As global markets navigate a complex landscape marked by fluctuating corporate earnings and AI competition, investors are keenly observing the shifts in major indices. Amidst these developments, penny stocks continue to offer intriguing opportunities for those willing to explore smaller or newer companies with strong financial foundations. Although often considered a niche area, penny stocks can still provide significant growth potential when backed by solid balance sheets and strategic positioning.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kingmaker Footwear Holdings (SEHK:1170)

Simply Wall St Financial Health Rating: ★★★★★★

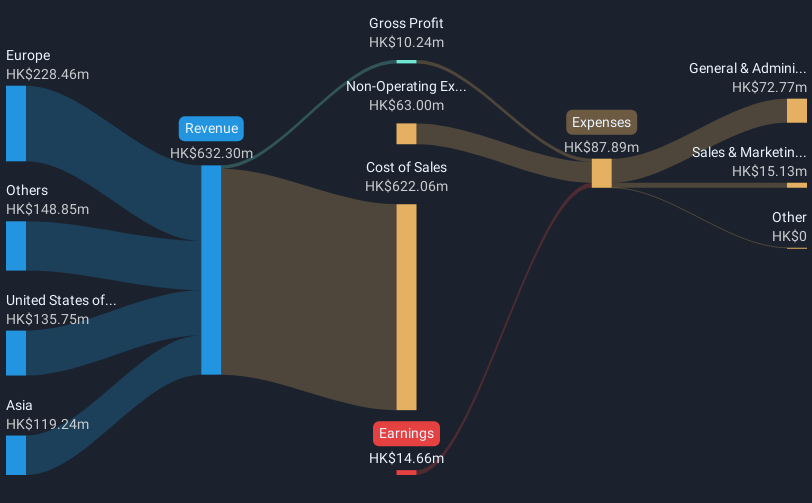

Overview: Kingmaker Footwear Holdings Limited is an investment holding company that manufactures and sells footwear products across the United States, Europe, Asia, and other international markets, with a market cap of HK$502.77 million.

Operations: The company's revenue is primarily derived from the manufacturing and sale of footwear products, totaling HK$632.30 million.

Market Cap: HK$502.77M

Kingmaker Footwear Holdings, with a market cap of HK$502.77 million, has been actively engaging in share buybacks to enhance its net asset value and earnings per share. Despite this strategic move, the company reported a net loss of HK$12.97 million for the half-year ending September 2024, compared to a profit in the previous year. The board did not recommend an interim dividend but announced a special dividend of HKD 0.02 per share. Kingmaker remains debt-free with strong short-term assets covering liabilities, yet it continues to face profitability challenges despite reducing losses over five years by approximately 19% annually.

- Click to explore a detailed breakdown of our findings in Kingmaker Footwear Holdings' financial health report.

- Evaluate Kingmaker Footwear Holdings' historical performance by accessing our past performance report.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★★

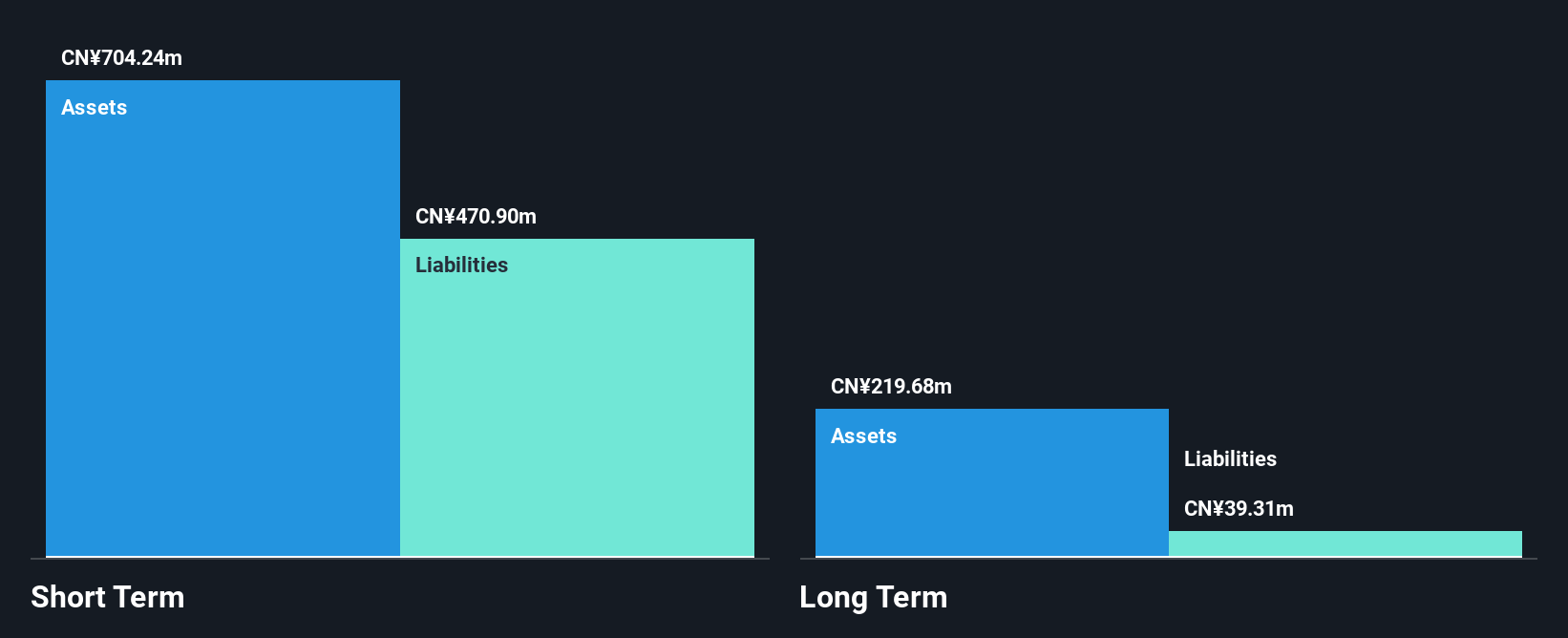

Overview: Be Friends Holding Limited is an investment holding company offering all-media services in the People's Republic of China, with a market cap of HK$1.27 billion.

Operations: The company generates revenue from New Media Services amounting to CN¥1.16 billion and Television Broadcasting Business totaling CN¥103.05 million.

Market Cap: HK$1.27B

Be Friends Holding Limited, with a market cap of HK$1.27 billion, has demonstrated robust financial health with its short-term assets significantly exceeding both long-term and short-term liabilities. The company has shown impressive earnings growth of 158.7% over the past year, surpassing the media industry average. Its debt levels are well-managed, supported by strong operating cash flow and a high return on equity at 37.5%. Recent executive changes saw Mr. Li Liang appointed as CEO and chairman of the investment committee, bringing extensive management experience from New Oriental Education & Technology Group Inc., potentially strengthening leadership stability amidst volatile share prices.

- Navigate through the intricacies of Be Friends Holding with our comprehensive balance sheet health report here.

- Gain insights into Be Friends Holding's historical outcomes by reviewing our past performance report.

Beijing Jingcheng Machinery Electric (SEHK:187)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Jingcheng Machinery Electric Company Limited manufactures and sells gas storage and transportation equipment in China and internationally, with a market cap of HK$5.08 billion.

Operations: Beijing Jingcheng Machinery Electric Company Limited does not report specific revenue segments.

Market Cap: HK$5.08B

Beijing Jingcheng Machinery Electric, with a market cap of HK$5.08 billion, is navigating its financial landscape with strategic adjustments. The company anticipates a net profit turnaround for 2024, projecting RMB6.30 million to RMB7.50 million in earnings attributable to shareholders, despite ongoing operational losses after non-recurring items are excluded. Its short-term assets significantly surpass both long-term and short-term liabilities, indicating solid liquidity management. Recent board changes introduce experienced professionals like Wang Kai and Zhao Xihua into leadership roles, potentially enhancing governance amidst high share price volatility and an unprofitable status due to limited revenue streams under US$1 million annually.

- Unlock comprehensive insights into our analysis of Beijing Jingcheng Machinery Electric stock in this financial health report.

- Assess Beijing Jingcheng Machinery Electric's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 5,714 Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingmaker Footwear Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1170

Kingmaker Footwear Holdings

An investment holding company, manufactures and sells footwear products in the United States, Europe, Asia, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives