Returns On Capital At Pacific Textiles Holdings (HKG:1382) Paint A Concerning Picture

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. Having said that, after a brief look, Pacific Textiles Holdings (HKG:1382) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Pacific Textiles Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.22 = HK$754m ÷ (HK$5.2b - HK$1.7b) (Based on the trailing twelve months to September 2020).

Therefore, Pacific Textiles Holdings has an ROCE of 22%. That's a fantastic return and not only that, it outpaces the average of 9.2% earned by companies in a similar industry.

View our latest analysis for Pacific Textiles Holdings

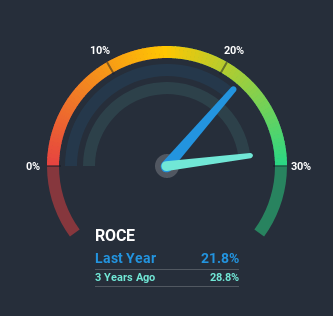

Above you can see how the current ROCE for Pacific Textiles Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From Pacific Textiles Holdings' ROCE Trend?

In terms of Pacific Textiles Holdings' historical ROCE movements, the trend doesn't inspire confidence. To be more specific, the ROCE was 32% five years ago, but since then it has dropped noticeably. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Pacific Textiles Holdings becoming one if things continue as they have.

In Conclusion...

In summary, it's unfortunate that Pacific Textiles Holdings is generating lower returns from the same amount of capital. It should come as no surprise then that the stock has fallen 37% over the last five years, so it looks like investors are recognizing these changes. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing to note, we've identified 2 warning signs with Pacific Textiles Holdings and understanding these should be part of your investment process.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you’re looking to trade Pacific Textiles Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1382

Pacific Textiles Holdings

Manufactures and trades in textile products in the People’s Republic of China, Vietnam, Indonesia, Bangladesh, Cambodia, Sri Lanka, Jordan, Africa, Hong Kong, India, the United States, Haiti, other Asian countries, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success