National Electronics Holdings (HKG:213) Is Due To Pay A Dividend Of HK$0.005

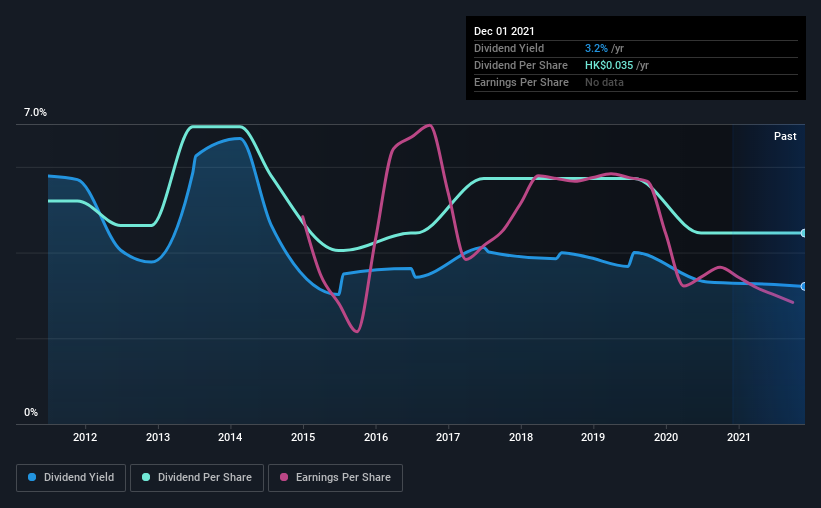

National Electronics Holdings Limited's (HKG:213) investors are due to receive a payment of HK$0.005 per share on 29th of December. This means the annual payment is 3.2% of the current stock price, which is above the average for the industry.

Check out our latest analysis for National Electronics Holdings

National Electronics Holdings' Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, National Electronics Holdings was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 16.3% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 40%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The first annual payment during the last 10 years was HK$0.041 in 2011, and the most recent fiscal year payment was HK$0.035. This works out to be a decline of approximately 1.5% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though National Electronics Holdings' EPS has declined at around 16% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about National Electronics Holdings' payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 4 warning signs for National Electronics Holdings you should be aware of, and 2 of them don't sit too well with us. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if National Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:213

National Electronics Holdings

An investment holding company, manufactures, assembles, and sells electronic watches and watch parts in the People’s Republic of China, Hong Kong, North America, Europe, and internationally.

Slight risk with acceptable track record.

Market Insights

Community Narratives