- China

- /

- Metals and Mining

- /

- SZSE:002721

Undiscovered Gems And 2 Other Small Caps with Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have exerted pressure on equities, particularly impacting small-cap stocks as the S&P 500 Index experienced a decline after a period of gains. Despite this challenging environment for smaller companies, opportunities remain for investors to discover promising small-cap stocks that are well-positioned to thrive amidst economic fluctuations and potential shifts in monetary policy. Identifying these gems often involves looking at companies with strong fundamentals and growth potential that can navigate the current landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shriram Pistons & Rings (NSEI:SHRIPISTON)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shriram Pistons & Rings Limited is an Indian company that manufactures and sells automotive components, with a market cap of ₹89.92 billion.

Operations: Shriram Pistons & Rings generates revenue primarily from the sale of automotive components, amounting to ₹33.35 billion.

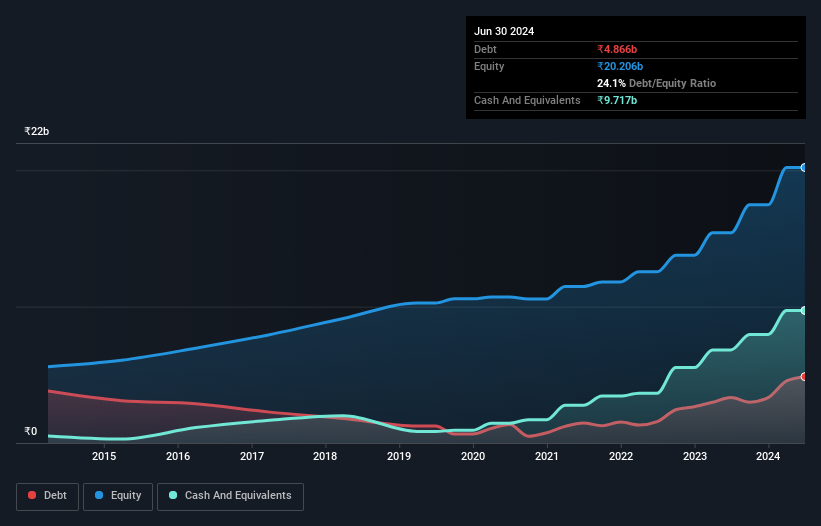

Shriram Pistons & Rings, a small cap player in the auto components sector, presents an intriguing profile with its earnings growth of 22.3% over the past year surpassing industry averages. The company trades at a favorable price-to-earnings ratio of 20.4x, notably below the Indian market average of 32.2x, suggesting good value relative to peers. Despite increased debt-to-equity from 6.3% to 21.2% over five years, it maintains robust interest coverage at 15.7x EBIT, indicating financial stability and profitability without cash runway concerns due to more cash than total debt and high-quality earnings supporting future growth prospects.

- Take a closer look at Shriram Pistons & Rings' potential here in our health report.

Learn about Shriram Pistons & Rings' historical performance.

Zhongman Petroleum and Natural Gas GroupLtd (SHSE:603619)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company involved in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market capitalization of CN¥9.28 billion.

Operations: Zhongman Petroleum and Natural Gas Group generates revenue primarily from its drilling and completion engineering services, alongside petroleum equipment manufacturing. The company's financial performance shows a notable trend in its gross profit margin, which has varied over recent periods.

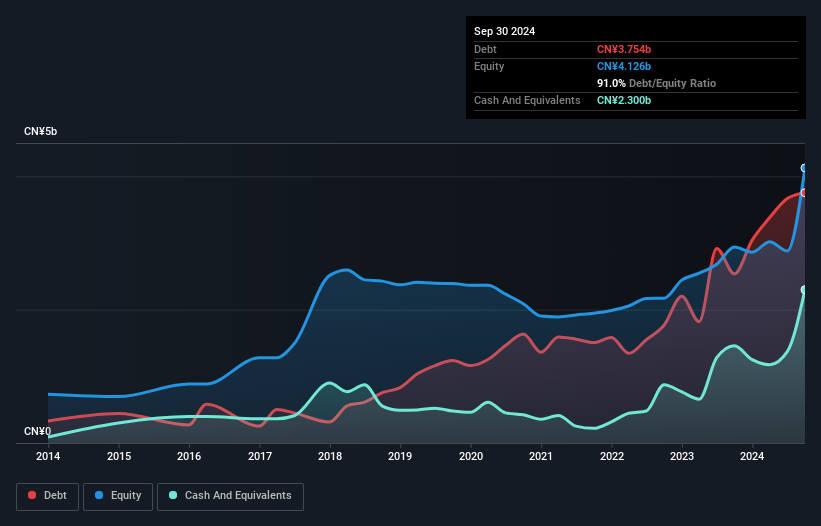

Zhongman Petroleum and Natural Gas Group Ltd. showcases impressive earnings growth, averaging 62% annually over the past five years, highlighting its potential in the energy sector. Trading at a significant discount of 70% to its estimated fair value, it appears undervalued compared to industry peers. Despite an increased debt-to-equity ratio from 52% to 91%, interest payments are well covered with EBIT at 30 times interest obligations. Recent earnings report shows sales rising to CNY 3 billion with net income reaching CNY 668 million for the nine months ending September 2024, reflecting steady financial performance amidst industry challenges.

