- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2148

Vesync Co., Ltd's (HKG:2148) P/S Still Appears To Be Reasonable

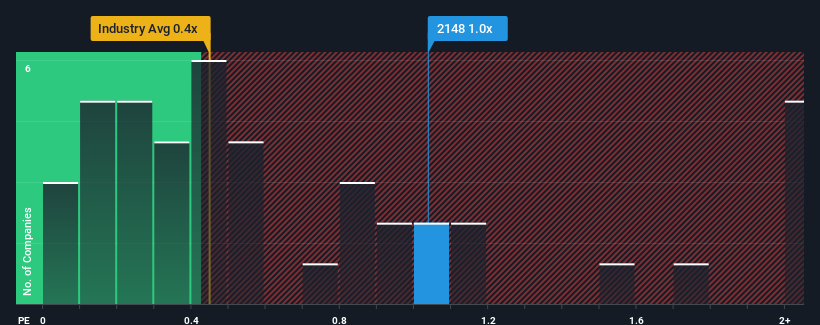

When you see that almost half of the companies in the Consumer Durables industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.4x, Vesync Co., Ltd (HKG:2148) looks to be giving off some sell signals with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Vesync

How Has Vesync Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Vesync has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Vesync's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Vesync?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Vesync's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 44% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 13% per annum during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 5.6% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Vesync is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Vesync's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Vesync shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Vesync that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2148

Vesync

Engages in the research and development, manufacture, and sale of smart household appliances and smart home devices in North America, Europe, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives