- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1070

Assessing TCL Electronics (SEHK:1070) Valuation as Momentum Builds in Consumer Electronics Sector

Reviewed by Simply Wall St

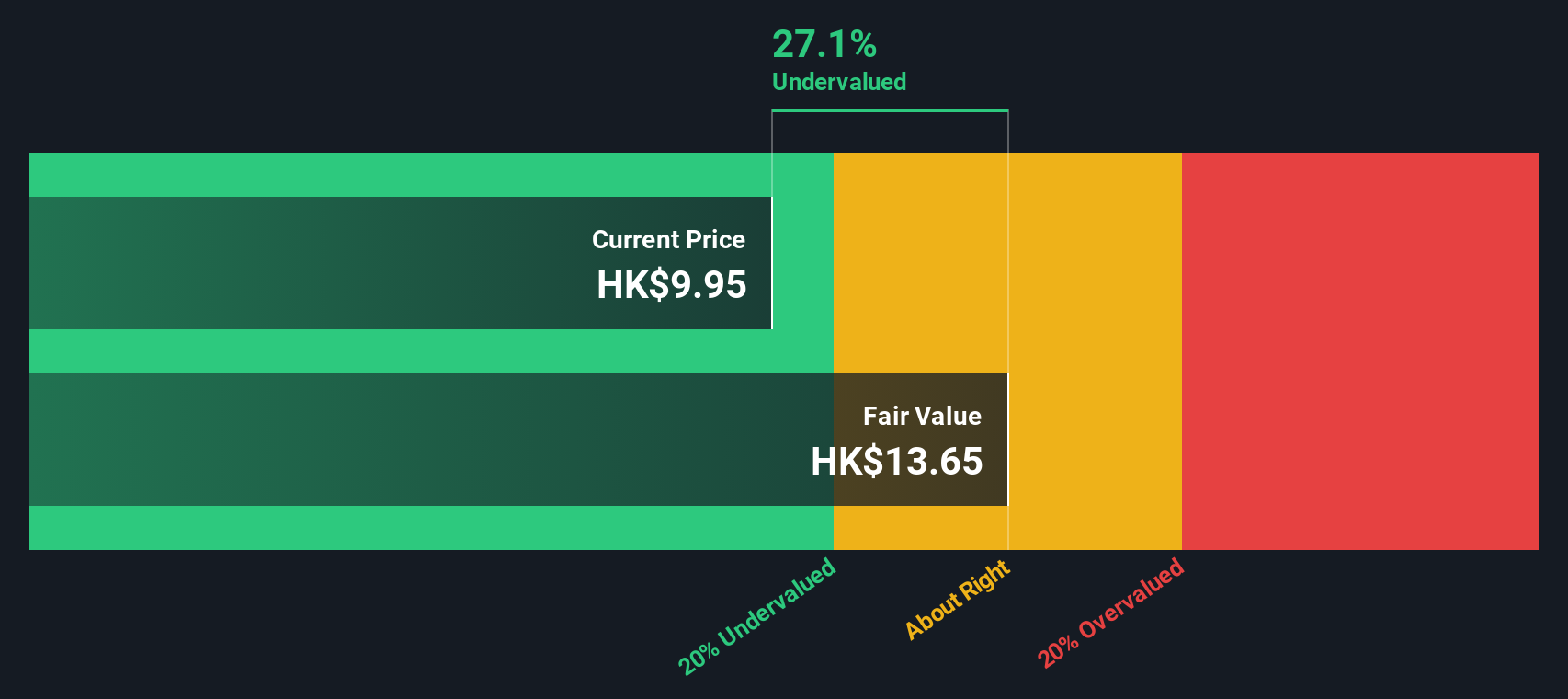

TCL Electronics Holdings (SEHK:1070) closed at HK$9.95, maintaining steady momentum over the past month. Investors have observed a gradual climb as the company’s stock gained 7% across the last week, which reflects renewed interest in the consumer electronics sector.

See our latest analysis for TCL Electronics Holdings.

The recent rally is part of a larger trend, as TCL Electronics’ solid 1-year total shareholder return of 103% and a sharp year-to-date share price gain of almost 60% show that momentum is building strongly around the stock. These moves suggest growing confidence in the company’s growth outlook and its ability to outperform in a competitive sector.

If the recent surge in consumer electronics has your attention, now is the perfect time to see what else is on the move and discover fast growing stocks with high insider ownership

With strong gains over the past year, some may wonder if TCL Electronics still has room to run, or if the current price already fully reflects its future growth potential. Is this a genuine buying opportunity, or has the market already priced in what is ahead?

Price-to-Earnings of 11.4x: Is it justified?

TCL Electronics is trading with a price-to-earnings (P/E) ratio of 11.4x, which raises questions about whether the market is accurately capturing the company's improving fundamentals. The last close was HK$9.95, signaling that investors may have room to reconsider its valuation stance.

The P/E ratio measures how much investors are willing to pay for each dollar of the company's earnings. For TCL Electronics, this multiple suggests that the market places a moderate premium on the business, likely reflecting its recent earnings surge and brighter outlook in consumer durables.

Interestingly, TCL Electronics’ P/E of 11.4x makes it look inexpensive relative to the peer average, which stands at 27.7x. However, it is a bit pricey compared to the broader Hong Kong Consumer Durables industry average of 8.7x. Compared to an estimated “fair” P/E of 11.7x, the current valuation also appears to be slightly below where the market could conceivably move, hinting at potential upside if financial performance continues on this trajectory.

Explore the SWS fair ratio for TCL Electronics Holdings

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, slower revenue growth or an unexpected dip in net income could challenge the current optimism and affect TCL Electronics’ ongoing momentum.

Find out about the key risks to this TCL Electronics Holdings narrative.

Another View: What Does Our DCF Model Say?

Looking beyond the price-to-earnings ratio, the SWS DCF model offers a fresh lens. By projecting future cash flows, this method estimates TCL Electronics' fair value at HK$13.66. The current share price is trading about 27% below this mark. Could this present a deeper value opportunity, or is it a sign of hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TCL Electronics Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TCL Electronics Holdings Narrative

If you have your own take on TCL Electronics, you can dig into the data and create your own narrative in just a few minutes, Do it your way

A great starting point for your TCL Electronics Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by checking out hand-picked stocks that could transform your portfolio. Don’t miss an edge—these ideas are just a click away.

- Unlock value with these 884 undervalued stocks based on cash flows for companies trading well below their true worth. Seize opportunities before the broader market catches on.

- Catch the wave in healthcare innovation by browsing these 31 healthcare AI stocks, where pioneering medical AI firms are shaking up the industry.

- Boost your income potential right now with these 15 dividend stocks with yields > 3%, featuring reliable stocks offering yields above 3% for smarter, steadier returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TCL Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1070

TCL Electronics Holdings

An investment holding company, operates as a consumer electronics company in Mainland China, Europe, North America, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives