- Hong Kong

- /

- Industrials

- /

- SEHK:2722

Why Chongqing Machinery & Electric's Dividend Falls Short And One Stock That Shines

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide a reliable source of income. However, not all dividend stocks are equally promising. For example, Chongqing Machinery & Electric has seen its dividend decline over time, raising concerns about the sustainability of its payouts and the overall health of the company. This makes it crucial to scrutinize whether a stock's dividend history indicates financial robustness or potential red flags.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 8.02% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.01% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 9.41% | ★★★★★★ |

| Lenovo Group (SEHK:992) | 3.43% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.97% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.20% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.18% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.69% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.22% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.31% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

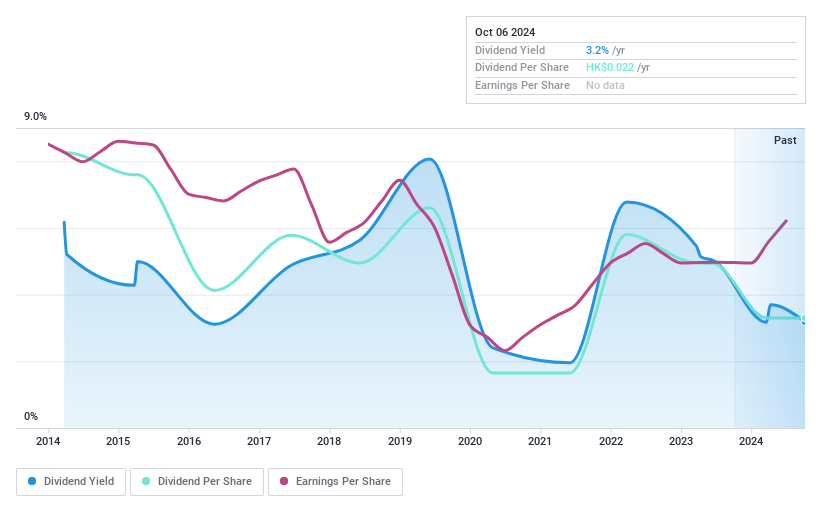

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited operates in manufacturing, trading, and selling elastic fabric, elastic webbing, and lace with a market capitalization of approximately HK$2.62 billion.

Operations: The company generates revenue primarily through two segments: HK$834.34 million from elastic webbing and HK$3.37 billion from elastic fabric and lace.

Dividend Yield: 6.6%

Best Pacific International Holdings has demonstrated a consistent ability to increase its dividend, with a recent declaration of a final dividend of HK$0.1138 per share for the year ended 31 December 2023, reflecting positive growth. Despite some volatility in dividend payments over the last decade, the company maintains a healthy coverage with a payout ratio of 50% and cash payout ratio of 23.9%. However, its current yield at 6.62% is below Hong Kong's top dividend payers' average.

- Get an in-depth perspective on Best Pacific International Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report Best Pacific International Holdings implies its share price may be lower than expected.

One To Reconsider

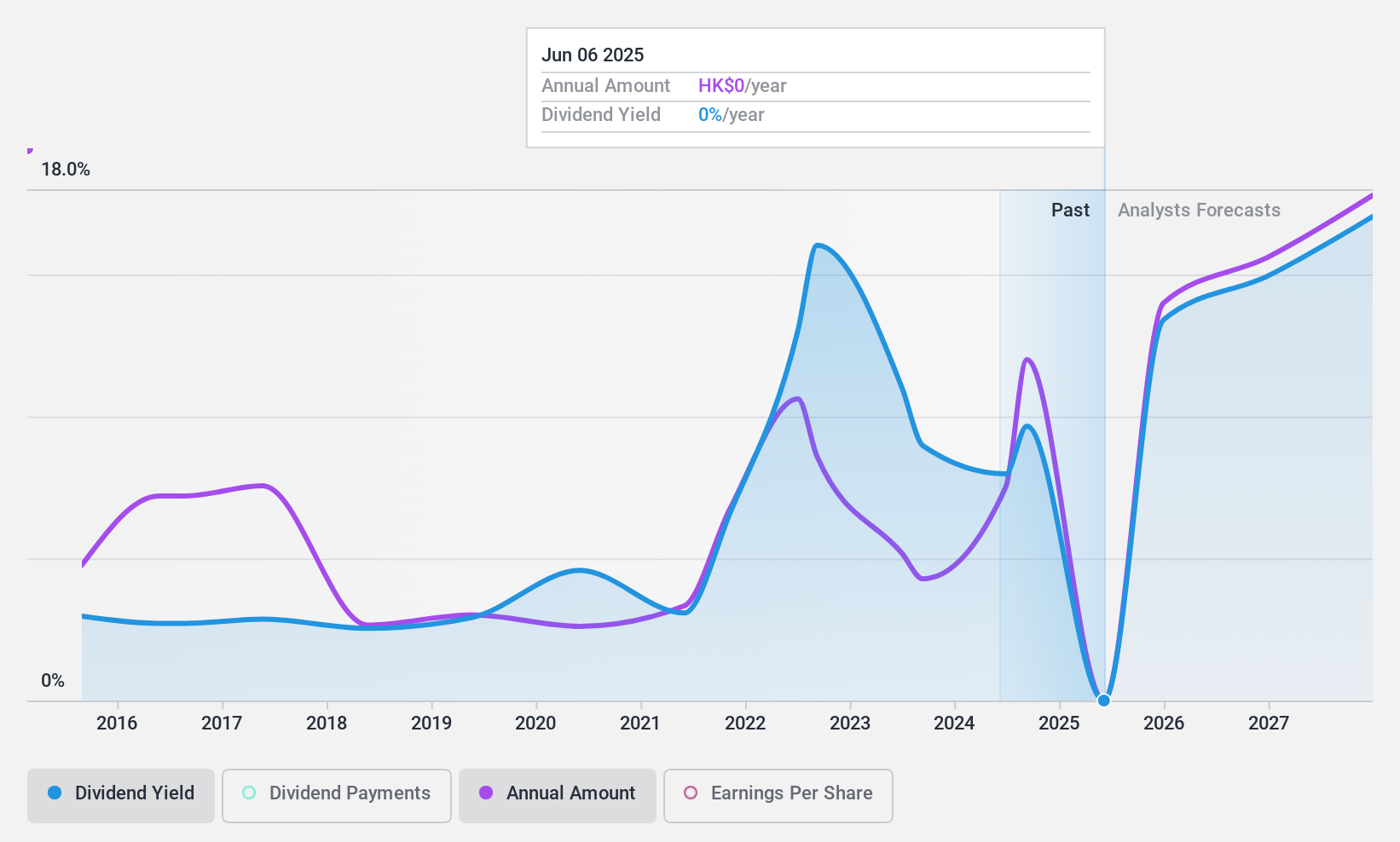

Chongqing Machinery & Electric (SEHK:2722)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Chongqing Machinery & Electric Co., Ltd. focuses on designing, manufacturing, and selling clean energy equipment and high-end smart manufacturing equipment, with a market capitalization of approximately HK$1.99 billion.

Operations: The company's revenue segments are primarily derived from hydroelectric generation equipment (CN¥2.26 billion), general machinery (CN¥2.20 billion), wire and cable products (CN¥1.81 billion), CNC machine tools (CN¥0.76 billion), and intelligent manufacturing (CN¥0.45 billion).

Dividend Yield: 4%

Chongqing Machinery & Electric Co., Ltd. has experienced a decline in dividend payments, with a recent final dividend of RMB 0.02 per share for 2023, indicating reduced shareholder returns. Despite a low payout ratio of 25%, the company struggles with unstable and unsustainable dividends, lacking support from free cash flows and consistent earnings coverage. Additionally, recent executive changes and amendments to company bylaws suggest potential instability within its operational structure.

Taking Advantage

- Gain an insight into the universe of 89 Top Dividend Stocks by clicking here.

- Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2722

Chongqing Machinery & Electric

Designs, manufactures, and sells clean energy equipment and high-end smart manufacturing equipment.

Proven track record with adequate balance sheet.