Yadong Group Holdings Limited (HKG:1795) Not Doing Enough For Some Investors As Its Shares Slump 27%

To the annoyance of some shareholders, Yadong Group Holdings Limited (HKG:1795) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

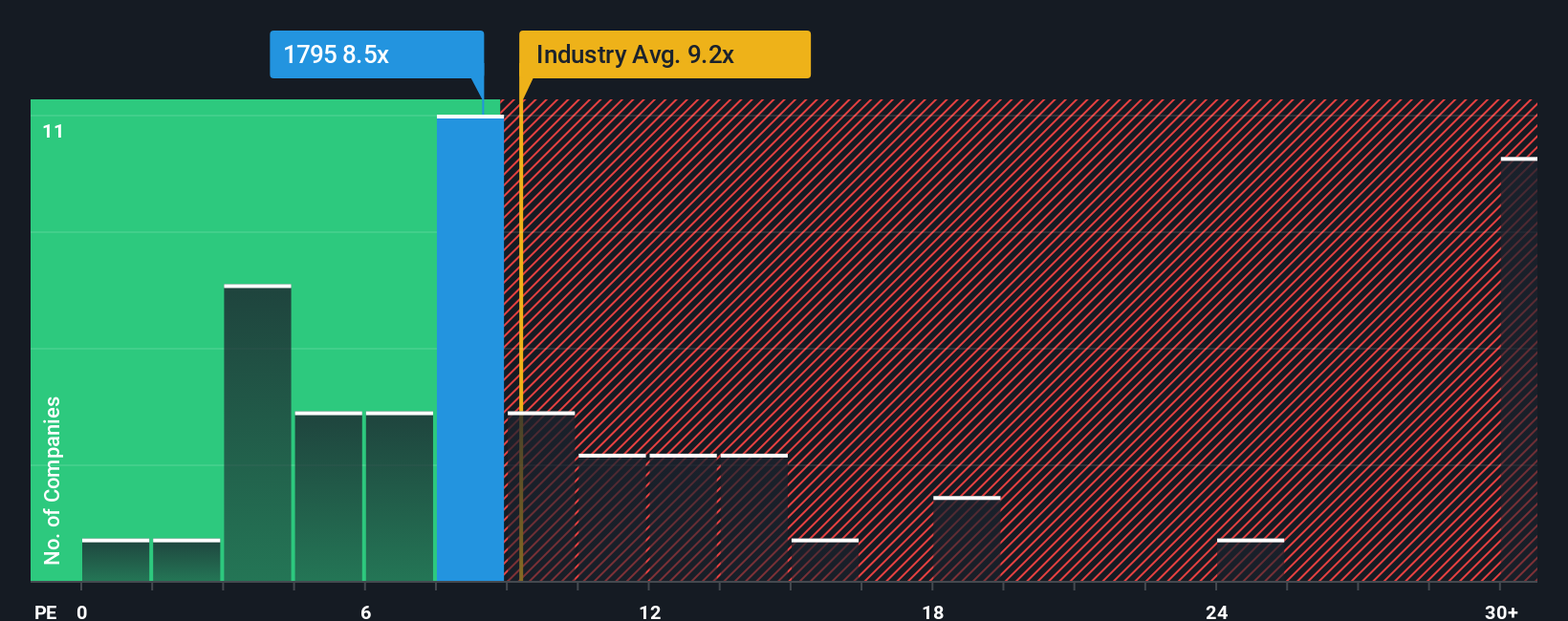

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Yadong Group Holdings as an attractive investment with its 8.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Yadong Group Holdings has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

View our latest analysis for Yadong Group Holdings

How Is Yadong Group Holdings' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Yadong Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.2% last year. The solid recent performance means it was also able to grow EPS by 5.3% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Yadong Group Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Yadong Group Holdings' P/E?

Yadong Group Holdings' recently weak share price has pulled its P/E below most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Yadong Group Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Yadong Group Holdings (2 are a bit unpleasant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1795

Yadong Group Holdings

An investment holding company, engages in the design, process, and sale of textile fabric products to garment manufacturers and trading companies.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026