Shareholders May Not Be So Generous With Eagle Nice (International) Holdings Limited's (HKG:2368) CEO Compensation And Here's Why

Under the guidance of CEO Yuk Sing Chung, Eagle Nice (International) Holdings Limited (HKG:2368) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18 August 2021. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Eagle Nice (International) Holdings

How Does Total Compensation For Yuk Sing Chung Compare With Other Companies In The Industry?

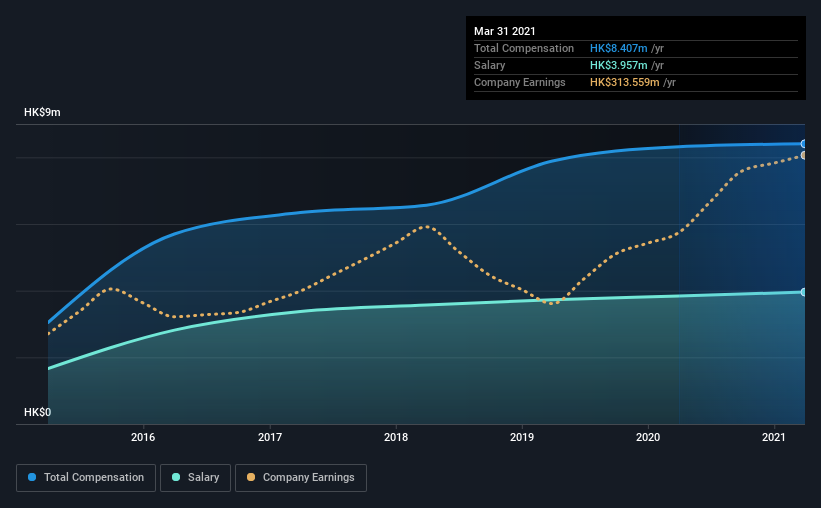

At the time of writing, our data shows that Eagle Nice (International) Holdings Limited has a market capitalization of HK$2.7b, and reported total annual CEO compensation of HK$8.4m for the year to March 2021. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$4.0m.

On examining similar-sized companies in the industry with market capitalizations between HK$1.6b and HK$6.2b, we discovered that the median CEO total compensation of that group was HK$4.2m. Hence, we can conclude that Yuk Sing Chung is remunerated higher than the industry median. Furthermore, Yuk Sing Chung directly owns HK$467m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$4.0m | HK$3.8m | 47% |

| Other | HK$4.5m | HK$4.5m | 53% |

| Total Compensation | HK$8.4m | HK$8.3m | 100% |

On an industry level, roughly 91% of total compensation represents salary and 9% is other remuneration. Eagle Nice (International) Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Eagle Nice (International) Holdings Limited's Growth Numbers

Over the past three years, Eagle Nice (International) Holdings Limited has seen its earnings per share (EPS) grow by 8.6% per year. Its revenue is up 7.7% over the last year.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Eagle Nice (International) Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Eagle Nice (International) Holdings Limited for providing a total return of 90% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Eagle Nice (International) Holdings that investors should look into moving forward.

Switching gears from Eagle Nice (International) Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eagle Nice (International) Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2368

Eagle Nice (International) Holdings

An investment holding company, manufactures and trades in sportswear and garments in Mainland China, the United States, Europe, Japan, South Korea, and internationally.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives