As global markets react to rising U.S. Treasury yields, with the S&P 500 Index finishing lower after several weeks of gains, investors are exploring diverse opportunities beyond large-cap stocks. Penny stocks, often associated with smaller or newer companies, remain a relevant area for those seeking growth at lower price points. Despite their historical connotations, these stocks can offer robust opportunities when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.32 | THB1.88B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,796 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Golden Solar New Energy Technology Holdings (SEHK:1121)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Solar New Energy Technology Holdings Limited is an investment holding company that manufactures and sells footwear products across various international markets, with a market capitalization of approximately HK$4.32 billion.

Operations: The company's revenue is primarily derived from its Original Equipment Manufacturer (OEM) segment at CN¥209.30 million, followed by Photovoltaic Products at CN¥49.29 million, Graphene-Based Products at CN¥7.01 million, and Boree Products at CN¥1.72 million.

Market Cap: HK$4.32B

Golden Solar New Energy Technology Holdings faces challenges typical of its segment, with a declining revenue trend and increasing net losses. Despite short-term assets exceeding liabilities, the company is unprofitable and has a negative return on equity. Recent earnings reports show sales of CN¥127.48 million for the first half of 2024, down from CN¥155.52 million in the previous year, while net losses increased to CN¥158.18 million due to factors like share-based payments and R&D expenses aimed at advancing solar cell technology. The company's cash runway is limited to less than a year without significant financial changes or improvements in free cash flow generation.

- Click to explore a detailed breakdown of our findings in Golden Solar New Energy Technology Holdings' financial health report.

- Learn about Golden Solar New Energy Technology Holdings' historical performance here.

Modern Dental Group (SEHK:3600)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Dental Group Limited is an investment holding company involved in the production, distribution, and trading of dental prosthetic devices across Europe, Greater China, North America, Australia, and other international markets with a market cap of HK$3.55 billion.

Operations: The company generates revenue primarily from Fixed Prosthetic Devices amounting to HK$2.02 billion and Removable Prosthetic Devices at HK$755.93 million.

Market Cap: HK$3.55B

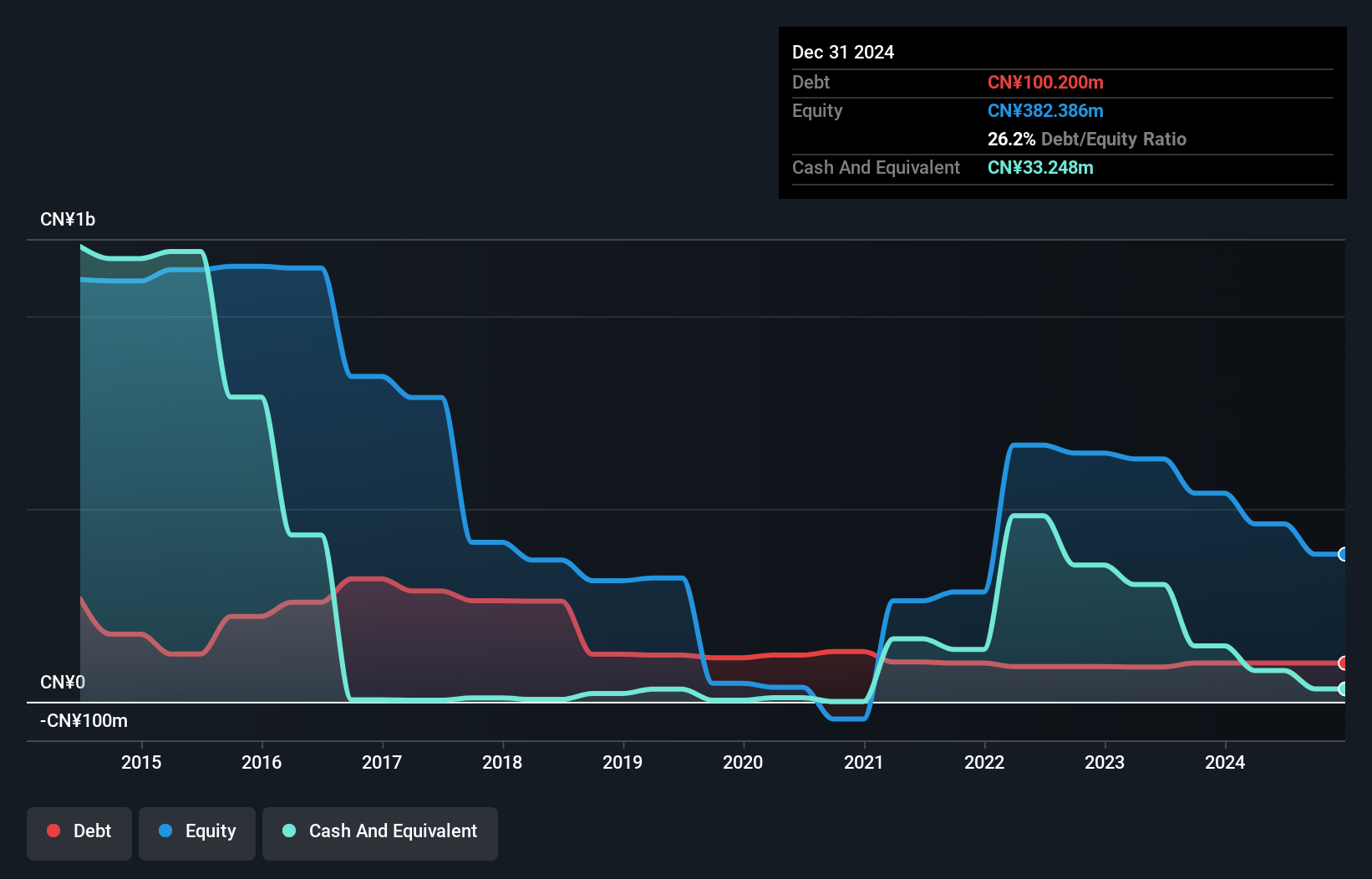

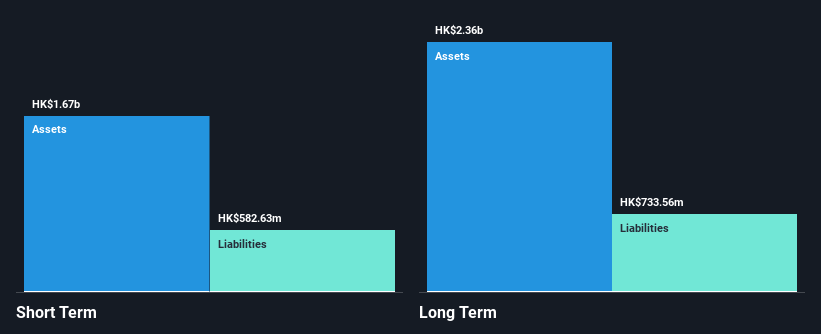

Modern Dental Group demonstrates financial stability with earnings growth of 23% over the past year, surpassing industry averages. The company's strong cash position exceeds its total debt, and its short-term assets cover both short- and long-term liabilities. Recent interim results show sales of HK$1.70 billion and net income of HK$215.25 million, reflecting consistent profitability despite a low return on equity at 15%. Interest payments are well-covered by EBIT, indicating manageable debt levels. While dividends have been inconsistent, Modern Dental's valuation appears attractive compared to peers in the medical equipment sector.

- Navigate through the intricacies of Modern Dental Group with our comprehensive balance sheet health report here.

- Gain insights into Modern Dental Group's outlook and expected performance with our report on the company's earnings estimates.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Liuzhou Chemical Industry Co., Ltd. is a company that produces and sells chemical fertilizers in China, with a market cap of CN¥2.24 billion.

Operations: Liuzhou Chemical Industry Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥2.24B

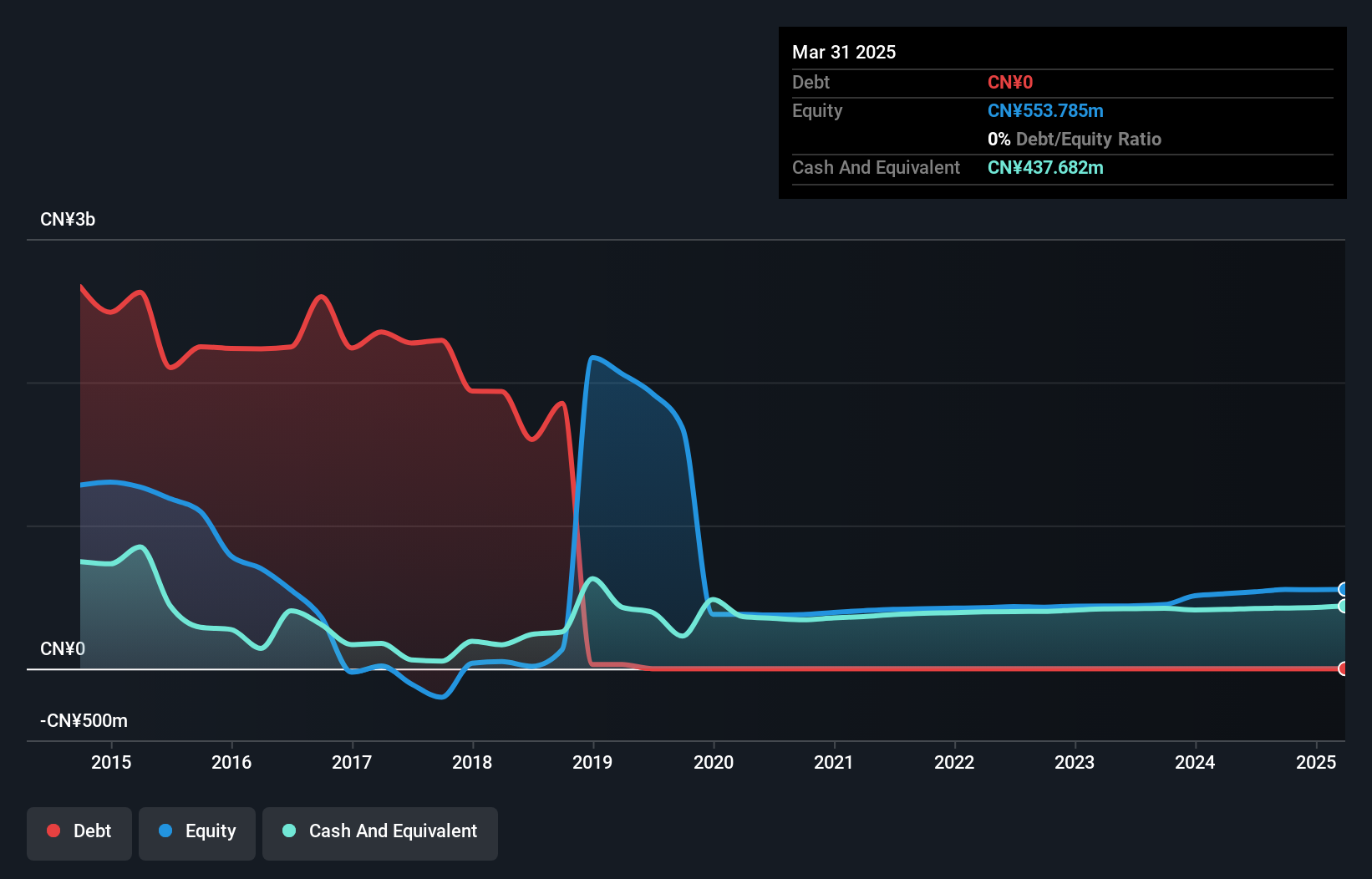

Liuzhou Chemical Industry shows promising financial metrics, with a Price-To-Earnings ratio of 24.6x, below the CN market average of 34x, indicating potential value. The company has experienced significant earnings growth of 381.3% over the past year, outpacing the industry decline and marking accelerated profit growth compared to its five-year average. Its management team is seasoned with an average tenure of 6.8 years, though its board lacks experience at 2.9 years on average. Liuzhou's short-term assets comfortably cover both short- and long-term liabilities, while recent earnings reveal increased sales and net income year-over-year.

- Jump into the full analysis health report here for a deeper understanding of Liuzhou Chemical Industry.

- Evaluate Liuzhou Chemical Industry's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 5,796 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600423

Liuzhou Chemical Industry

Produces and sells chemical fertilizers in China.

Excellent balance sheet with proven track record.