Beijing Kingee Culture Development (SZSE:002721)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Kingee Culture Development Co., Ltd. operates in the cultural and creative industries, with a market cap of CN¥85.63 billion.

Operations: Financial data for Beijing Kingee Culture Development is not available in the provided text, preventing a detailed summary of its revenue streams or cost breakdowns.

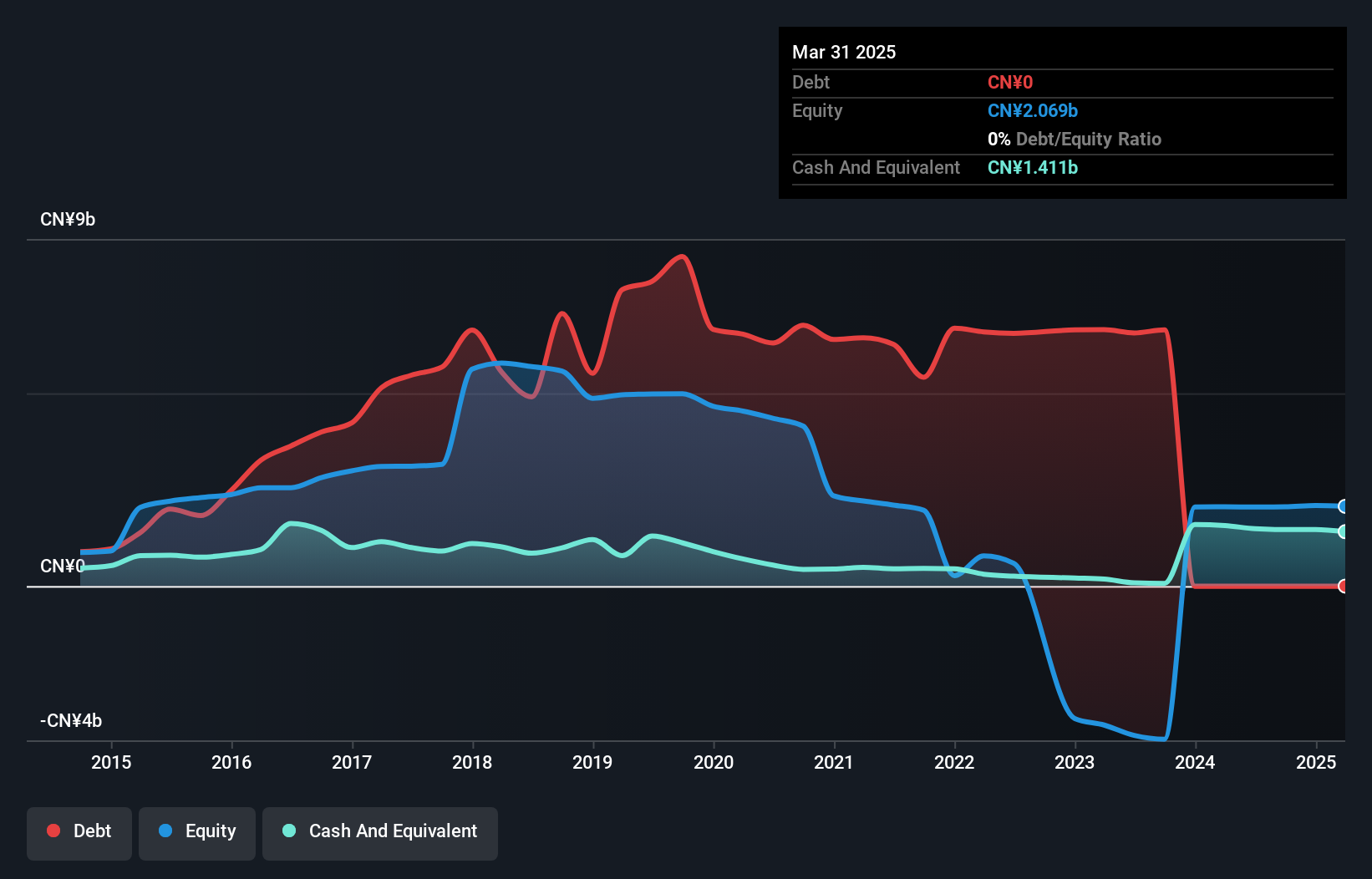

Kingee Culture Development, a relatively small player, has seen a turnaround by becoming profitable this year with net income at CNY 0.61 million compared to a loss of CNY 521.4 million previously. The company's price-to-earnings ratio sits attractively at 7.3x, significantly below the CN market average of 34x, suggesting potential undervaluation. However, shareholders faced substantial dilution over the past year despite the company having more cash than its total debt and reducing its debt-to-equity ratio from an alarming 171% to just 0.4% over five years, indicating improved financial stability and management efficiency in handling liabilities.

Seize The Opportunity

- Reveal the 4734 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Kingee Culture Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002721

Beijing Kingee Culture Development

Beijing Kingee Culture Development Co., Ltd.

Adequate balance sheet with acceptable track record.