Stock Analysis

July 2024 Insight On Undervalued Small Caps With Insider Buying In The Region

Reviewed by Simply Wall St

As global markets exhibit mixed signals with the S&P 500 reaching new heights amidst a cooling labor market and falling interest rates, investors are keenly observing shifts in economic indicators that could impact investment decisions. In this context, undervalued small-cap stocks with insider buying present a compelling area for consideration, potentially offering resilience and growth opportunities against broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 9.1x | 3.1x | 41.41% | ★★★★★★ |

| AtriCure | NA | 2.7x | 47.85% | ★★★★★☆ |

| Titan Machinery | 3.9x | 0.1x | 25.84% | ★★★★★☆ |

| Columbus McKinnon | 21.2x | 1.0x | 48.19% | ★★★★☆☆ |

| Norconsult | 28.0x | 1.0x | 43.68% | ★★★☆☆☆ |

| Citizens & Northern | 12.4x | 2.8x | 39.17% | ★★★☆☆☆ |

| Ramaco Resources | 13.9x | 1.1x | 12.03% | ★★★☆☆☆ |

| Trifast | NA | 0.4x | -46.18% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -134.46% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

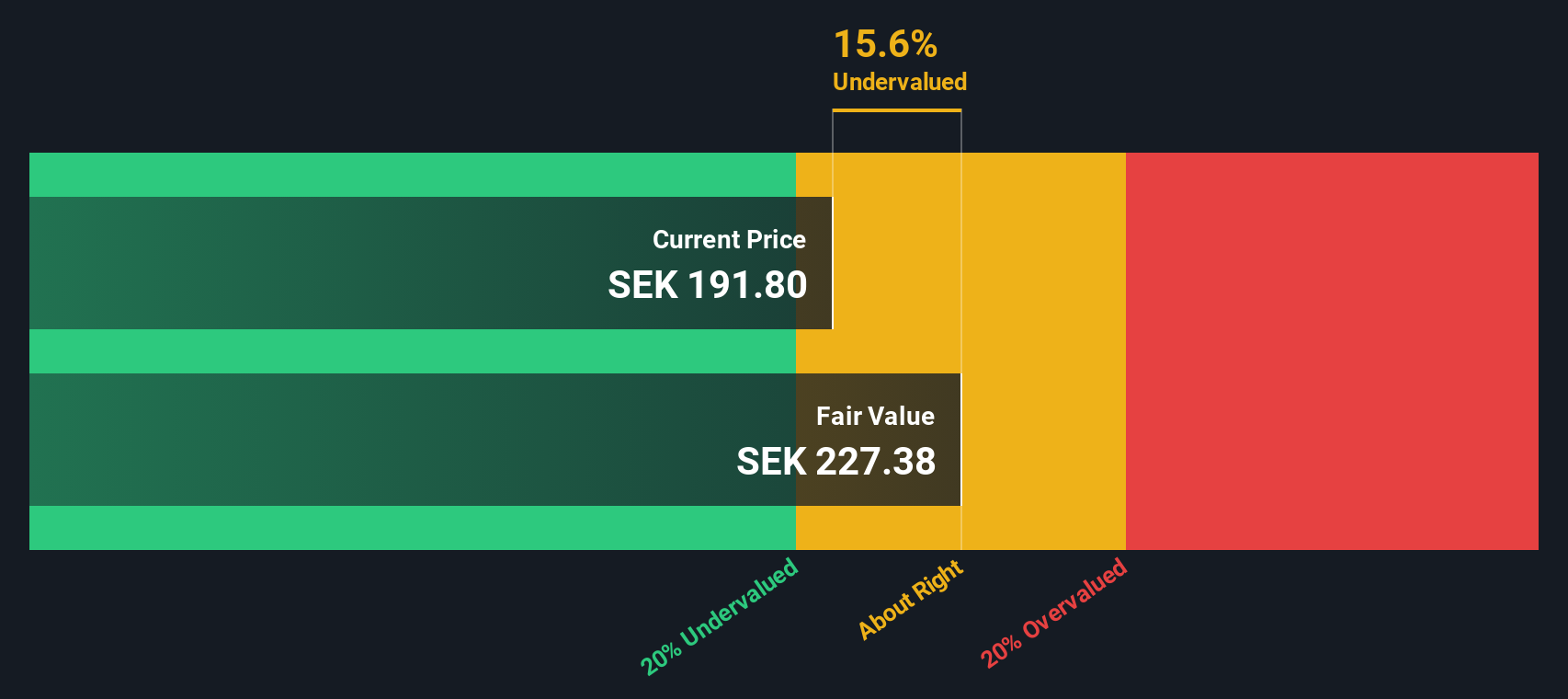

AddLife (OM:ALIF B)

Simply Wall St Value Rating: ★★★★★☆

Overview: AddLife is a company specializing in life science products and services, operating primarily in the Labtech and Medtech sectors with a market capitalization of approximately SEK 9.80 billion.

Operations: Labtech and Medtech are the primary revenue contributors, generating SEK 3.61 billion and SEK 6.20 billion respectively. The company's gross profit margin has shown a slight increase over recent periods, reaching approximately 37.17% by the end of the latest reported period in 2024.

PE: 218.4x

Recently, AddLife has shown a mixed financial landscape, with first-quarter sales rising to SEK 2.57 billion from SEK 2.46 billion year-over-year, yet net income dipped significantly to SEK 62 million from SEK 174 million. Despite this, insider confidence is evident as earnings are projected to surge by over 56% annually. This optimism is underscored by strategic decisions made during their latest board meeting and a modest dividend payout adjustment, reflecting a cautious yet forward-looking management approach in navigating current market challenges.

- Navigate through the intricacies of AddLife with our comprehensive valuation report here.

Examine AddLife's past performance report to understand how it has performed in the past.

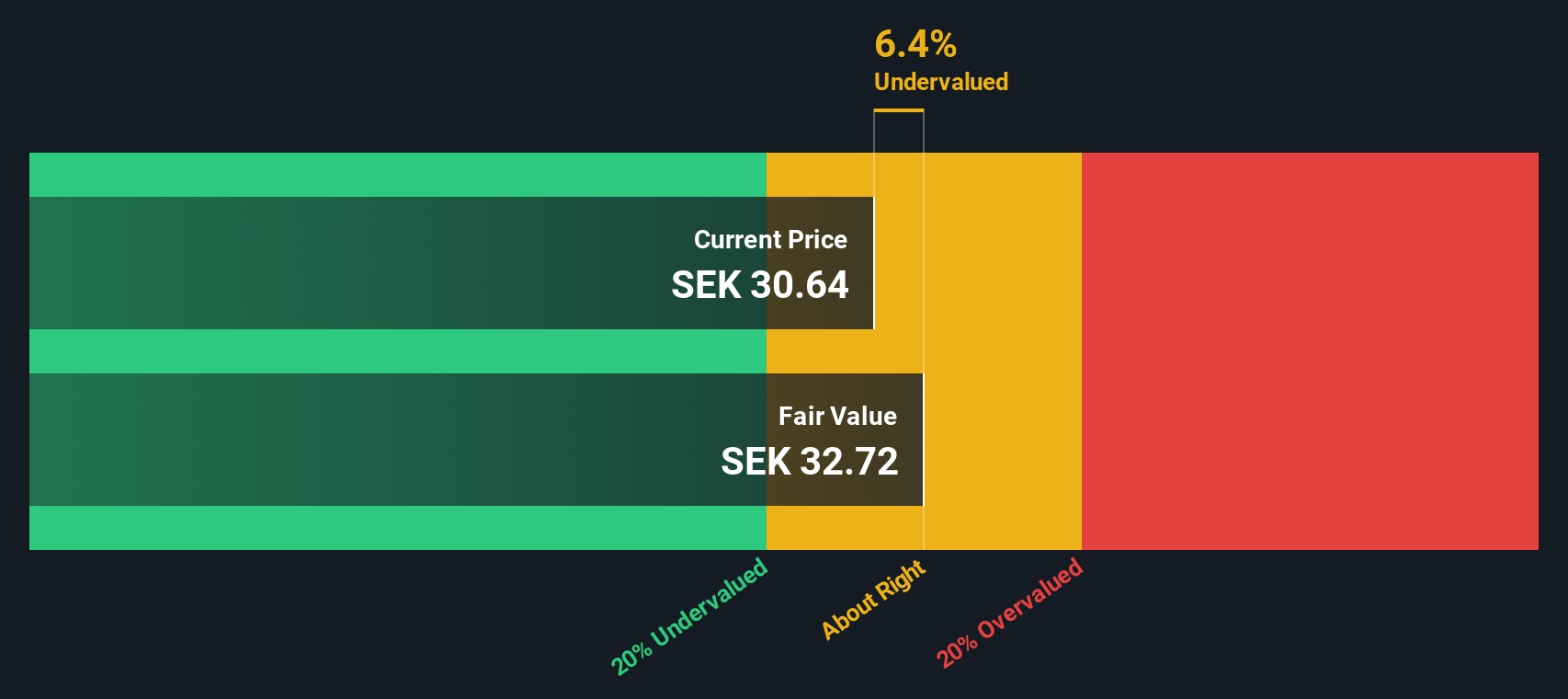

Vimian Group (OM:VIMIAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vimian Group is a diversified healthcare company, operating across multiple segments including Medtech, Diagnostics, Specialty Pharma, and Veterinary Services with a market capitalization of approximately €1.00 billion.

Operations: From 2018 to 2024, the company experienced a growth in revenue from €8.10 billion to €334.95 billion, alongside fluctuations in net income, including a significant increase to €9.84 billion by the end of 2023. Over this period, the gross profit margin remained relatively stable around 69%, reflecting consistent efficiency in managing production costs relative to sales.

PE: 209.4x

Recently, Gabriel Fitzgerald demonstrated insider confidence in Vimian Group by acquiring 10 million shares for €235 million, reflecting a 30.55% increase in their holdings. This move aligns with the company's promising outlook, despite a slight dip in net income to €3.5 million from last year's €5.41 million as reported in Q1 2024 results. With sales climbing to €91.3 million and earnings expected to grow significantly, Vimian is positioned intriguingly within its market sector, further evidenced by strategic board enhancements including the appointment of Magnus Welander as chairman.

- Unlock comprehensive insights into our analysis of Vimian Group stock in this valuation report.

Review our historical performance report to gain insights into Vimian Group's's past performance.

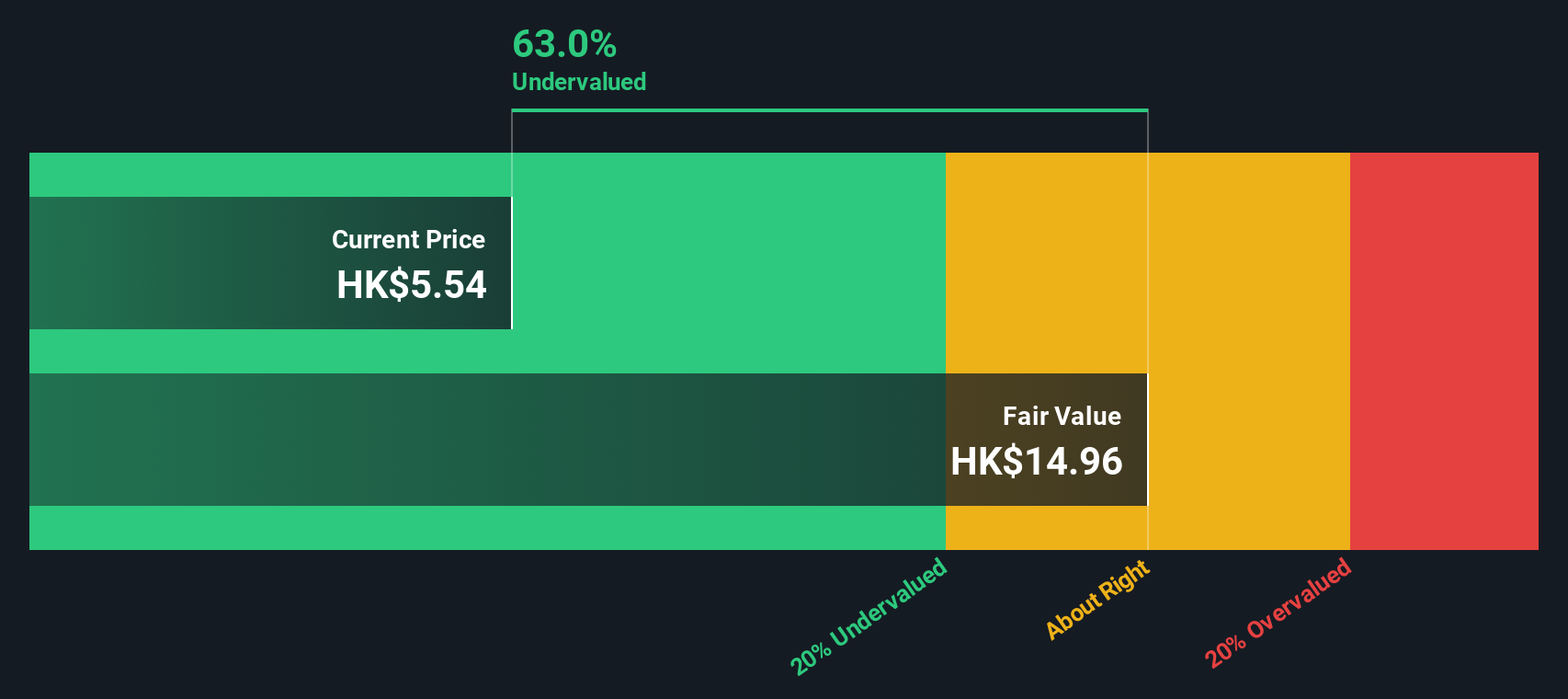

Xtep International Holdings (SEHK:1368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xtep International Holdings is a sportswear company that operates primarily in the mass market, fashion sports, and professional sports segments with a market capitalization of approximately CN¥7.64 billion.

Operations: The company generates its revenue primarily from three segments: Mass Market contributing CN¥11.95 billion, Fashion Sports at CN¥1.60 billion, and Professional Sports at CN¥795.53 million. Over recent periods, it has experienced a gross profit margin of approximately 42%, reflecting its cost management in relation to sales revenue.

PE: 11.9x

Xtep International Holdings, reflecting a promising outlook, recently saw insider confidence with Shui Po Ding acquiring 2 million shares for HK$14.15 million, signaling strong belief in the company's future. This move coincides with a robust operational update indicating expected retail growth of 10% over three months and high single digits semi-annually. Additionally, strategic shifts in executive roles aim to enhance financial oversight and business development, further positioning Xtep for potential growth amidst its industry peers.

Taking Advantage

- Delve into our full catalog of 233 Undervalued Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1368

Xtep International Holdings

Designs, develops, manufactures, and markets sports footwear, apparel, and accessories for adults and children in China.

Excellent balance sheet, good value and pays a dividend.