If EPS Growth Is Important To You, 361 Degrees International (HKG:1361) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like 361 Degrees International (HKG:1361). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for 361 Degrees International

How Fast Is 361 Degrees International Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, 361 Degrees International has grown EPS by 31% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

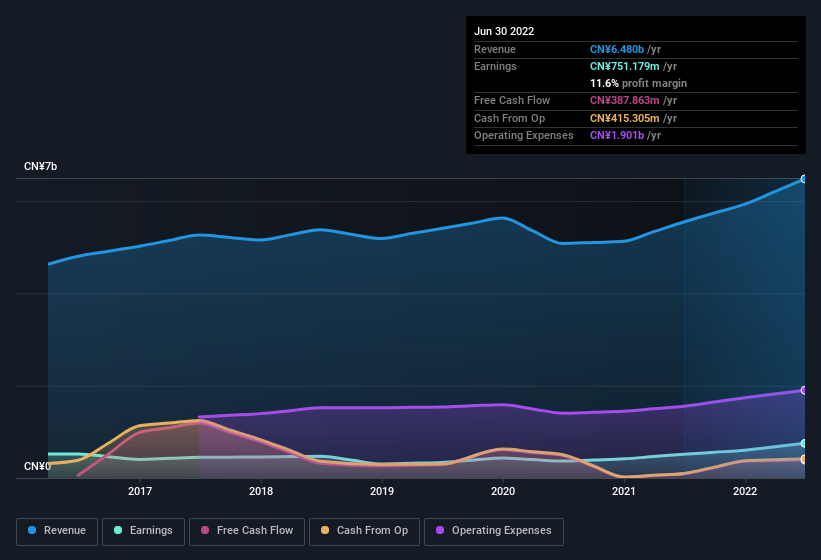

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. 361 Degrees International maintained stable EBIT margins over the last year, all while growing revenue 17% to CN¥6.5b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for 361 Degrees International?

Are 361 Degrees International Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that 361 Degrees International insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 65% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to 361 Degrees International, with market caps between CN¥2.7b and CN¥11b, is around CN¥3.8m.

The CEO of 361 Degrees International only received CN¥1.3m in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is 361 Degrees International Worth Keeping An Eye On?

For growth investors, 361 Degrees International's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes 361 Degrees International look rather interesting indeed. Now, you could try to make up your mind on 361 Degrees International by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 361 Degrees International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1361

361 Degrees International

An investment holding company, manufactures and trades in sporting goods in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives