The Price Is Right For Golden Solar New Energy Technology Holdings Limited (HKG:1121) Even After Diving 27%

Golden Solar New Energy Technology Holdings Limited (HKG:1121) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

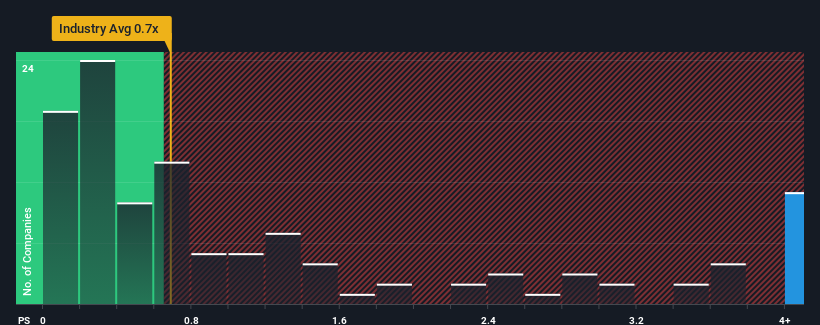

In spite of the heavy fall in price, when almost half of the companies in Hong Kong's Luxury industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Golden Solar New Energy Technology Holdings as a stock not worth researching with its 25.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Golden Solar New Energy Technology Holdings

How Golden Solar New Energy Technology Holdings Has Been Performing

Revenue has risen firmly for Golden Solar New Energy Technology Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Golden Solar New Energy Technology Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Golden Solar New Energy Technology Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Golden Solar New Energy Technology Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.7% gain to the company's revenues. Pleasingly, revenue has also lifted 164% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Golden Solar New Energy Technology Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Golden Solar New Energy Technology Holdings' shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Golden Solar New Energy Technology Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Golden Solar New Energy Technology Holdings that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1121

Golden Solar New Energy Technology Holdings

An investment holding company, manufactures and sells footwear products in the People’s Republic of China, the United States, South America, Europe, South East Asia, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives