Market Cool On Cosmo Lady (China) Holdings Company Limited's (HKG:2298) Earnings

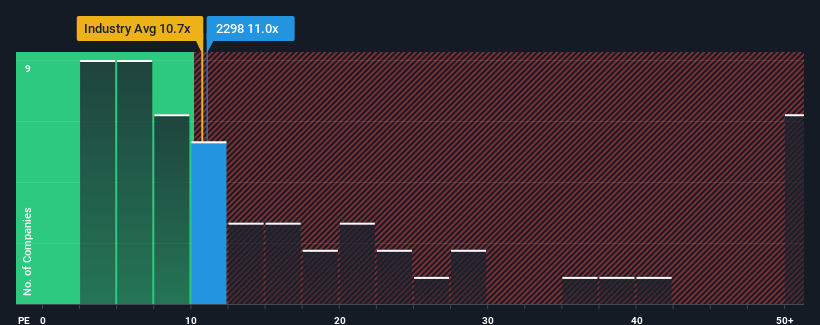

With a median price-to-earnings (or "P/E") ratio of close to 10x in Hong Kong, you could be forgiven for feeling indifferent about Cosmo Lady (China) Holdings Company Limited's (HKG:2298) P/E ratio of 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Cosmo Lady (China) Holdings has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Cosmo Lady (China) Holdings

How Is Cosmo Lady (China) Holdings' Growth Trending?

In order to justify its P/E ratio, Cosmo Lady (China) Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 55% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 21%, which is noticeably less attractive.

In light of this, it's curious that Cosmo Lady (China) Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Cosmo Lady (China) Holdings' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cosmo Lady (China) Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Cosmo Lady (China) Holdings that you should be aware of.

You might be able to find a better investment than Cosmo Lady (China) Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2298

Cosmo Lady (China) Holdings

An investment holding company, engages in the design, research, development, and sale of branded intimate wear products in the People ‘s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives