Hong Kong Technology Venture And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and cautious monetary policies, investors are keenly watching indices like the S&P 500 and Nasdaq Composite, which have recently approached record highs. In such a climate, identifying stocks with strong financials becomes crucial for those seeking potential growth opportunities. Although the term "penny stocks" may seem outdated, it remains relevant for investors interested in smaller or newer companies that offer affordability and potential upside. This article will explore three penny stocks that stand out due to their financial strength and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,683 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Hong Kong Technology Venture (SEHK:1137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hong Kong Technology Venture Company Limited operates in the ecommerce and technology sectors in Hong Kong, with a market capitalization of approximately HK$993.57 million.

Operations: The company's revenue is derived from its Hong Kong ecommerce business, generating HK$3.85 billion, and its new ventures and technology business, contributing HK$160.58 million.

Market Cap: HK$993.57M

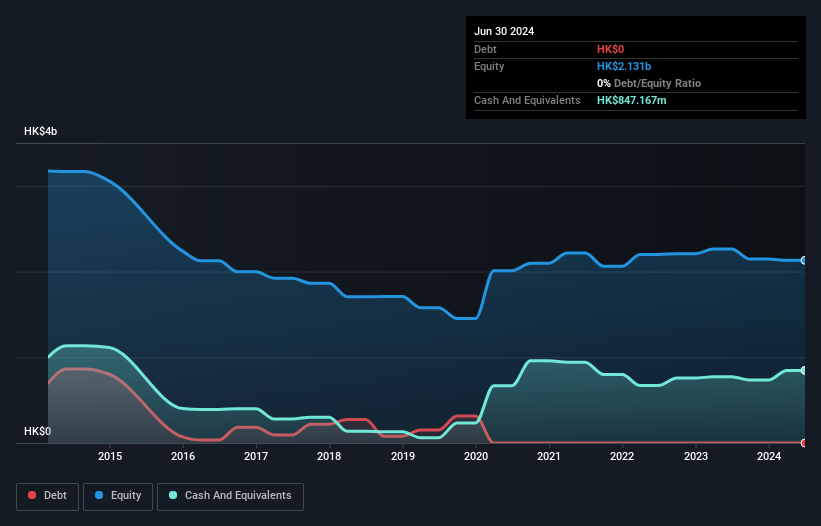

Hong Kong Technology Venture operates with a market cap of HK$993.57 million, primarily generating revenue from its Hong Kong ecommerce business (HK$3.85 billion) and new ventures (HK$160.58 million). Despite being unprofitable, the company has reduced losses over the past five years and maintains a stable financial position with short-term assets exceeding liabilities. It is debt-free and trades significantly below estimated fair value, offering potential upside if profitability improves. The management team and board are seasoned with an average tenure of over five years, contributing to strategic stability in navigating market challenges.

- Click to explore a detailed breakdown of our findings in Hong Kong Technology Venture's financial health report.

- Review our historical performance report to gain insights into Hong Kong Technology Venture's track record.

Gogox Holdings (SEHK:2246)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gogox Holdings Limited is an investment holding company that offers logistic and delivery solutions, with a market cap of HK$0.29 billion.

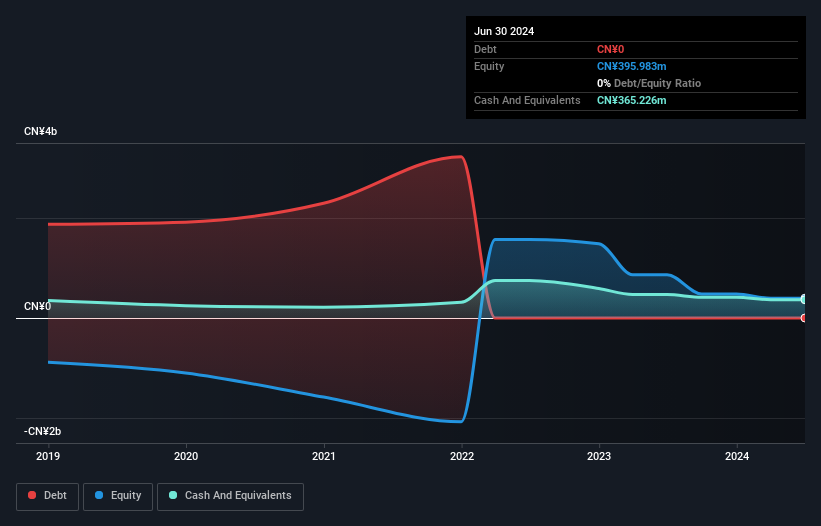

Operations: The company's revenue is derived from its Chinese Mainland Operations, contributing CN¥227.56 million, and its Hong Kong and Overseas Operations, which account for CN¥477.69 million.

Market Cap: HK$289.26M

Gogox Holdings, with a market cap of HK$0.29 billion, derives its revenue primarily from Hong Kong and Overseas Operations (CN¥477.69 million) and Chinese Mainland Operations (CN¥227.56 million). Despite being unprofitable with declining earnings over the past five years, Gogox is debt-free and has sufficient cash runway for over three years based on current free cash flow levels. The company's short-term assets significantly exceed both short-term and long-term liabilities, indicating financial stability in managing obligations. Additionally, the management team is experienced with an average tenure of 3.6 years, providing strategic direction amidst market volatility.

- Navigate through the intricacies of Gogox Holdings with our comprehensive balance sheet health report here.

- Evaluate Gogox Holdings' historical performance by accessing our past performance report.

Chiho Environmental Group (SEHK:976)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chiho Environmental Group Limited is an investment holding company involved in the metal recycling business across Asia, Europe, and North America, with a market capitalization of approximately HK$746.40 million.

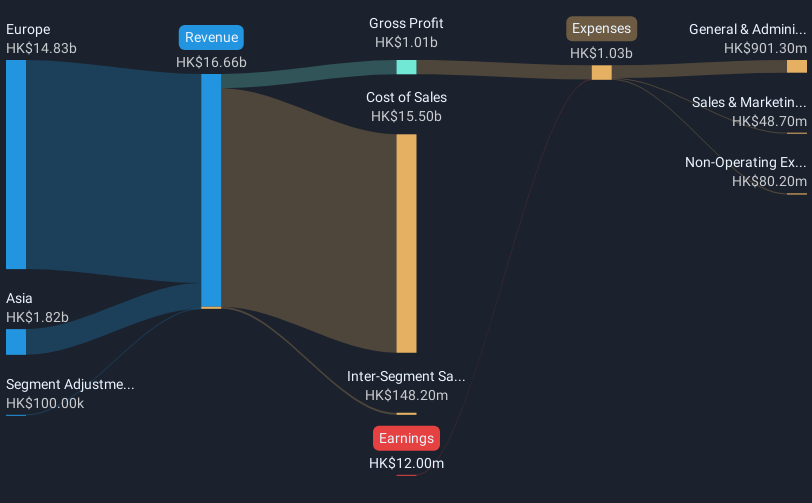

Operations: The company's revenue is primarily derived from Europe, contributing HK$14.83 billion, followed by Asia with HK$1.82 billion.

Market Cap: HK$746.4M

Chiho Environmental Group, with a market cap of HK$746.40 million, primarily generates revenue from Europe (HK$14.83 billion) and Asia (HK$1.82 billion). Despite being unprofitable, the company has reduced losses over five years by 32.6% annually and improved its debt to equity ratio from 56.8% to 21.1%. Short-term assets of HK$4.4 billion cover both short-term liabilities (HK$3.2 billion) and long-term liabilities (HK$877.3 million), indicating solid financial management capabilities despite volatility in share price and a relatively inexperienced management team with an average tenure of 1.9 years.

- Dive into the specifics of Chiho Environmental Group here with our thorough balance sheet health report.

- Assess Chiho Environmental Group's previous results with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 5,683 Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2246

Gogox Holdings

An investment holding company, provides logistic and delivery solutions in Mainland China, Hong Kong, Korea, Singapore, and internationally.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives