Here's Why Shareholders May Want To Be Cautious With Increasing Best Pacific International Holdings Limited's (HKG:2111) CEO Pay Packet

Key Insights

- Best Pacific International Holdings' Annual General Meeting to take place on 3rd of June

- Total pay for CEO Haitao Zhang includes HK$4.66m salary

- The total compensation is 135% higher than the average for the industry

- Over the past three years, Best Pacific International Holdings' EPS grew by 15% and over the past three years, the total shareholder return was 67%

CEO Haitao Zhang has done a decent job of delivering relatively good performance at Best Pacific International Holdings Limited (HKG:2111) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 3rd of June. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Best Pacific International Holdings

How Does Total Compensation For Haitao Zhang Compare With Other Companies In The Industry?

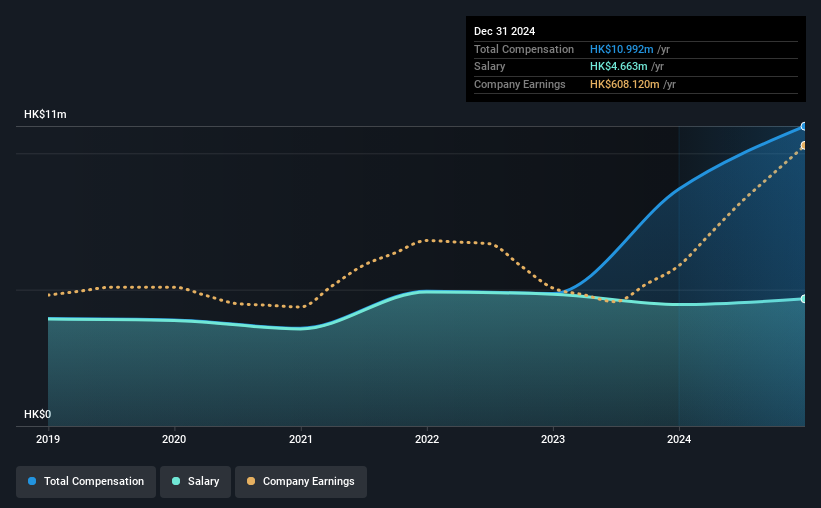

Our data indicates that Best Pacific International Holdings Limited has a market capitalization of HK$2.6b, and total annual CEO compensation was reported as HK$11m for the year to December 2024. That's a notable increase of 27% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$4.7m.

In comparison with other companies in the Hong Kong Luxury industry with market capitalizations ranging from HK$1.6b to HK$6.3b, the reported median CEO total compensation was HK$4.7m. This suggests that Haitao Zhang is paid more than the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$4.7m | HK$4.5m | 42% |

| Other | HK$6.3m | HK$4.2m | 58% |

| Total Compensation | HK$11m | HK$8.7m | 100% |

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. It's interesting to note that Best Pacific International Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Best Pacific International Holdings Limited's Growth

Over the past three years, Best Pacific International Holdings Limited has seen its earnings per share (EPS) grow by 15% per year. In the last year, its revenue is up 20%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Best Pacific International Holdings Limited Been A Good Investment?

We think that the total shareholder return of 67%, over three years, would leave most Best Pacific International Holdings Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Best Pacific International Holdings that investors should be aware of in a dynamic business environment.

Important note: Best Pacific International Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Best Pacific International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2111

Best Pacific International Holdings

Manufactures, trades in, and sells elastic fabric, elastic webbing, and lace.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives