Benign Growth For Yadong Group Holdings Limited (HKG:1795) Underpins Stock's 25% Plummet

Unfortunately for some shareholders, the Yadong Group Holdings Limited (HKG:1795) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

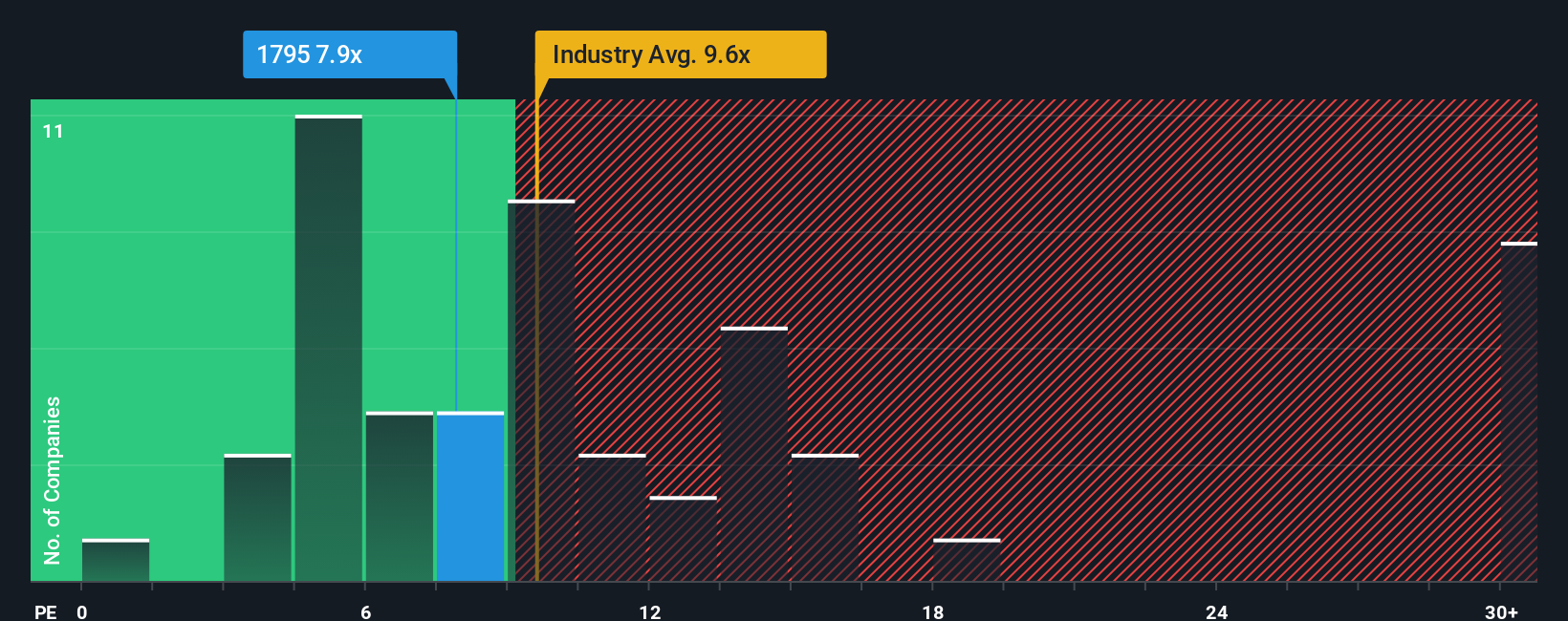

Although its price has dipped substantially, Yadong Group Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.9x, since almost half of all companies in Hong Kong have P/E ratios greater than 13x and even P/E's higher than 25x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Yadong Group Holdings over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Yadong Group Holdings

How Is Yadong Group Holdings' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Yadong Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Yadong Group Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Yadong Group Holdings' P/E?

Yadong Group Holdings' P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Yadong Group Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Yadong Group Holdings (2 are a bit unpleasant!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1795

Yadong Group Holdings

An investment holding company, engages in the design, process, and sale of textile fabric products to garment manufacturers and trading companies.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives