Should Shareholders Have Second Thoughts About A Pay Rise For Kader Holdings Company Limited's (HKG:180) CEO This Year?

Key Insights

- Kader Holdings will host its Annual General Meeting on 24th of June

- Salary of HK$600.0k is part of CEO Kenneth Ting's total remuneration

- The overall pay is 52% below the industry average

- Kader Holdings' three-year loss to shareholders was 49% while its EPS was down 82% over the past three years

The underwhelming performance at Kader Holdings Company Limited (HKG:180) recently has probably not pleased shareholders. The next AGM coming up on 24th of June will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for Kader Holdings

How Does Total Compensation For Kenneth Ting Compare With Other Companies In The Industry?

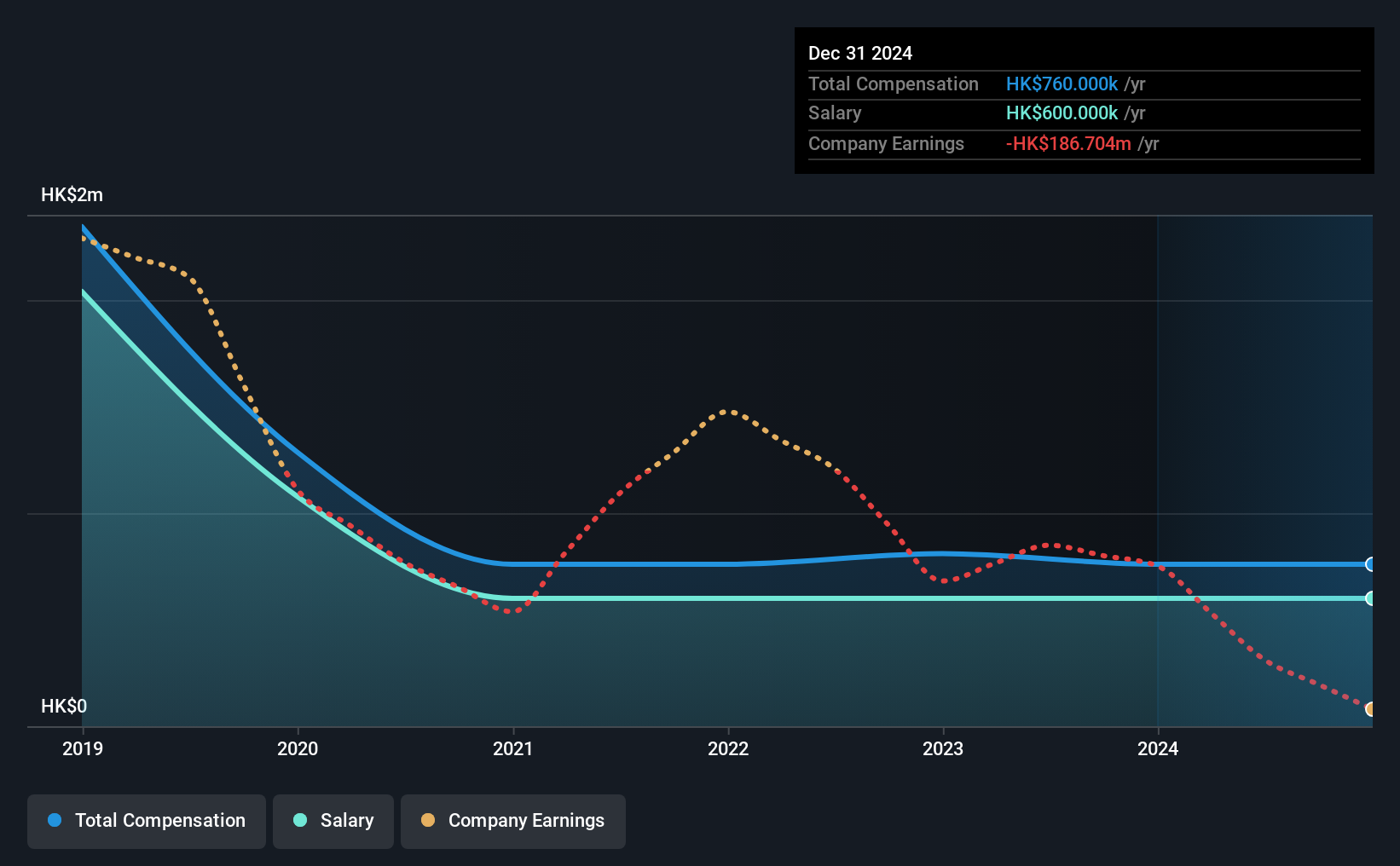

Our data indicates that Kader Holdings Company Limited has a market capitalization of HK$217m, and total annual CEO compensation was reported as HK$760k for the year to December 2024. This was the same as last year. In particular, the salary of HK$600.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Leisure industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.6m. That is to say, Kenneth Ting is paid under the industry median. What's more, Kenneth Ting holds HK$66m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$600k | HK$600k | 79% |

| Other | HK$160k | HK$160k | 21% |

| Total Compensation | HK$760k | HK$760k | 100% |

Talking in terms of the industry, salary represented approximately 92% of total compensation out of all the companies we analyzed, while other remuneration made up 8% of the pie. In Kader Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Kader Holdings Company Limited's Growth

Kader Holdings Company Limited has reduced its earnings per share by 82% a year over the last three years. It saw its revenue drop 8.8% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Kader Holdings Company Limited Been A Good Investment?

The return of -49% over three years would not have pleased Kader Holdings Company Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which shouldn't be ignored) in Kader Holdings we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kader Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:180

Kader Holdings

An investment holding company, manufactures and trades plastic, electronic and stuffed toys, and model trains in Hong Kong, Mainland China, North America, Europe, Japan, Singapore, and internationally.

Good value with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion