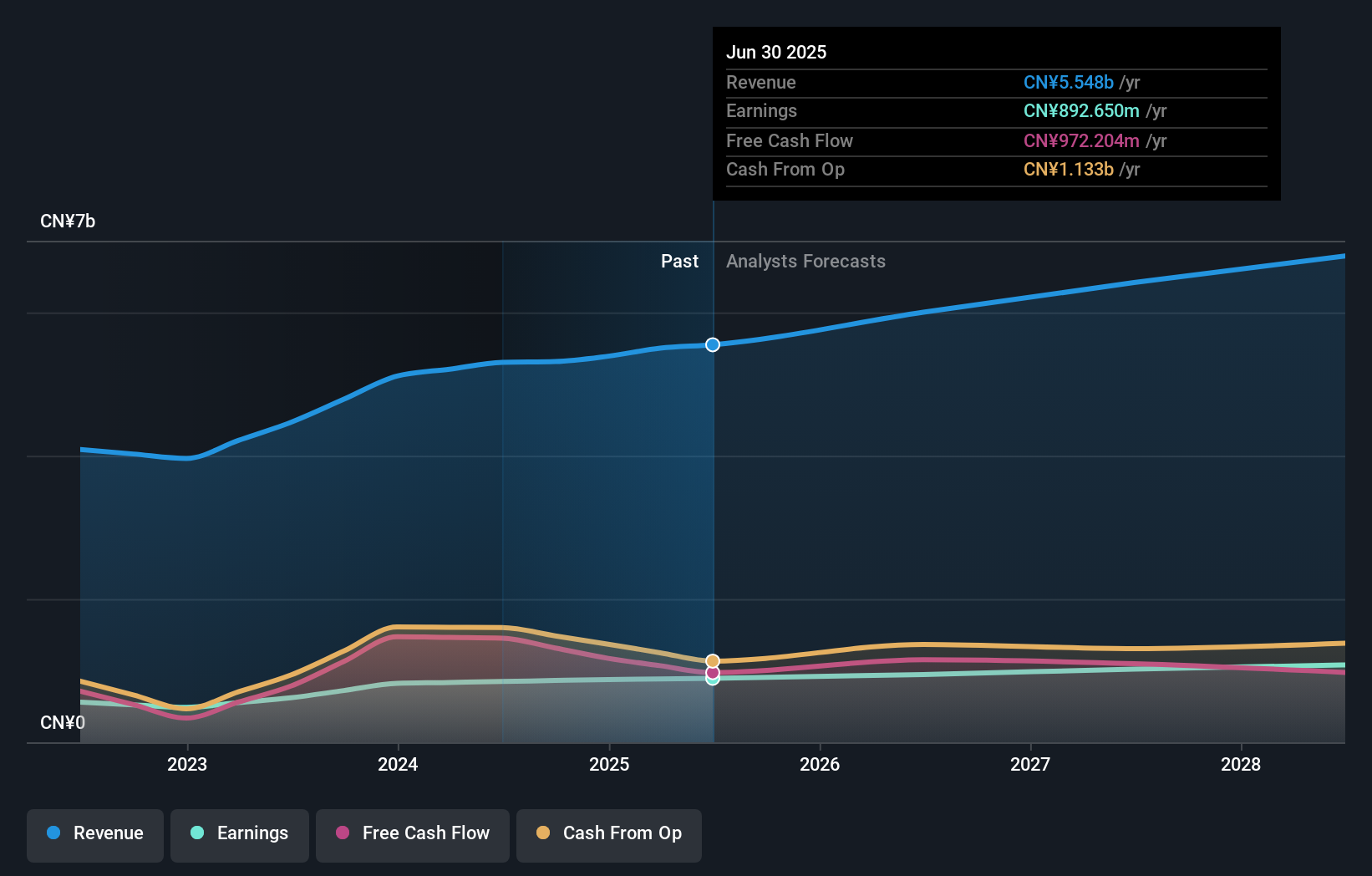

To be comfortable owning JNBY Design, you need to believe in its ability to deliver steady earnings and dividend growth despite operating in a challenging luxury market. The board’s move to approve a larger final dividend, up from HK$0.86 last year to HK$0.93, signals a continued commitment to capital returns, but questions linger about the sustainability of payouts given an unstable dividend track record. The freshly appointed auditor, Deloitte Touche Tohmatsu, introduces an element of oversight change, which could reassure some investors but may also introduce short-term uncertainty as processes transition. While recent price gains suggest little immediate impact from the boardroom changes, investors remain focused on whether profit growth can keep pace with market benchmarks and if high returns on equity will persist. It is still too soon to tell if these changes will meaningfully alter JNBY’s risk-reward balance, but it’s a development worth monitoring.

But in contrast to strong dividend headlines, past payout volatility remains a crucial point for investors to consider. JNBY Design's shares have been on the rise but are still potentially undervalued by 38%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on JNBY Design - why the stock might be worth less than half the current price!

Build Your Own JNBY Design Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JNBY Design research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JNBY Design research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JNBY Design's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3306

JNBY Design

Engages in the design, marketing, retail, and sale of fashion apparels, accessory products, and household goods in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives