- China

- /

- Real Estate

- /

- SHSE:600094

November 2025's Global Market Penny Stocks To Watch

Reviewed by Simply Wall St

The global markets have recently been weighed down by concerns over AI valuations and mixed economic signals, leading to a cautious sentiment among investors. Despite these challenges, opportunities still exist for those willing to explore beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to hold potential for growth when backed by strong financials. In this article, we explore three penny stocks that stand out for their balance sheet strength and potential for significant returns in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.45 | MYR228.82M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.04 | SGD421.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.36 | SGD13.22B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.655 | $380.77M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.85 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,582 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Winton Land (NZSE:WIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Winton Land Limited operates in the real estate sector across New Zealand and Australia, with a market capitalization of NZ$608.06 million.

Operations: The company generates revenue from three main segments: Residential at NZ$130.30 million, Commercial at NZ$24.70 million, and Retirement at NZ$0.45 million.

Market Cap: NZ$608.06M

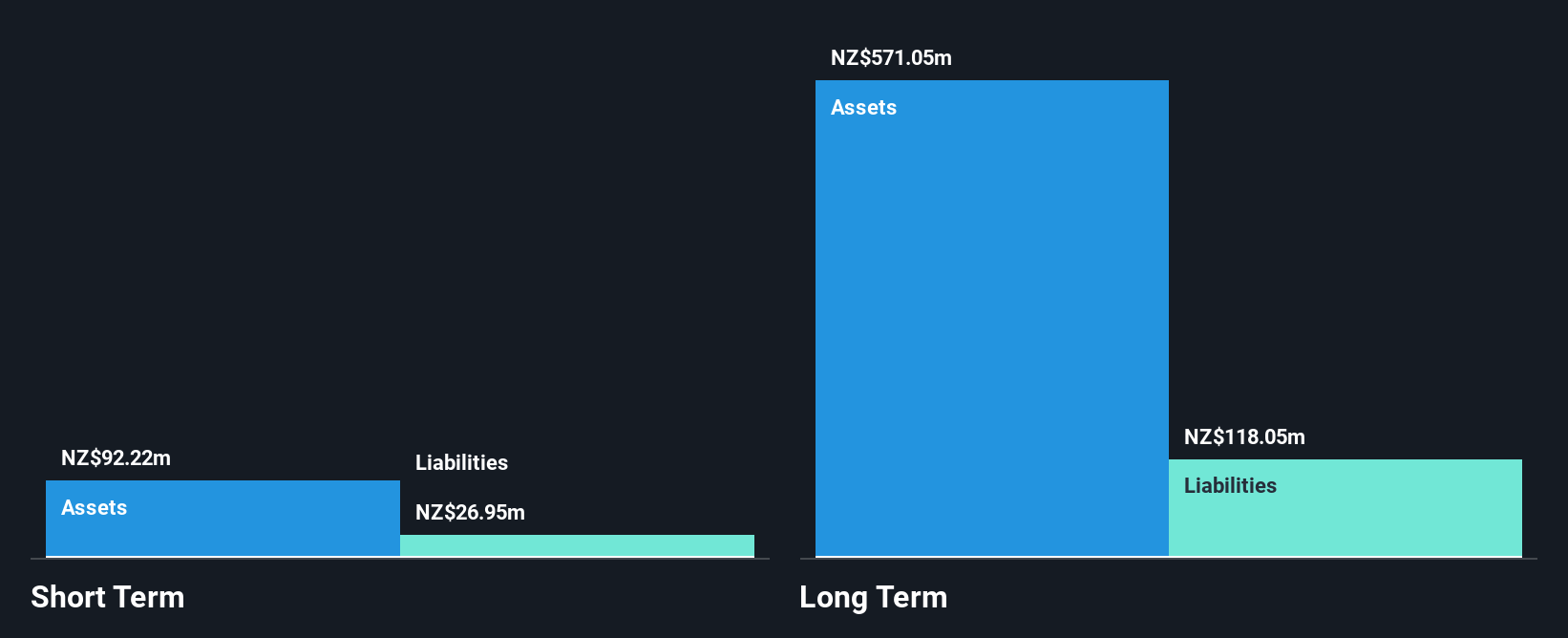

Winton Land Limited, operating in the real estate sector, faces challenges with its short-term assets (NZ$71.3M) not covering long-term liabilities (NZ$126.8M), though interest payments are well-covered by EBIT. The company has reduced its debt to equity ratio significantly over five years and maintains a satisfactory net debt to equity ratio of 17.3%. Despite stable weekly volatility and an experienced board, Winton's earnings growth remains negative with profit margins declining from 9.1% to 6.6%. Recent annual earnings show decreased sales and net income compared to the previous year, highlighting ongoing financial pressures.

- Click here to discover the nuances of Winton Land with our detailed analytical financial health report.

- Gain insights into Winton Land's outlook and expected performance with our report on the company's earnings estimates.

China Lilang (SEHK:1234)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Lilang Limited, along with its subsidiaries, focuses on the manufacturing and sale of branded menswear and related accessories in the People's Republic of China, with a market capitalization of HK$4.07 billion.

Operations: The company generates revenue of CN¥3.78 billion from its operations in manufacturing and selling menswear and accessories.

Market Cap: HK$4.07B

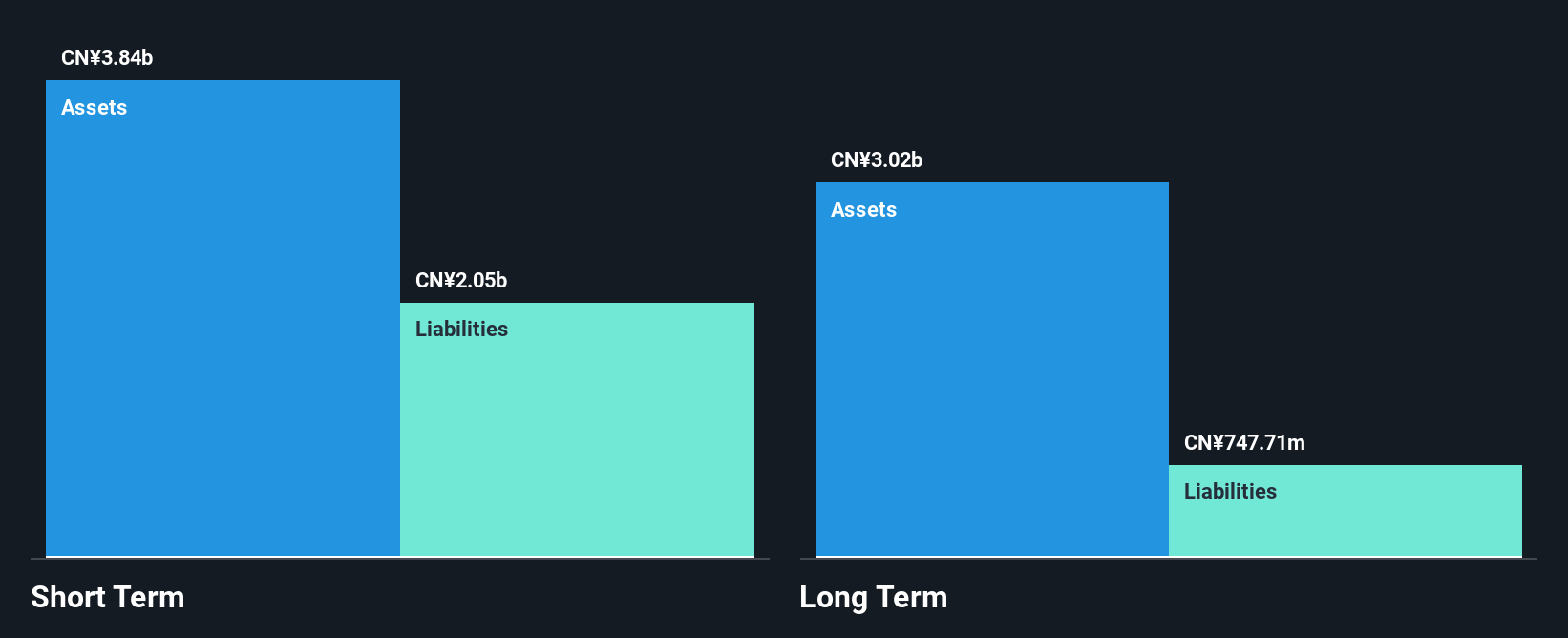

China Lilang Limited, with a market cap of HK$4.07 billion, shows resilience in the menswear sector despite challenges. Its third-quarter 2025 sales saw a low double-digit increase year-over-year, indicating some growth momentum. The company maintains robust financial health with short-term assets (CN¥4.6B) exceeding both short and long-term liabilities, and it covers interest payments comfortably. However, declining profit margins from 14.8% to 11.2% and negative earnings growth over the past year highlight profitability concerns. Despite trading below fair value estimates by 42.8%, its Return on Equity remains low at 9.9%.

- Jump into the full analysis health report here for a deeper understanding of China Lilang.

- Understand China Lilang's earnings outlook by examining our growth report.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China and has a market capitalization of approximately CN¥9.18 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥2.30 billion.

Market Cap: CN¥9.18B

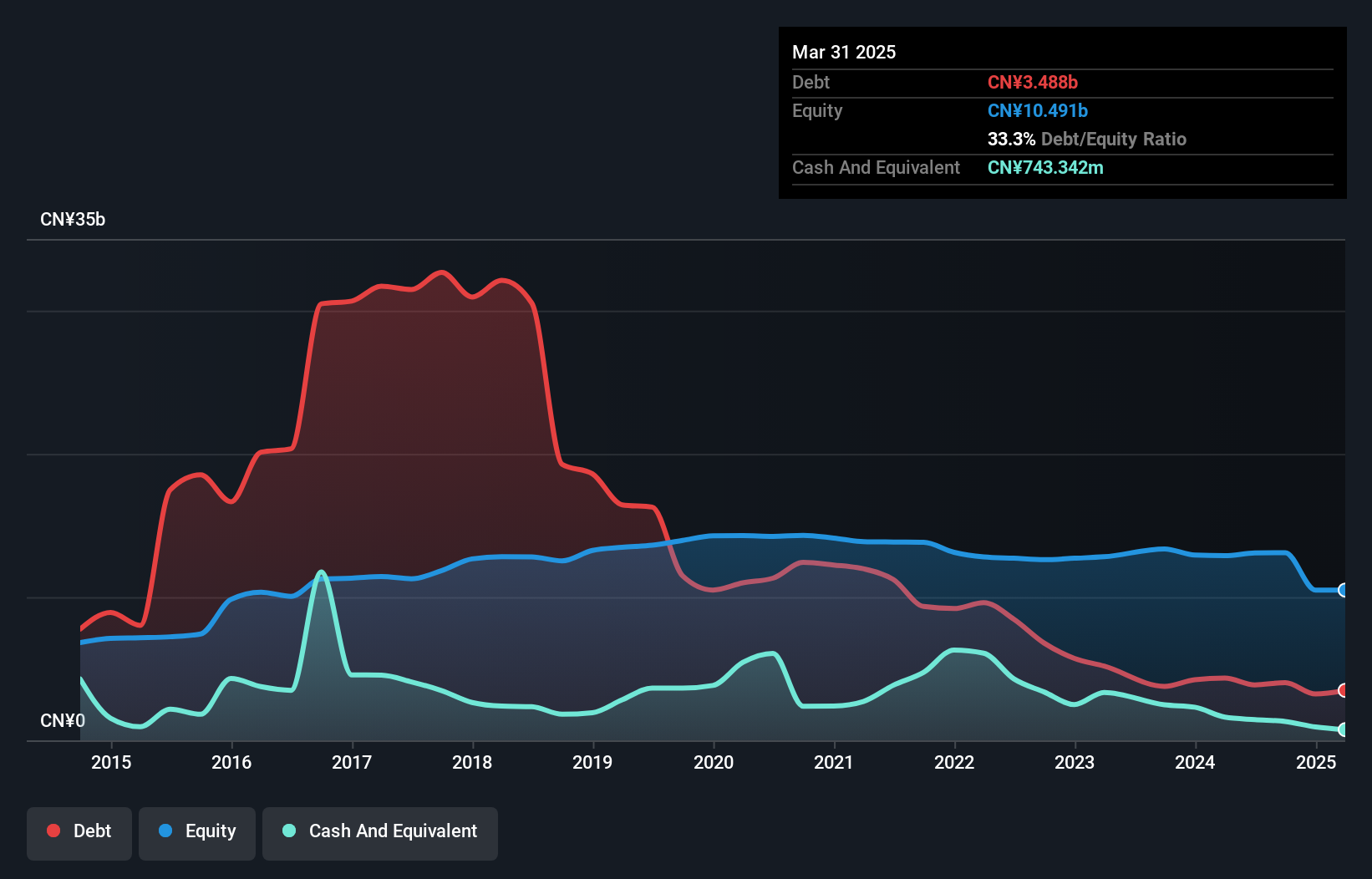

Greattown Holdings Ltd., with a market cap of CN¥9.18 billion, operates in China's real estate sector and reported revenue of CN¥1.94 billion for the first nine months of 2025, down from the previous year. Despite its unprofitability, Greattown's debt management is commendable; its net debt to equity ratio is a satisfactory 5.6%, and short-term assets exceed both short and long-term liabilities significantly. The company has not diluted shareholders recently, but it faces high share price volatility and negative return on equity at -21.86%. Earnings are forecast to grow substantially by over 100% annually according to analyst estimates.

- Dive into the specifics of Greattown Holdings here with our thorough balance sheet health report.

- Assess Greattown Holdings' future earnings estimates with our detailed growth reports.

Next Steps

- Take a closer look at our Global Penny Stocks list of 3,582 companies by clicking here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600094

Greattown Holdings

Engages in the real estate development business in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success