- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2148

Investors Appear Satisfied With Vesync Co., Ltd's (HKG:2148) Prospects As Shares Rocket 33%

The Vesync Co., Ltd (HKG:2148) share price has done very well over the last month, posting an excellent gain of 33%. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

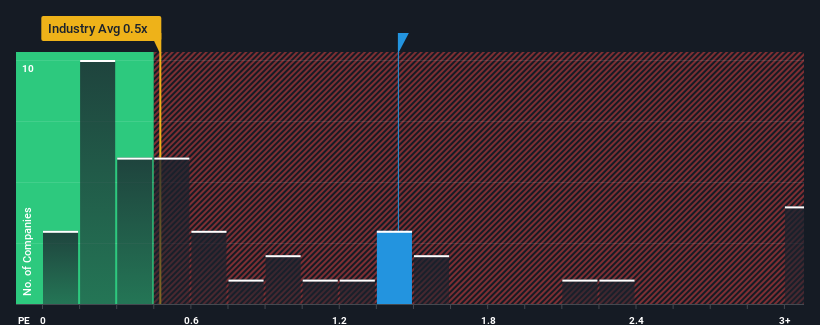

After such a large jump in price, when almost half of the companies in Hong Kong's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Vesync as a stock probably not worth researching with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Vesync

What Does Vesync's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Vesync has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Vesync will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Vesync?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Vesync's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Pleasingly, revenue has also lifted 68% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's understandable that Vesync's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Vesync's P/S?

Vesync shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Vesync shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Vesync that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2148

Vesync

Engages in the research and development, manufacture, and sale of smart household appliances and smart home devices in North America, Europe, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives