Uncovering Huicheng International Holdings And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced fluctuations, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic data, while European indexes showed resilience. Amid these market dynamics, identifying promising investment opportunities requires careful consideration of financial stability and growth potential. Penny stocks, though often considered a relic term, continue to offer intriguing possibilities for investors seeking value in smaller or newer companies with strong fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.83 | HK$43.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £483.91M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.08 | £322.74M | ★★★★★★ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Huicheng International Holdings (SEHK:1146)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Huicheng International Holdings Limited is an investment holding company that designs, manufactures, markets, and sells apparel and accessories in Mainland China and Taiwan, with a market cap of HK$327.32 million.

Operations: The company's revenue primarily comes from its Apparel Products and Accessories segment, generating CN¥176.20 million.

Market Cap: HK$327.32M

Huicheng International Holdings, with a market cap of HK$327.32 million, operates in the apparel and accessories sector in Mainland China and Taiwan. Despite being unprofitable, the company maintains a strong financial position with short-term assets of CN¥837.9 million exceeding both its short-term and long-term liabilities significantly. Its weekly volatility has decreased over the past year, suggesting more stable stock performance. The management team is experienced, averaging 10.4 years of tenure, and the board is seasoned as well. Additionally, Huicheng has sufficient cash runway for over three years based on current free cash flow levels without significant shareholder dilution recently.

- Get an in-depth perspective on Huicheng International Holdings' performance by reading our balance sheet health report here.

- Gain insights into Huicheng International Holdings' past trends and performance with our report on the company's historical track record.

HC Group (SEHK:2280)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HC Group Inc., an investment holding company, offers business information services online in the People’s Republic of China and has a market cap of approximately HK$301.28 million.

Operations: The company's revenue is primarily derived from Smart Industries, generating CN¥15.20 billion, with additional income from Technology-Driven New Retail at CN¥298.05 million.

Market Cap: HK$301.28M

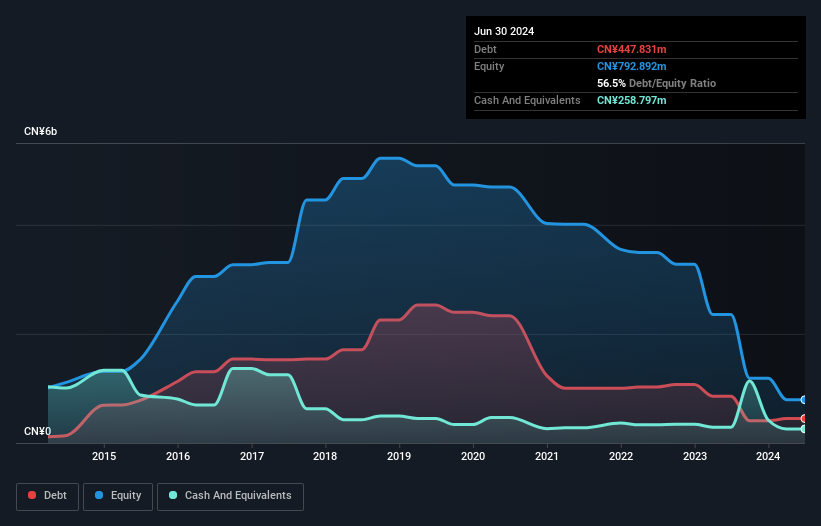

HC Group, with a market cap of approximately HK$301.28 million, operates in the business information services sector in China. Despite being unprofitable and experiencing a 32.4% annual increase in losses over five years, it maintains a satisfactory net debt to equity ratio of 23.8% and covers both its short-term (CN¥1.6 billion) and long-term liabilities (CN¥8.5 million) with CN¥1.9 billion in short-term assets. The company's stock has been highly volatile recently but remains significantly undervalued compared to its estimated fair value, while having an experienced management team and board of directors with substantial tenures.

- Jump into the full analysis health report here for a deeper understanding of HC Group.

- Gain insights into HC Group's historical outcomes by reviewing our past performance report.

P.S.P. Specialties (SET:PSP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: P.S.P. Specialties Public Company Limited, along with its subsidiaries, produces and distributes lubricants and greases both within Thailand and internationally, with a market capitalization of THB5.77 billion.

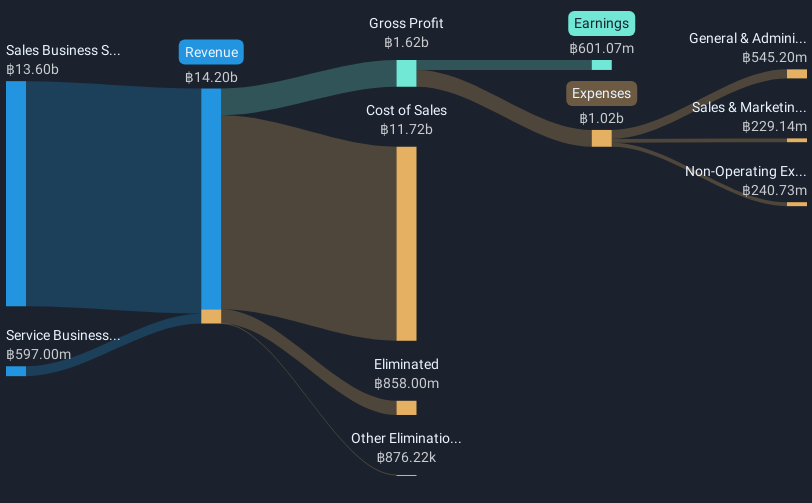

Operations: The company generates revenue primarily from its Sales Business Section, amounting to THB13.60 billion, and its Service Business Segment, contributing THB597 million.

Market Cap: THB5.77B

P.S.P. Specialties, with a market cap of THB5.77 billion, has shown robust financial performance, highlighted by a 55.4% earnings growth over the past year, surpassing its five-year average of 13.7%. The company's net profit margins have improved to 4.5%, and it trades significantly below its estimated fair value. Its short-term assets comfortably cover both short and long-term liabilities, ensuring financial stability. While the debt-to-equity ratio has risen to 49.2% over five years, debt is well-covered by operating cash flow at 68.5%, and interest payments are adequately managed with an EBIT coverage of 5.2 times.

- Click here to discover the nuances of P.S.P. Specialties with our detailed analytical financial health report.

- Explore historical data to track P.S.P. Specialties' performance over time in our past results report.

Next Steps

- Gain an insight into the universe of 5,706 Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PSP

P.S.P. Specialties

Manufactures and sells lubricant and grease oils in Thailand and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion